Quick Take

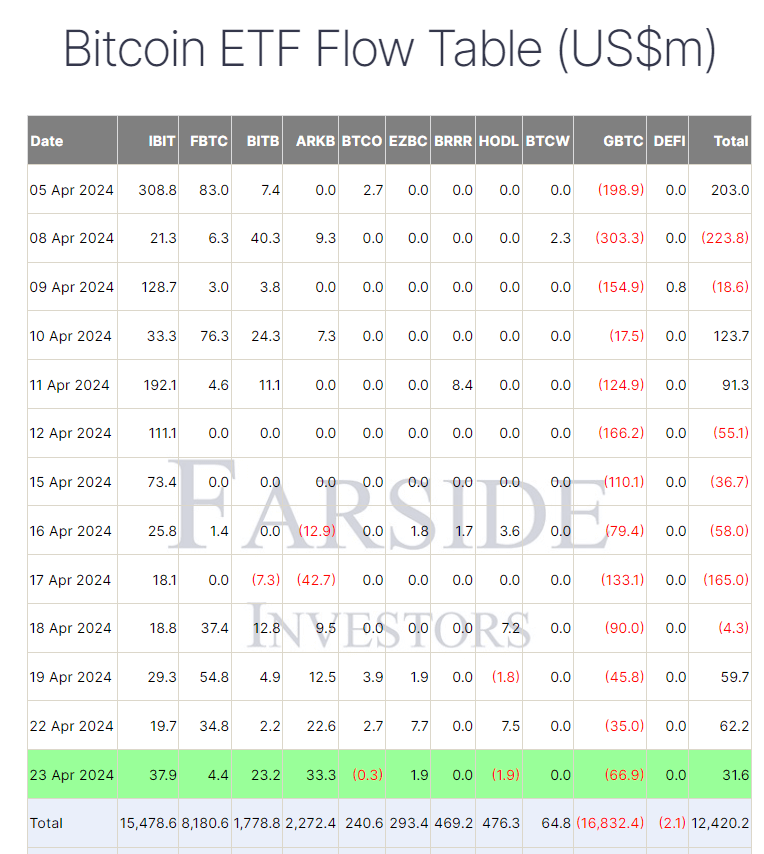

Farside data shows that the Bitcoin (BTC) exchange-traded funds (ETFs) market saw a total inflow of $31.6 million on April 23. The market has experienced a surge in inflows over the past few days, with April 23 marking the third consecutive trading day of positive net inflows.

BlackRock’s IBIT led the charge, which recorded a net inflow of $37.9 million, its highest since April 15. This brings IBIT’s total net inflow to an impressive $15,478.6 billion. Ark’s ARKB also saw a substantial inflow of $33.3 million, marking its most significant inflow since March 27 and pushing its total net inflow to $2,272.4 billion, according to data from Farside.

Farside data reports that five of the 11 Bitcoin ETFs on April 23 experienced inflows, with IBIT, FBTC, BITB, ARKB, and EZBC leading the pack. However, Grayscale’s GBTC continued to see outflows, with a $66.9 million outflow on April 23. Despite this, the fact that GBTC has seen four consecutive trading days of double-digit outflows is a promising sign that outflows are reducing. Since their launch, Bitcoin ETFs have collectively brought in $12,420.2 billion.

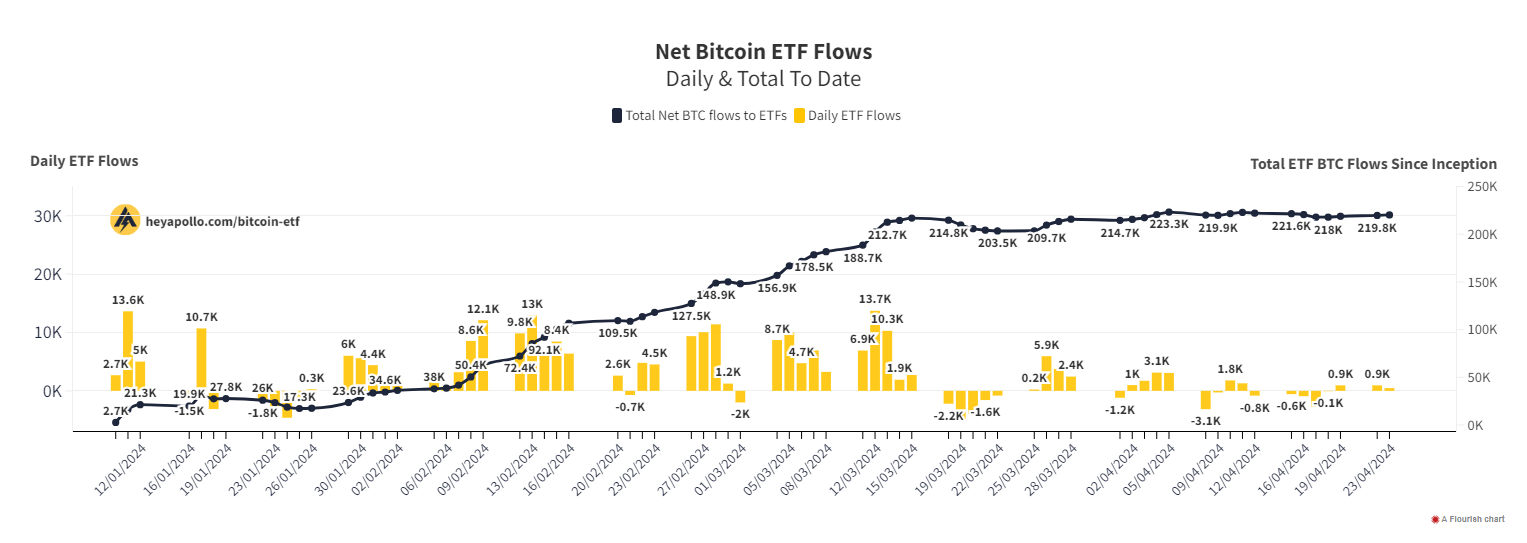

Data from Heyapollo shows that the daily Bitcoin flow into ETFs on April 23 was roughly 500 BTC, surpassing the total amount of Bitcoin mined on the same day, approximately 450 BTC.

The post Bitcoin US ETFs inflows exceed new daily mining output on April 23 appeared first on CryptoSlate.