Ethereum, the second-largest digital asset by market capitalization, has been under the spotlight once again. Recent movements of ETH by the Ethereum Foundation have stirred concerns among market observers, igniting debates about potential volatility in Ethereum’s price.

Foundation’s Massive ETH Transfers

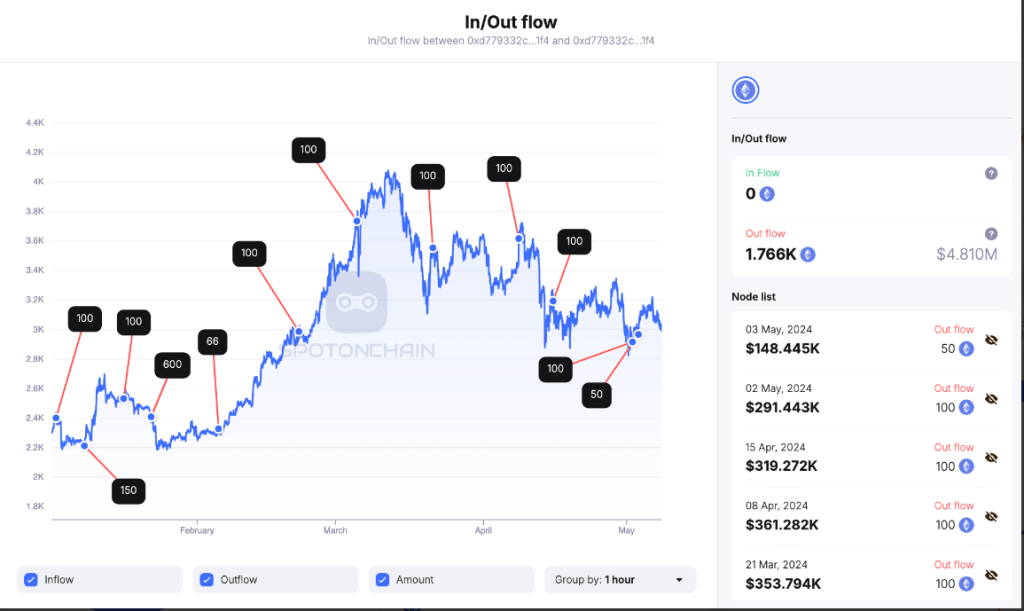

The Ethereum Foundation’s series of transfers to the multisign address “0xbc9” have captured the attention of crypto enthusiasts. According to reports from Spot On Chain, the foundation has transferred a total of 5,000 ETH to this address since the start of 2024. The latest transaction, involving 1,000 ETH valued at $3 million, has added fuel to the ongoing discussion.

Market Speculation Amidst Resistance Levels

Against the backdrop of the crypto’s struggle to breach the $3,200 resistance level, the current market environment amplifies the apprehension. ETH hovers below $3,000 per coin, prompting speculation about whether the foundation’s actions could exacerbate the downward trend. Some analysts even predict a potential drop in ETH’s price to $2,500, adding to the market’s uncertainty.

Market Impact Analysis

A considerable percentage of the ETH supplied to the address—specifically, 1,76 ETH—was quickly sold for 4.80 million DAI, averaging $2,72 per ETH. However, these sales frequently correspond with a drop in ETH price, raising suspicions about possible price manipulation.

Historical data further supports these concerns, indicating a correlation between the foundation’s sell-offs and downward pressure on ETH’s price. With the multisign address currently holding 2,508 ETH, equivalent to $7.51 million, market participants are treading cautiously, wary of the implications for the coin’s value.

Developments In The Ethereum Ecosystem

Despite the market turbulence, the ETH ecosystem continues to evolve. Recent developments, including Ethereum Improvement Proposals (EIPs), reflect the community’s efforts to enhance the network’s functionality and scalability. Notably, EIP-7702 has emerged as an alternative to EIP-3074, showcasing the community’s commitment to addressing the altcoin’s challenges.

Related Reading: Commencement Exercises Chaos! Drug-Induced Bitcoin Speech Gets Booed At Ohio State

Moreover, Ethereum’s transition from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism remains a focal point. The network’s inflationary dynamics following the Dencun upgrade in March have sparked discussions about its long-term sustainability.

The burning of gas fees post-Merge has led to a notable reduction in the growth of ETH’s circulating supply, signaling a significant shift in the crypto’s economic model.

Looking Ahead

As the crypto community braces for what lies ahead, all eyes remain glued to Ethereum’s price chart, eagerly awaiting clues about the next move of the leading altcoin. Amidst market uncertainties, Ethereum’s potential rally gathers attention, with reports suggesting a resurgence in momentum.

With intriguing updates expected on the ETH blockchain and ongoing discussions about its future direction, the Ethereum community remains resilient, navigating through the ever-changing landscape of digital assets.

Featured image from X.com, chart from TradingView