Quick Take

Bitcoin’s mining difficulty is on the brink of its most significant downward adjustment since the FTX collapse in December 2022. Newhedge forecasts a reduction of over 4% on May 9, which would mark a substantial trend shift after the Bitcoin halving. The network’s hash rate has already dropped by 10% from its peak on a seven-day moving average.

In March, CryptoSlate accurately predicted this hash rate correction, citing the anticipated disruption caused by reduced miner rewards post-halving. The delay in the correction’s onset is attributed to the elevated fees following the launch of Runes.

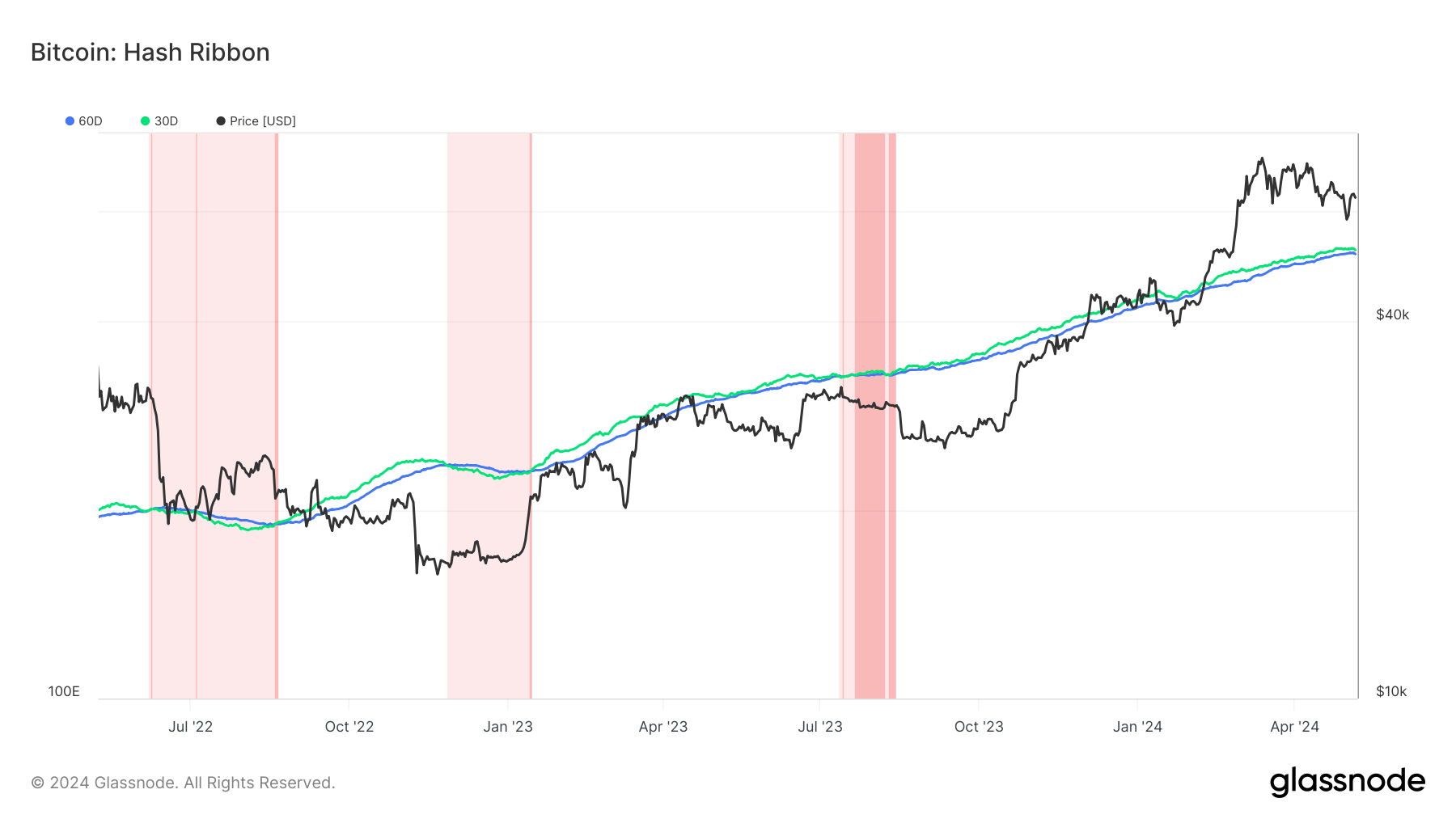

Despite these developments, Glassnode’s hash ribbon indicator hasn’t confirmed a miner capitulation event. This metric signals a potential Bitcoin bottom when mining expenses outweigh profits. While the convergence of the 30-day and 60-day moving averages shows an increased risk of miner capitulation, the indicator has not been triggered.

