Digital asset investment products saw significant outflows totaling $726 million, matching the highest outflow recorded earlier this year in March, according to CoinShares‘ latest report.

James Butterfill, head of research at CoinShares, attributed this negative sentiment to stronger-than-expected macroeconomic data from the previous week. This increased the likelihood of a 25-basis point interest rate hike by the US Federal Reserve.

He added:

“Daily outflows slowed later in the week as employment data fell short of expectations, leaving market opinions on a potential 50bp rate cut highly divided. The markets are now awaiting Tuesday’s Consumer Price Index (CP|) inflation report, with a 50bp cut more likely if inflation comes in below expectations.”

US, Bitcoin lead outflows

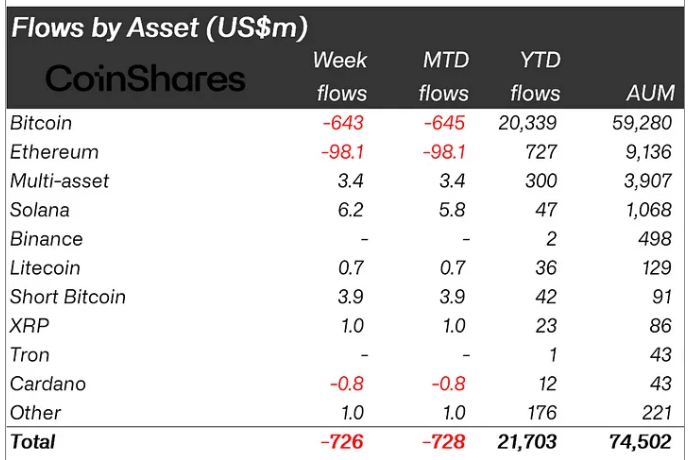

Bitcoin led the outflows, losing $643 million, bringing its monthly outflows to $645 million. Short BTC funds, however, saw minor inflows of $3.9 million.

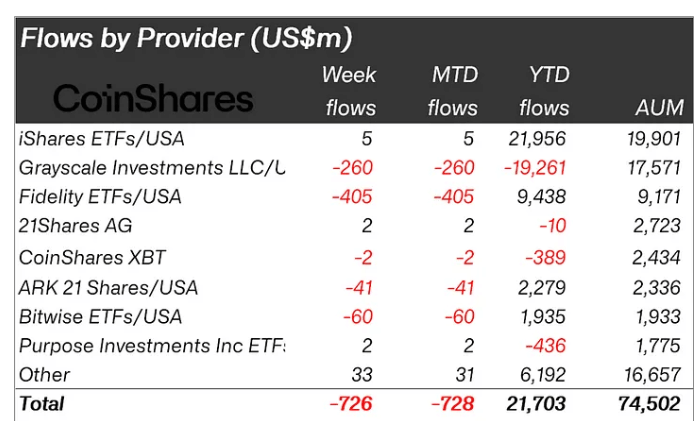

Meanwhile, US Bitcoin exchange-traded funds (ETFs) saw an eight-day outflow streak, causing net outflows of $721 million in the country. Fidelity’s FBTC fund was responsible for most of this, with $405 million in outflows last week.

It was followed by Grayscale’s GBTC, which saw $280 million in outflows. Bitwise ETFs completed the top three for last week with losses of around $60 million.

Canada also recorded outflows of $28 million. In contrast, Europe had more positive sentiment, with Germany and Switzerland seeing inflows of $16.3 million and $3.2 million, respectively.

Altcoins suffer contrasting fates.

Ethereum-based investment products recorded $98 million in net outflows last week.

This was primarily due to Grayscale’s converted ETHE fund, which lost $111 million during the period. This meant the minimal inflows into other spot Ethereum ETF products could not offset the significant outflows, further fuelling suggestions that there was no demand for these investment products.

However, Solana-based investment products secured $6.2 million in net inflows, the largest among digital asset products.

Other digital assets like Cardano saw outflows of around $800,000 despite completing the first phase of its highly anticipated Chang Hard Fork. In comparison, Litecoin and XRP products saw cumulative inflows of $1.7 million.

The post Digital assets suffer as Bitcoin leads $726 million outflow appeared first on CryptoSlate.