Based on on-chain data, here’s how much unrealized profit the various Bitcoin whale and miner groups are holding right now.

Bitcoin Whale & Miner Profits Compared Across Cohorts

In a new post on X, CryptoQuant founder and CEO Ki Young Ju discussed the total unrealized profits currently held by the various on-chain cohorts.

Ju has talked about four groups. First is the “short-term holder (STH) whales.” Whales are typically defined as investors carrying at least 1,000 coins in their wallets, while STHs refer to investors who bought their coins within the past 155 days.

Thus, the STH whales would be the large entities that have recently entered the market. Like the STHs, there are also “long-term holders” (LTHs) who have been holding for more than 155 days. The LTH whales, therefore, would represent the veteran large hands of the market.

The other two groups of interest here are miner-related: the miners carrying between 100 and 1,000 BTC and miner whales (1,000 BTC+, once again). The former would represent the small miners on the network, while the latter would be the mining companies.

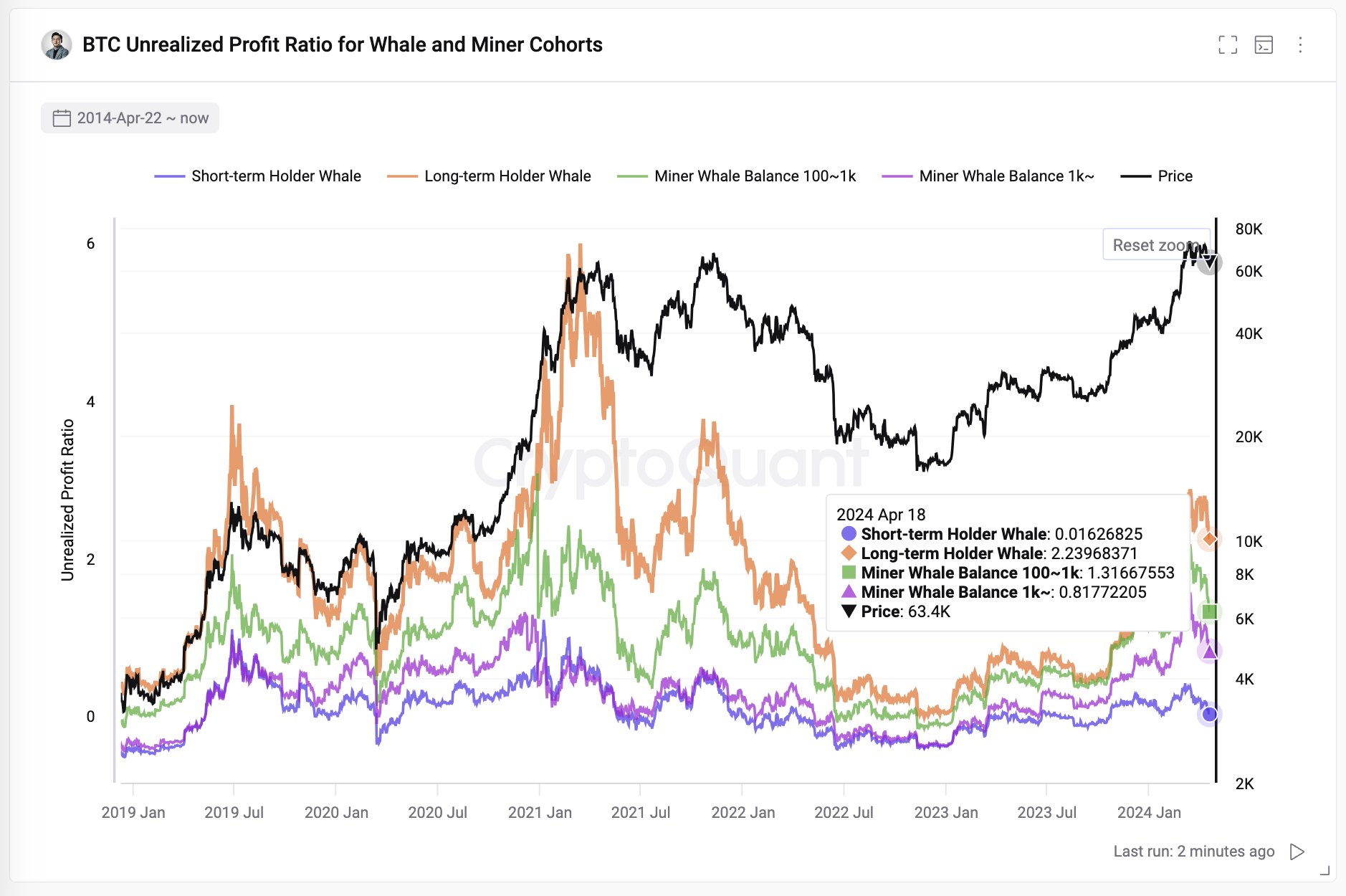

Now, here is the chart shared by the CryptoQuant founder that shows the trend in the Unrealized Profit Ratio for these four Bitcoin cohorts over the past few years:

The Unrealized Profit Ratio here is an indicator that goes through the transaction history of the coins these investors hold to see at what price they acquired said coins.

Based on this, it calculates what unrealized gains these holders are carrying and divides it by the cohort’s total market cap to output the profits as a ratio.

The chart shows that the Unrealized Profit Ratio has shot up for three of these groups as the latest rally has occurred. The metric is now at 2.23 for the LTH whales, 1.31 for small miners, and 0.81 for mining companies.

This means that the LTH whales are the biggest gainer in the market, holding more than 223% of profits. This suggests that these investors, who have been holding for a relatively long time, have been rewarded for their patience.

The small miners are the next biggest winners, with 131% profits, outperforming the 81% profits of the miner whales. While these profits are significantly less than those of the LTH whales, they are still substantial nonetheless.

For the STH whales, though, the Unrealized Profit Ratio is at just 0.016, implying that this group carries only 1.6% in profits. These investors correspond to the big money that has come through the spot exchange-traded funds (ETFs) over the last few months.

These large entities have had to buy at relatively high prices, so their break-even mark is much higher than that of the LTHs, and thus, their profits are also much smaller.

Overall, based on the Unrealized Profit Ratio for these Bitcoin cohorts, the CryptoQuant CEO comments, “not enough profit to end this cycle, imo.”

BTC Price

Bitcoin is currently floating around the $64,300 level as the asset continues its recent trend of sideways movement.