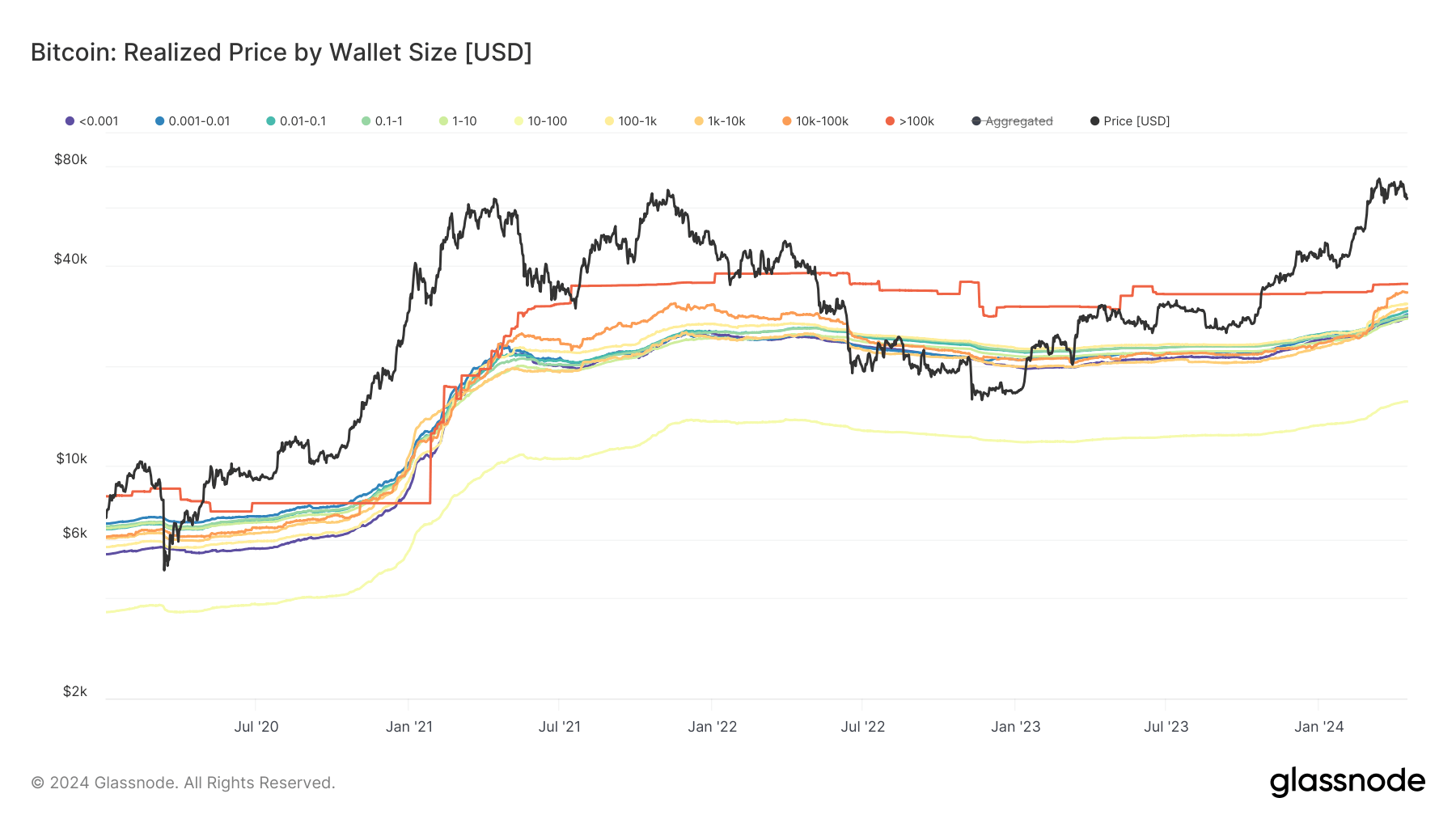

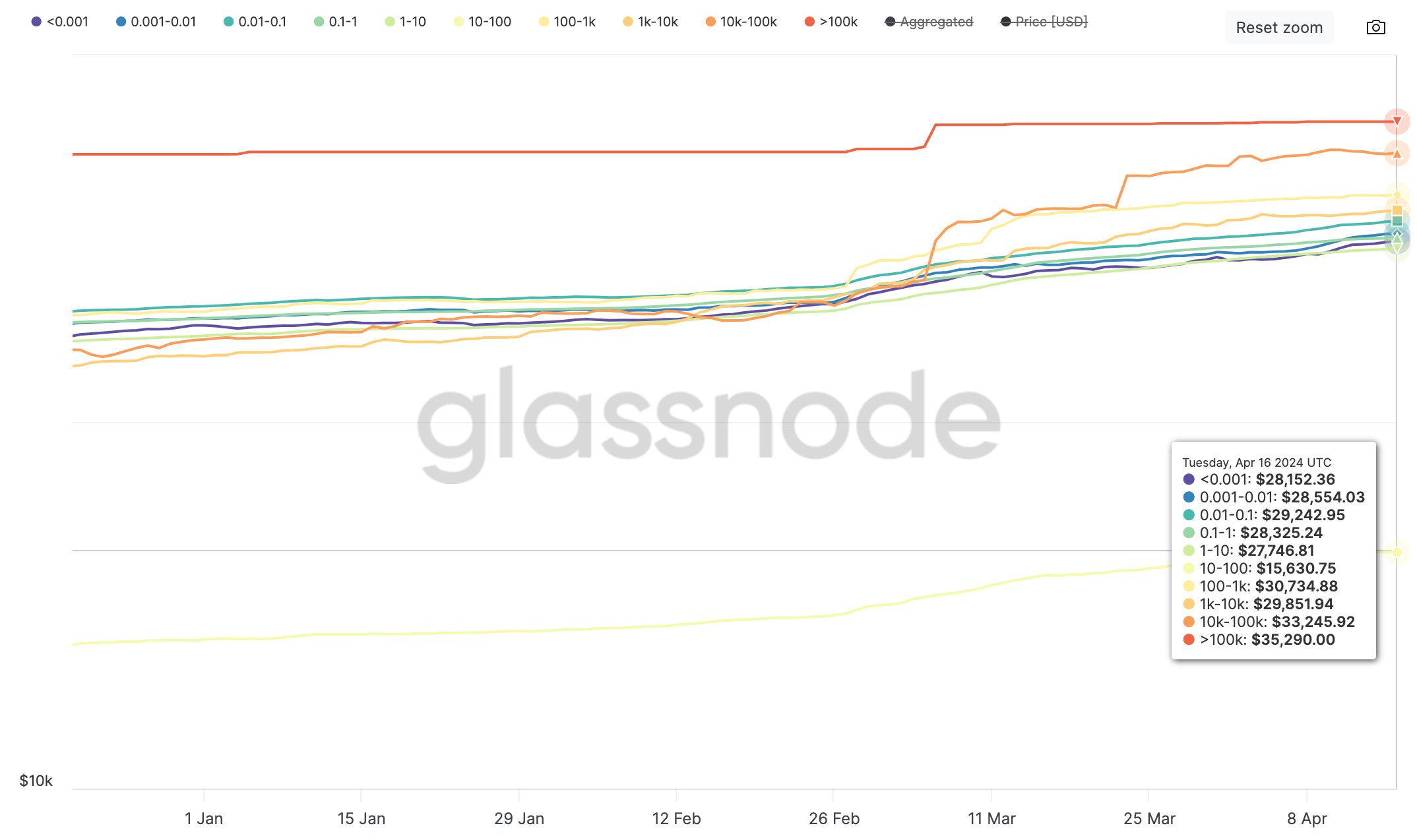

Glassnode data shows that OG Bitcoin holders, or Fish (yellow), those holding between 1 – 10 BTC, still have the lowest realized price by quite some margin at just $15,630. Compared to Whales, whose realized price is currently $35,290, this indicates Fish have the lowest average cost per Bitcoin out of all holders.

Further, any time the Bitcoin price has touched the Fish realized price, it has marked the bottom of the market, as seen in 2011, 2014, and 2018.

