On-chain data suggests Bitcoin is no longer being used as electronic cash by its userbase as the token’s circulation has seen a steep drop.

Bitcoin ‘Velocity’ Has Plunged To Historical Lows Recently

As explained by CryptoQuant founder and CEO Ki Young Ju in a post on X, Bitcoin’s circulation has recently slowed down. The on-chain indicator of relevance here is “Velocity,” which keeps track of the rate at which the cryptocurrency’s tokens are circulating in the market.

When the value of this metric is high, the coins move around faster on the network. On the other hand, a low value implies tokens are still inside an address long before being transferred.

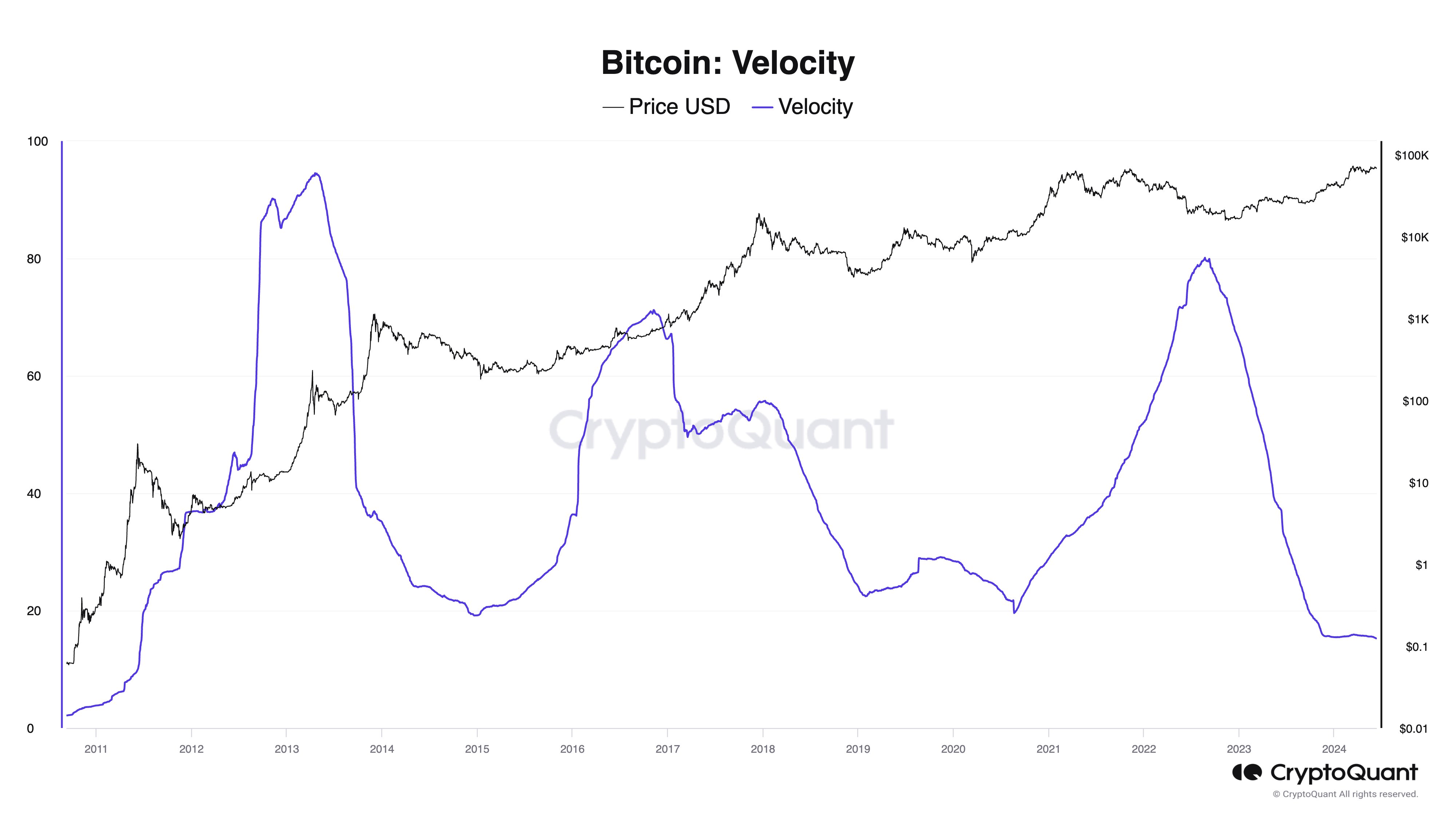

Below is a chart that shows how the Velocity of Bitcoin has changed throughout its history.

As displayed in the above graph, the Bitcoin Velocity had been rising during the 2021 bull run and had observed a peak in the middle of the 2022 bear market. Following this top, though, the metric completely reversed its trend as it started sharply going down instead.

This drawdown continued until the last few months of 2023, and the indicator has been moving sideways since then. The chart shows that these low levels that the metric has recently been consolidating are the lowest in around 13 years.

This would mean the cryptocurrency’s circulation rate is the same as in 2011. Now, as for the significance of the recent trend, it may tell us how the current userbase of the cryptocurrency is looking at the asset.

Bitcoin was originally meant to be cash in electronic form that works peer-to-peer (P2P), without requiring any central entity at all. The fact that the BTC tokens are no longer being circulated would imply that they aren’t being used much for monetary transactions. As the CryptoQuant founder puts it,

Despite Satoshi’s vision of “P2P Electronic Cash,” Bitcoin is primarily used as “Digital Gold,” with institutions holding it without frequent transactions.

It’s unclear whether the recent low Velocity is here to stay for BTC, given that the indicator did observe a rapid increase to high values just a few years back.

As the graph shows, the indicator has gone through cycles over the cryptocurrency’s history, shifting between highs and lows. Ju notes Bitcoin will see its velocity “peak someday when BTC is widely used for payments.”

BTC Price

Bitcoin has extended its latest decline as its price is now down to just $66,400. The cryptocurrency’s returns now stand at -8% since the $72,000 high registered on Friday.