Coinbase’s newly launched wrapped Bitcoin product, cbBTC, has seen rapid adoption within its first 24 hours, with a market capitalization nearing $100 million.

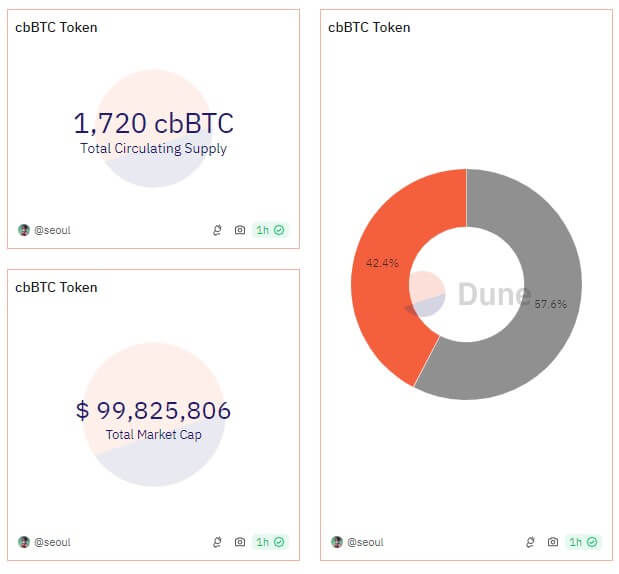

Data from Dune Analytics shows the circulating supply of cbBTC has reached 1,720 tokens, valued at $99.8 million. Of this, 43% is on Base, while 57% resides on Ethereum.

Base’s DeFi growth

Industry analysts have noted that Coinbase’s cbBTC growth could significantly boost DeFi activities on the exchange’s layer-2 network, Base.

Luke Youngblood, a contributor to Moonwell DeFi, highlighted the product’s impact. He pointed out that cbBTC’s fungibility with Bitcoin on Coinbase would enable retail BTC holdings exceeding $20 billion and institutional holdings over $200 billion to seamlessly integrate with Base’s on-chain ecosystem.

Nansen CEO Alex Alealso praised the token’s rapid adoption and predicted that it would substantially increase total assets on the Base network.

Further, He shared that Coinbase currently holds about 36% of the supply, while market maker Wintermute ranks among the top holders. Svanevik remarked:

“[It appears] Wintermute is the #1 market maker. [It will] be a solid business for them.”

Sun FUDs cbBTC

Despite cbBTC’s early success, not everyone is optimistic.

TRON founder Justin Sun voiced skepticism, dubbing cbBTC “central bank BTC” due to its lack of Proof of Reserve audits and potential government intervention.

He stated:

“cbbtc lacks Proof of Reserve, no audits, and can freeze anyone’s balance anytime. Essentially, it’s just ‘trust me.’ Any US government subpoena could seize all your BTC. There’s no better representation of central bank Bitcoin than this. It’s a dark day for BTC.”

Sun further claimed that integrating cbBTC into DeFi could introduce security risks, as government subpoenas could instantly freeze on-chain Bitcoin, undermining decentralization. He said:

“I’m friends with many DeFi protocol founders, but integrating cbbtc will pose major security risks to decentralized finance. A single government subpoena could freeze on-chain Bitcoin instantly, making decentralization a joke.”

Some have suggested Sun’s criticisms may stem from concerns that Coinbase’s cbBTC could encroach on the market share of BitGo’s WBTCa project with which Sun has ties. Notably, his involvement with WBTC has sparked debate within the crypto community, as some now seek alternatives.

The post Coinbase’s cbBTC soars to $100M in first day despite Justin Sun’s criticism appeared first on CryptoSlate.