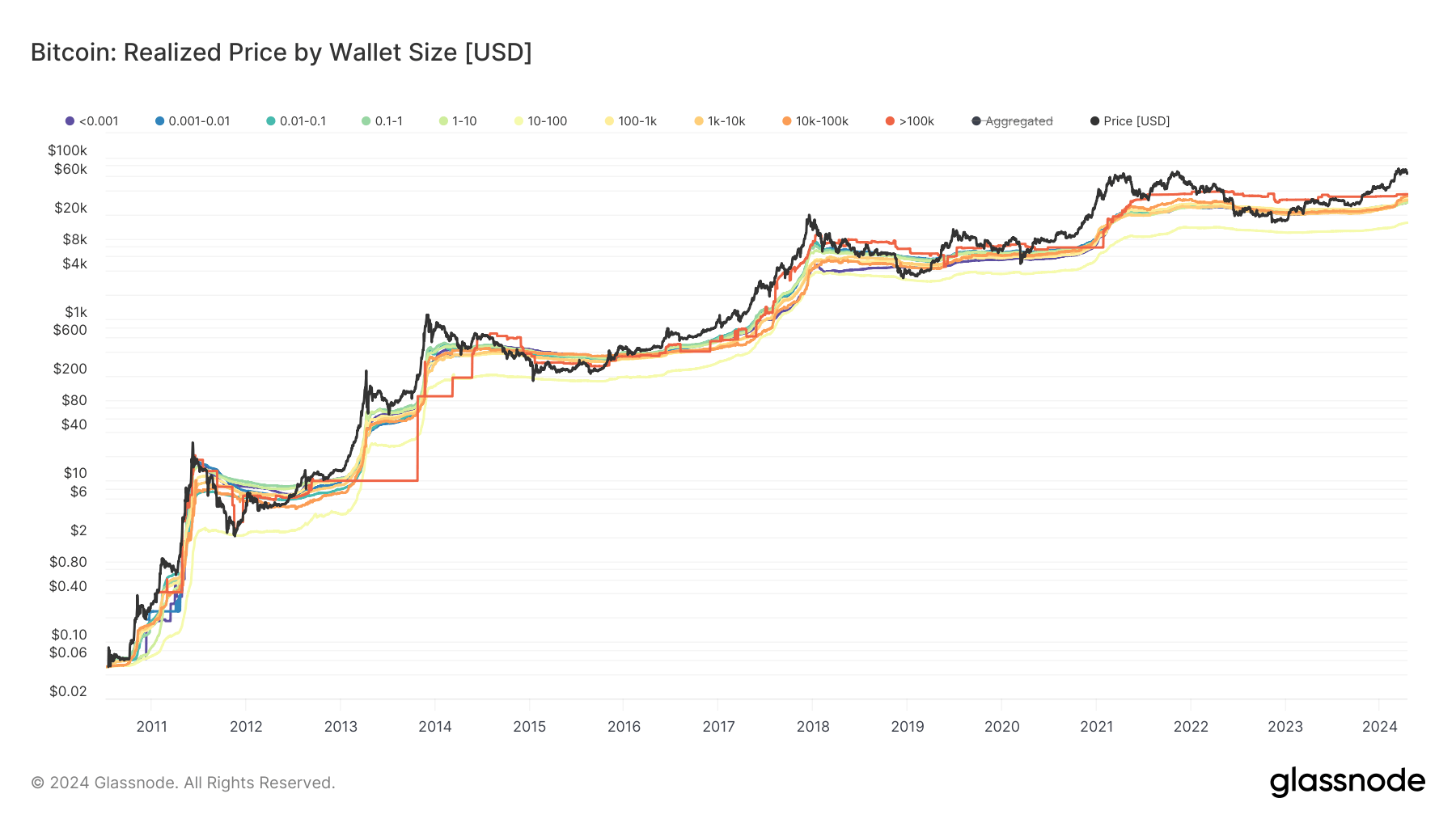

The realized price above chart shows the average cost at which Bitcoin holders have acquired their coins, broken down by the size of their wallets since 2010. The “Realized Price” measures the average price paid for Bitcoin based on when each coin was last moved. This doesn’t necessarily match the current market price but rather reflects the average acquisition cost over time.

Wallets are grouped (like ‘whales’ for large holders and ‘retail investors’ for smaller holders) to show if bigger wallets tend to pay more or less on average than smaller ones. This breakdown helps you see the distribution of buying prices across different types of investors. It’s useful for understanding whether larger investors (who hold more Bitcoin) generally buy at higher or lower prices compared to smaller investors.

Looking at the chart since 2020, Fish have never been underwater and retained a healthy gap from all other cohorts. Fish are either the largest holders of lost coins or the smartest money in Bitcoin.

