As Bitcoin dips below the $65,000 mark, currently trading at $64,886, the cryptocurrency market is witnessing a heightened sense of urgency among traders.

This recent downturn reflects a broader trend observed over the past week, with Bitcoin shedding approximately 2.4% of its value. The last 24 hours alone saw a further decline of 1%, signaling growing market nervousness.

Should You Panic?

Analysts from the blockchain analytics platform Santiment highlight the ongoing decline phase as a steepest three-day decline in active Bitcoin wallets since the peak earlier in March, suggesting a significant shift in investor behavior and market sentiment.

However, this contrasts sharply with ETH, as Ethereum wallets continue to increase, indicating divergent investor confidence between the leading cryptocurrencies.

The increase in Ethereum wallets suggests a bullish outlook for ETH despite the bearish pressure on Bitcoin. Meanwhile, according to Bitfinex analysts, the ongoing sell-off has been significantly influenced by long-term Bitcoin holders and whales adjusting their holdings amid the market’s consolidation phase.

This behavior is typical of long-term holders who opt to reduce their positions during periods of market uncertainty to capitalize on or mitigate losses.

The Bitfinex analyst reveals that the Hodler Net Position Change metric has consistently shown negative values, indicating that these significant players are moving their holdings to exchanges, potentially to sell, exerting downward pressure on Bitcoin prices.

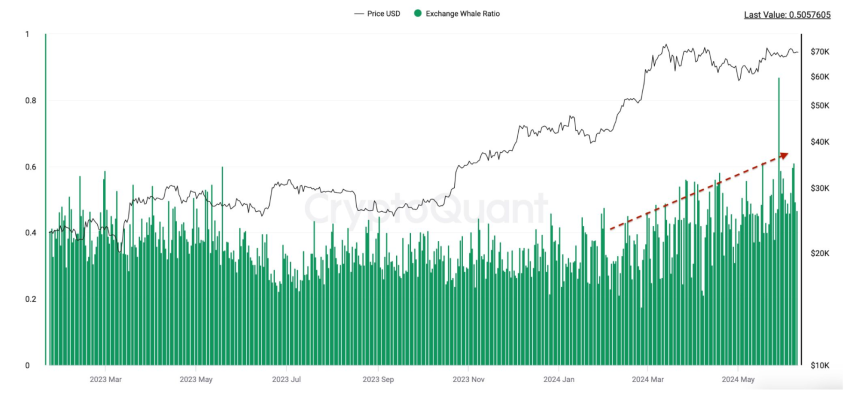

This trend is echoed by the rising Bitcoin Exchange Whale Ratio, which tracks large deposits into exchanges relative to overall market activity.

As more whales transfer their Bitcoin to trade on platforms, the increased potential supply on the market can lead to price drops.

Should You Buy?

Despite these pressures, some analysts remain cautiously optimistic about a potential rebound. CrediBULL Crypto, a prominent analyst, suggested on X that BTC might be nearing its lower support levels, with the current prices potentially front-running a deeper market low that many fear.

There’s a chance our $BTC bottom is in with this SFP.

Below is what I am watching for now.

Yes, we can still technically go lower into the “dream long” zone below, but as I’ve previously said it would not surprise me to see that zone front run.

That being said, you sell the… pic.twitter.com/cI6moqbadJ

— CrediBULL Crypto (@CredibleCrypto) June 18, 2024

Funding rates in the crypto derivatives market serve as a critical indicator of trader sentiment. Recent data from Coinglass indicates that funding rates are slightly positive, which traditionally signals a bullish outlook among traders.

Notably, positive funding rates imply that more traders are betting on the price of Bitcoin going up and are willing to pay a premium to hold long positions in futures contracts.

Funding rates are slightly positive, showing bullish .

Buy the dip.

https://t.co/iyLrhuoty0 pic.twitter.com/YFfCsGMTni

— CoinGlass (@coinglass_com) June 18, 2024

This metric can often counterbalance the prevailing market sentiment, suggesting that despite the sell-off, a section of the market is preparing for a potential price increase.

Featured image created with DALL-E, Chart from TradingView