Quick Take

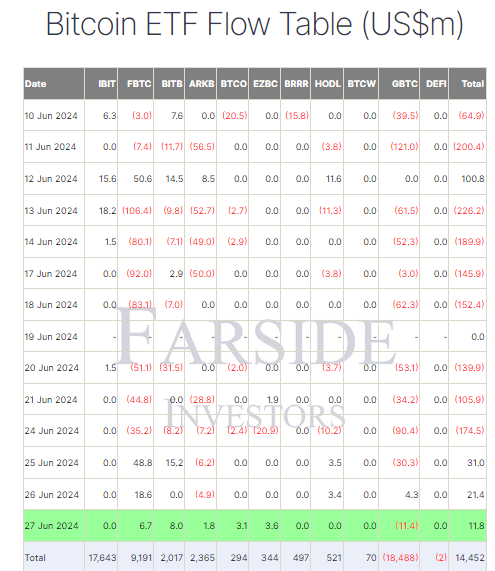

Farside data shows that the Bitcoin Exchange-Traded Funds (ETFs) experienced a modest inflow of $11.8 million on June 27, marking the third consecutive day of positive inflows. This trend is encouraging as Bitcoin maintains its position slightly above $60,000. The inflows were distributed across five ETF issuers, signaling a potential for continued steady performance into the summer months, although a seasonal slowdown could be anticipated.

Among the major ETF issuers, Fidelity’s FBTC saw an inflow of $6.7 million, followed by Bitwise’s BITB with $8.0 million and ARK’s ARKB with $1.8 million. However, Grayscale’s GBTC experienced an outflow of $11.4 million, bringing its total outflows to $18.5 billion. BlackRock’s IBIT ETF remained unchanged, with no inflows or outflows. The cumulative ETF inflows now total $14.5 billion.

In related news, BlackRock’s Global Allocation Fund disclosed that it owned 43,000 shares of the iShares Bitcoin Trust as of April 30, according to a recent disclosure.

MacroScope commented:

“This follows two filings that BlackRock made on May 28 disclosing Bitcoin exposure in its Strategic Global Bond Fund and in its Strategic Income Opportunities Portfolio.”

The post BlackRock discloses further Bitcoin holdings amid 3rd consecutive day of ETF inflows appeared first on CryptoSlate.