In a market that has long been captivated by the rapid rise and often speculative nature of meme coins like Dogecoin (DOGE), Shiba Inu (SHIB) and PEPE, a notable shift is underway.

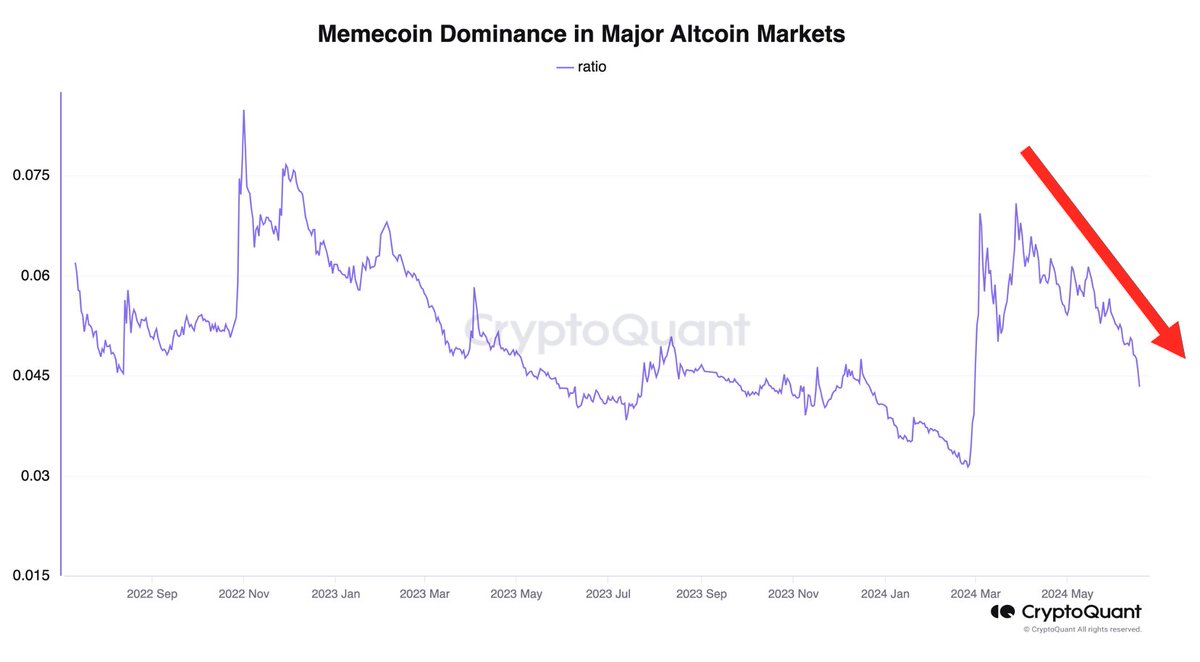

According to Ki Young Ju, the CEO of CryptoQuant, the once-dominant meme coins are witnessing a decline in market influence, potentially signaling a maturing cryptocurrency landscape.

The Decline of Meme Coins Dominance

Ki Young Ju’s analysis reveals a significant reduction in the dominance of meme coins within the altcoin sector, a trend observed from recent market data.

This change suggests a shift from speculative investments towards projects with more substantial fundamentals, akin to earlier phases in the development of the crypto market.

“The era of meme coin speculation is winding down,” Ju states, emphasizing a return to fundamental analysis as a key driver for investment decisions.

Memecoin dominance in alt markets is declining.

CT would be shifting from gambling to focusing on fundamentals, similar to a few years ago.

Pack it up lads, it’s over. pic.twitter.com/H5d81mRIJB

— Ki Young Ju (@ki_young_ju) June 19, 2024

This observation is seen as a reflection of a broader movement away from high-risk gambles in digital assets. Meanwhile, as meme coins may be experiencing a downturn, Ju maintains a positive outlook on more fundamentally sound assets like Bitcoin.

The CryptoQuant CEO particularly noted:

Some people misunderstood my tweet. I’m bearish on memecoins, not BTC. Long-term bullish on Bitcoin.

Market Response And Future Outlook

The current market dynamics further illustrate this shift. So far, the top meme coins have declined over the past week. Particularly, Dogecoin, Shiba Inu, and PEPE have all experienced a week-long downturn, with declines of 13.1%, 14.1%, and 7.9%, respectively.

This trend continued over the past 24 hours, with Dogecoin dropping an additional 0.3%, Shiba Inu 1.8%, and PEPE 4%. However, despite these decreases, IntoTheBlock data shows a silver lining, as a large proportion of holders for these meme coins remain profitable—74.99% for Dogecoin, 80.57% for PEPE, and 76.85% for FLOKI holders.

In contrast to the recent downturns, analyst Moustache remains optimistic about the potential for altcoins in the coming year. He parallels current chart patterns and previous bullish years like 2020 and 2017.

There are some massive signs that Altcoins will rise exponentially in 2024.

-The chart looks like it did in 2020, or even 2017.

-The 2W Gaussian Channel has changed from red to green.Don’t get shaken out of the market, this is just a retest imo. pic.twitter.com/aEm9FE8o06

— 𝕄𝕠𝕦𝕤𝕥𝕒𝕔ⓗ𝕖

(@el_crypto_prof) June 20, 2024

The 2-week Gaussian Channel shifting from red to green is a significant technical indicator supporting his outlook, signaling potential upward movements.

Moustache advises investors to stay the course despite the market’s short-term volatility, suggesting that the current fluctuations may be setting the stage for a major rally in 2024.

Featured image created with DALL-E, Chart from TradingView