Quick Take

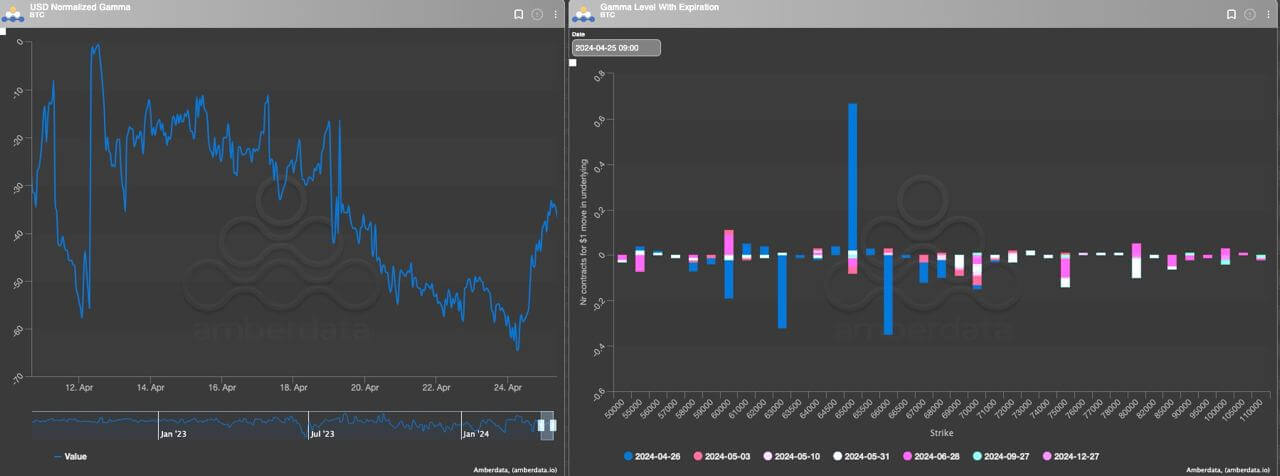

As Bitcoin’s price hovers around $63,000, slightly down over the past 24 hours, the options market is providing insights into shifting investor sentiment ahead of the expiration on April 26. A key development has been the reduction in positive gamma exposure as Bitcoin declined through the heavily traded $65,000 call strike.

According to Imran Lakha, a 20-year professional options trader notes:

Short gamma reduced on the way down as we went through the big long strike at 65k suggesting volume has been smashed lower, calls are getting dumped

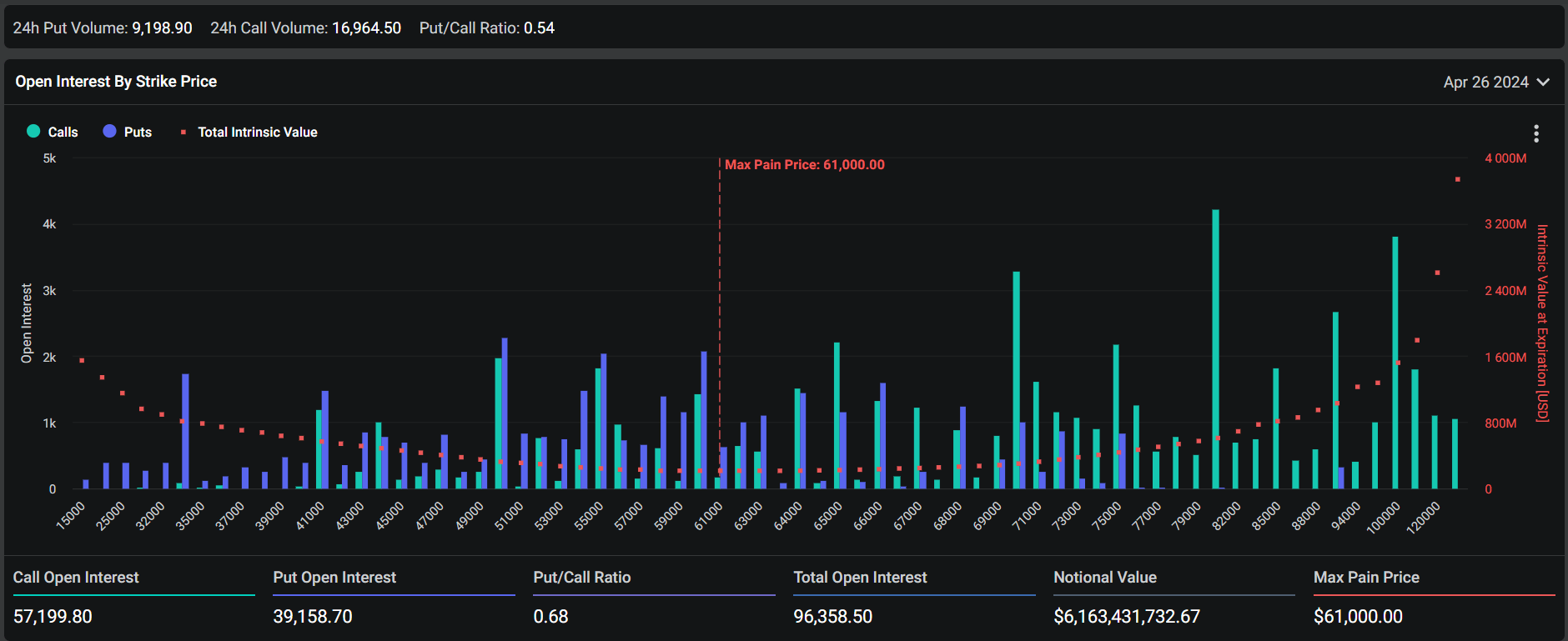

The options open interest data provided by Deribit reveals a max pain price of $61,000, which could potentially serve as a short-term support level. While significant open interest remains in calls above the current spot price, the lack of put open interest below $60,000 indicates a lack of downside protection. CryptoSlate has pinpointed this price level as a crucial support threshold.

The put/call ratio of 0.68 reflects a modest bias towards calls, but this has decreased notably due to likely profit-taking on downside hedges.

In conclusion, the options market data suggests a cooling of bullish sentiment as Bitcoin pulled back from recent highs. However, the remaining upside option holdings could still influence short-term price action, with the max pain level as a potential support zone to monitor.

The post Bitcoin options signal cooling bullish sentiment as key support level emerges at $61,000 appeared first on CryptoSlate.