Bitcoin was one of the cryptocurrencies that reacted to Federal Reserve Chairman Jerome Powell’s remarks during a panel discussion on Tuesday. Powell reiterated the central bank’s commitment to maintaining a restrained monetary policy, despite encouraging economic indicators. His remarks, which highlighted the importance of persisting with current interest rates due to limited progress in reaching the Fed’s inflation target, sparked reactions across various financial markets, including Bitcoin.

Bitcoin’s Price Response to Powell’s Statements

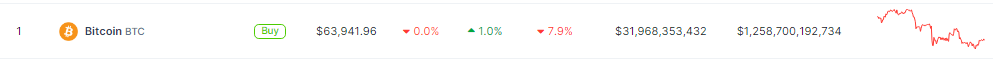

Bitcoin, the leading cryptocurrency by market capitalization, saw a nearly 8% decline in its price in the weekly chart, settling at approximately $63,941. This dip coincided with Powell’s statements regarding the future trajectory of interest rates.

Historically, Bitcoin has exhibited sensitivity to interest rate movements, with investors often interpreting higher rates as an indication of a less favorable investment environment for riskier assets like cryptocurrencies.

SUMMARY OF POWELL’S SPEECH AT THE WASHINGTON FORUM:

1. Powell warned that recent data show lack of further progress on inflation.

2. It will likely take longer than expected to achieve confidence that inflation will return to 2%.

3. Powell is prepared to leave rates at… pic.twitter.com/AB4BypYWLl

— Jesse Cohen (@JesseCohenInv) April 16, 2024

Investors and analysts had anticipated potential rate cuts in response to strong economic numbers, such as robust job growth and higher-than-expected retail sales. However, Powell’s assertion that rates could remain elevated for a longer duration than previously anticipated dashed hopes of immediate monetary easing, impacting market sentiments.

Bitcoin’s Volatility Amidst Fed Policy Outlook

The response from the cryptocurrency market, particularly Bitcoin, underscores its volatility and susceptibility to macroeconomic factors. While some investors may view the crypto as a hedge against traditional financial instruments, its price movements in response to statements from central bankers highlight the interconnectedness between traditional and digital asset markets.

Powell’s indication that rate cuts might not occur until later in the year, if at all, has prompted a reevaluation of investment strategies. The approaching Bitcoin halving event, which typically impacts supply dynamics and investor sentiment, has been overshadowed by bearish sentiment driven by the Fed’s policy outlook.

Market Uncertainty Surrounding Bitcoin’s Future

As the Federal Reserve’s next meeting approaches on April 30 and May 1, investors are closely monitoring developments for clues about the central bank’s future actions. Analysts have revised their forecasts, pushing back expectations for rate cuts and reducing the probability of multiple cuts within the year.

The absence of mention of rate cuts in recent statements by Fed Vice Chair Philip Jefferson further reinforces the cautious approach adopted by the central bank. Jefferson emphasized the importance of maintaining tight monetary policy and reiterated the Fed’s commitment to data-dependent decision-making.

Powell’s remarks on the central bank’s monetary policy stance have reverberated across financial markets, including the cryptocurrency space. Bitcoin’s price response to Powell’s statements underscores its sensitivity to macroeconomic factors and highlights the ongoing uncertainty surrounding its future trajectory.

Featured image from Pexels, chart from TradingView