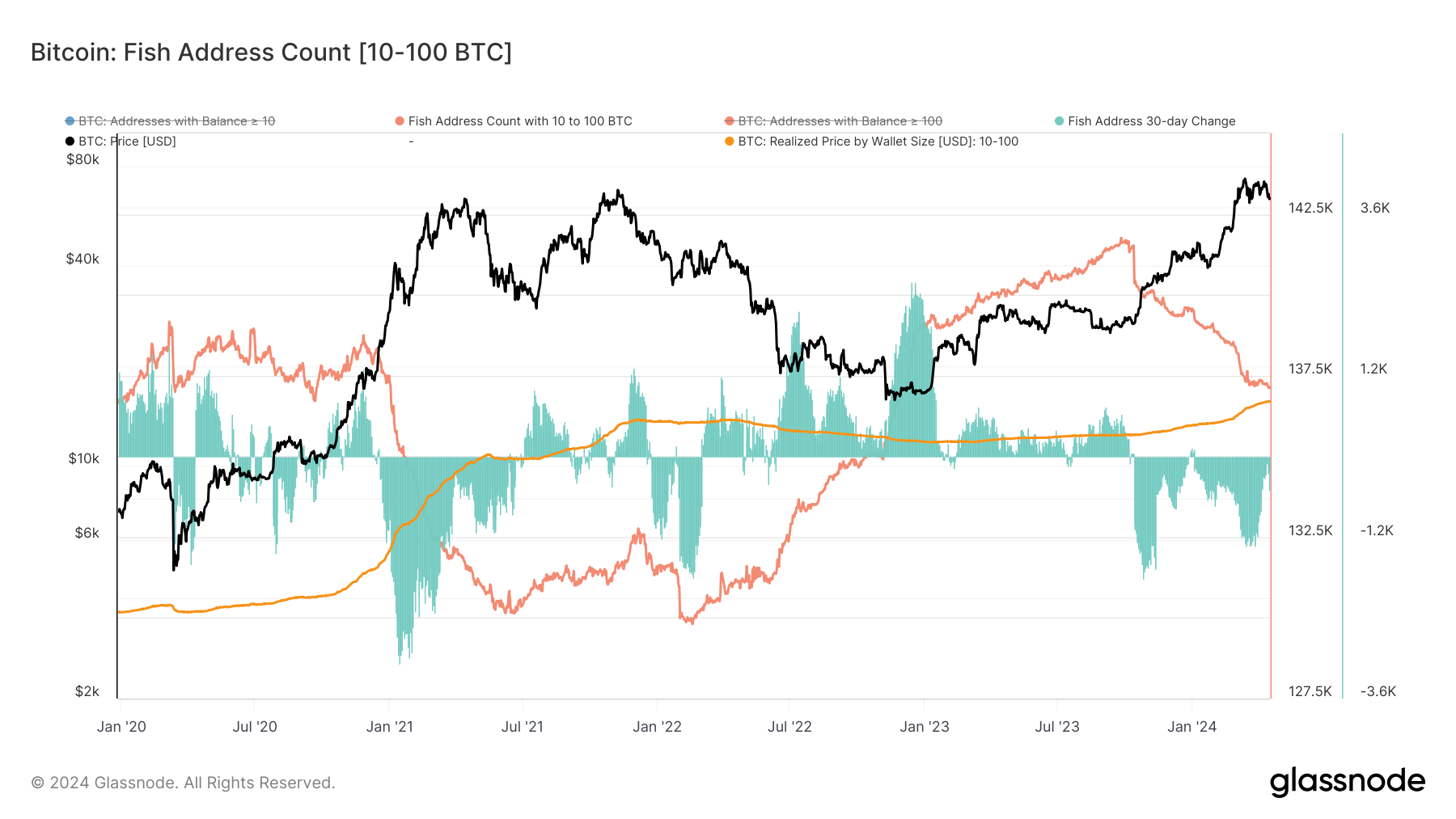

When we look at the number of addresses, we can see Fish numbers increase during bear markets and decrease in bull markets, indicating Fish are not simply lost Bitcoin holders. Interestingly, Fish accumulated the most Bitcoin as Bitcoin ran up from $15,000 in November 2022 until October 2023. Fish well and truly bought the dip – earning the title ‘King’ Fish in my eyes.

Fish addresses started to fall in October 2023 and have continued to do so throughout 2024. However, this year Fish realized price rose from $13,282 to $15,530, an increase of 16.9%, while Bitcoin’s trading price has increased by 41% over the same period. This suggests some Fish are taking profits while some Fish are evolving into Sharks (100 – 1,000 BTC).

The post OG Bitcoin holders or ‘King’ Fish retain $15k cost basis after buying the dip appeared first on CryptoSlate.