Bitcoin remains shaky when writing, down 13% from its all-time high. However, despite the short-term uncertainty, one analyst on X remains bullish on the world’s most valuable coin, citing current developments from a technical perspective.

Is Bitcoin Inside A Wyckoff Re-accumulation Phase?

Taking to X, the analyst believes Bitcoin might be forming a Wyckoff Re-accumulation pattern on the daily chart. This means the coin could consolidate in a trading range before catapulting higher in the days ahead.

Technically, the Wyckoff Re-accumulation pattern identifies a phase when it is assumed that big players, primarily whales, are quietly buying at a discount. Price action remains muted and inside a defined range whenever they do this.

Currently, Bitcoin prices are inside a zone marked by support, at $60,000 on the lower end and all-time highs, at around $74,000 on the upper end.

Though the momentum remains bullish, bulls’ failure to edge higher or dump below the psychological level suggests that some big players might be deliberately keeping prices at spot rates.

This preview considers the failure of bears to confirm losses of April 13. Even though BTCUSDT prices are still trapped inside this bear bar, it is clear that bulls flew back to support prices.

The only time sellers will be in control is if prices collapse below April 13 lows and $60,000 at the back of increasing volume. As it is, buyers have a chance and are trending inside a broad range, capped at $73,800.

Is BTC Preparing For Gains?

Though optimism exists, the leg up would be sparked by technical but most fundamental factors. Following last weekend’s Halving on April 20, the network’s daily emissions have decreased by 50%. With a reduced supply, the resulting scarcity could drive prices higher, assuming demand remains.

However, whether this spike will occur in the next weeks or months remains to be seen. Once halving occurs, Bitcoin usually breaks previous all-time highs, in this case, $73,800. If this historical printout is respected, BTC could soar to fresh all-time highs by the end of the year.

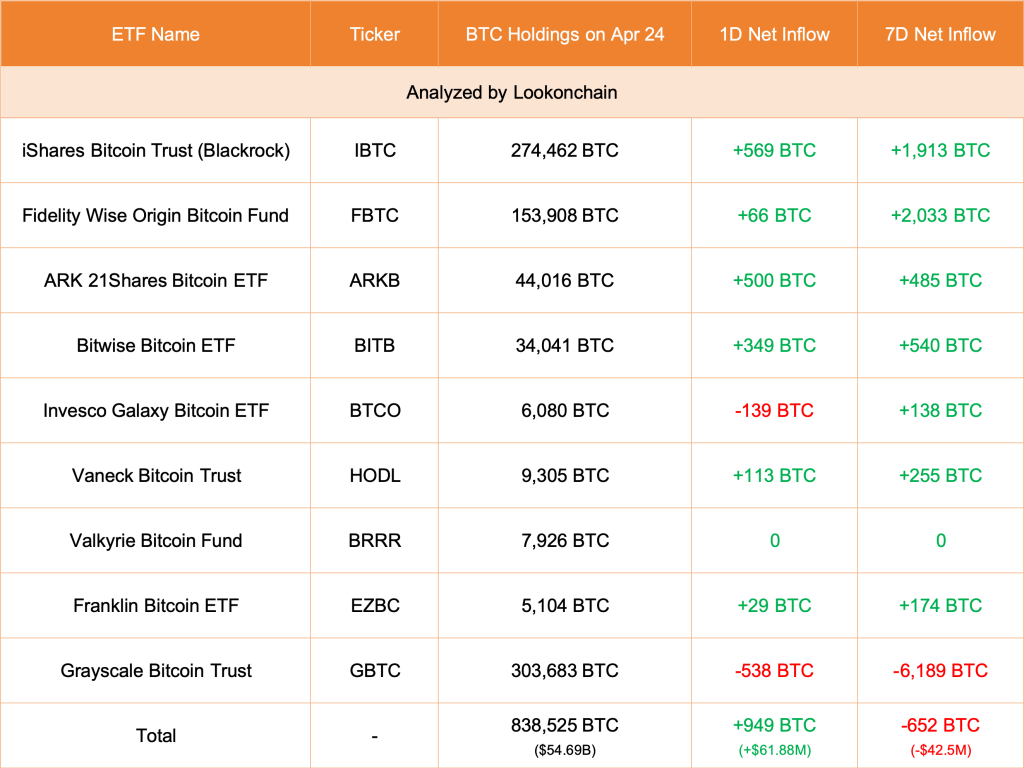

Increasing institutional adoption via spot Bitcoin exchange-traded funds (ETFs) will drive a big part of this expected. As of April 24, Lookonchain data shows that GBTC decreased 538 BTC while BlackRock and other spot ETF issuers added 569 BTC.

Inflow has reduced, but assuming prices pick up, it is likely that more users will be keen to add BTC to their portfolios. This, as a result, could drive prices higher.