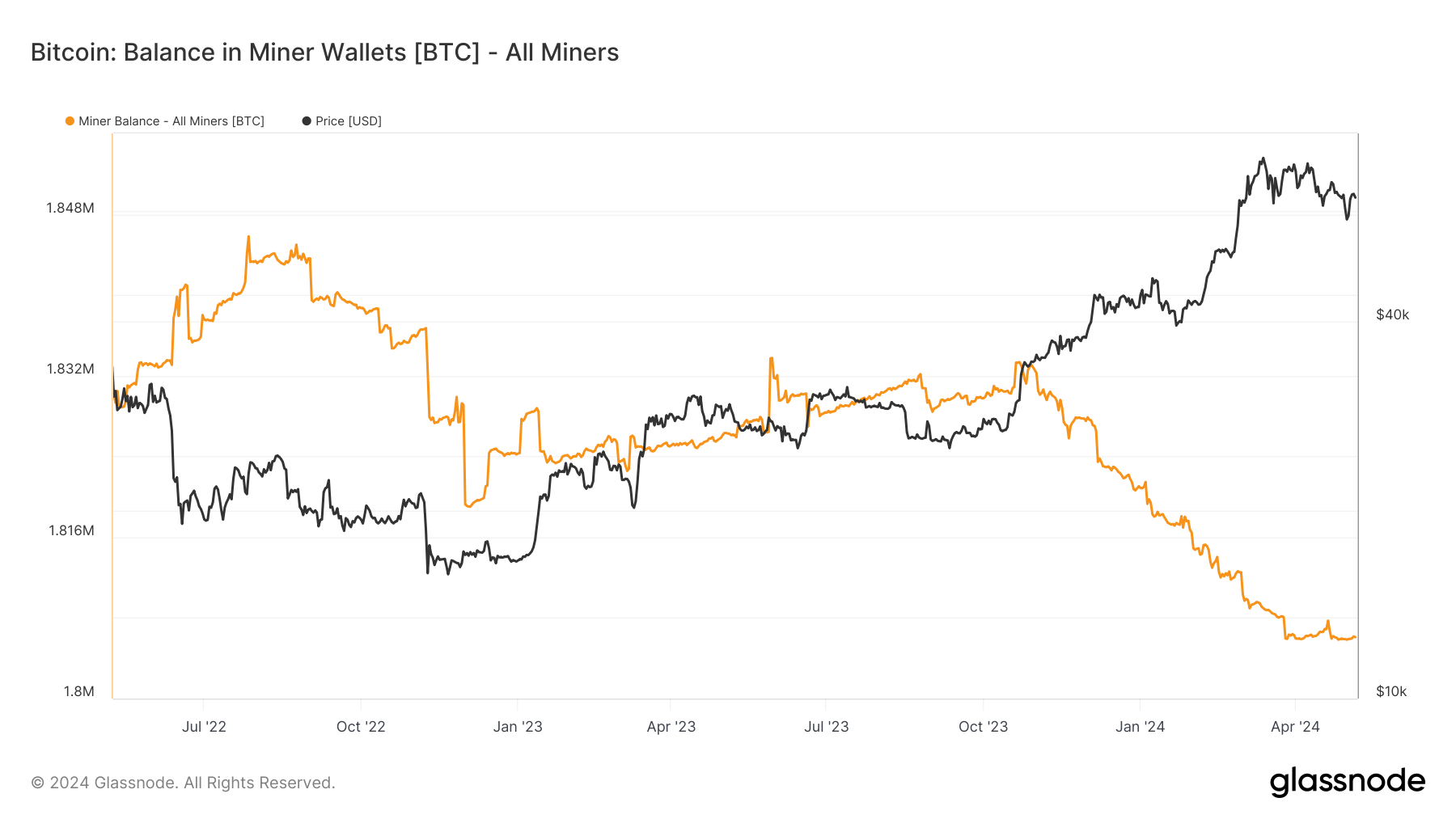

On the other hand, data regarding miner balances suggests a potential resilience within the network. Despite approximately 30,000 BTC being offloaded between October 2023 and March 2024, miner reserves have risen over the last five weeks. This indicates that weaker miners may have already exited the network, alleviating sell-side pressure as the remaining participants maintain their holdings.

The post Bitcoin mining difficulty set for sharpest drop since FTX collapse appeared first on CryptoSlate.