On-chain data shows the percentage of the PEPE investors currently in the green has fallen to 69% after the 26% plunge the memecoin has seen in the past week.

69% Of All PEPE Addresses Are Carrying Some Gains Right Now

In a new post on X, the market intelligence platform IntoTheBlock has posted an update on how the investor profitability is looking for the memecoin PEPE currently.

The analytics firm’s metric gauges whether a holder is in profit or not by reviewing their address’s on-chain history. Based on when the wallet acquired the coins, the indicator calculates the investor’s average cost basis using the spot price of the asset at the time of those purchases.

If the current spot value of the cryptocurrency is higher than this average cost basis for any address, then that particular investor is carrying net gains currently. IntoTheBlock categorizes such addresses to be “in the money.”

Similarly, investors with a cost basis higher than the latest price are considered “out of the money.” Naturally, the two values being exactly equal would suggest the holder is just breaking even on their investment or is “at the money.”

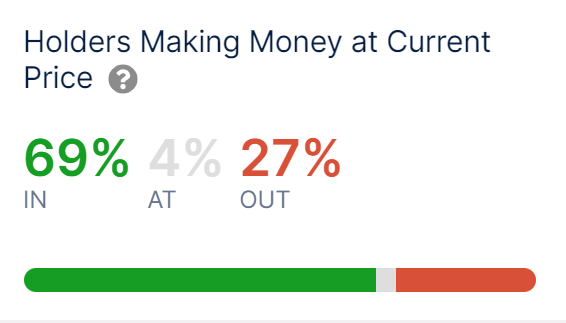

Now, here is the data shared by the analytics firm that shows how this investor breakdown looks like for PEPE at the moment:

As is visible above, 69% of the total addresses holding PEPE have their cost basis higher than the current spot price of the coin, while 27% are in losses. 4% of the investors are sitting on their cost basis right now.

This profitability ratio isn’t that high, as, for example, 89% of Bitcoin investors are currently in profit, according to IntoTheBlock data. The reason behind the lower profits for the memecoin is that its price has seen a steep drawdown recently.

Historically, the addresses in the green have been more likely to sell to harvest their gains. As such, when the market profit-loss balance is overwhelmingly towards profits, a mass selloff can occur.

Naturally, this means the chances of a top being hit increase with increasing investor profits. However, a low percentage of investors being in profits can be conducive to bottoms forming, as profit-selling exhausts at these levels.

At present, PEPE is neither dominated by green investors nor red ones. In bull runs, however, profitability levels generally remain higher, so any cooldown can help prices rebound.

Thus, the fact that investor profitability has returned to the 69% level for the memecoin could be a sign that a bottom is close if the bullish regime has to continue.

PEPE Price

PEPE has returned to the $0.0000050913 mark after having declined more than 26% over the last seven days. The chart below shows the memecoin’s performance over the past month.