In the volatile landscape of cryptocurrency markets, Shiba Inu, the popular meme coin, has once again captured the attention of investors with a notable surge in value, despite losing 4% of its value in the last day. The memecoin reached a high of $0.00002296 after experiencing a temporary dip to $0.00002092 just the day before.

Open Interest Surge Signals Market Activity

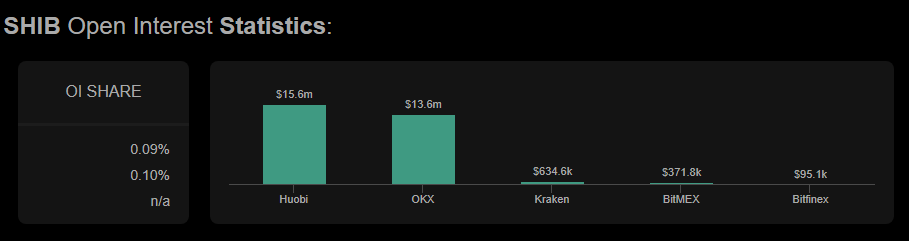

A key indicator of this newfound interest in Shiba Inu lies in the surge of open interest observed across major exchanges. Leading the charge are exchanges like Huobi and OKX, where Shiba Inu’s open interest soared to nearly $16 million and $15 million, respectively.

This surge in open interest reflects heightened market activity and suggests a growing number of investors are actively engaging with Shiba Inu futures contracts.

Mixed Sentiment Persists Among Traders

Despite the surge in open interest and the subsequent price rally, sentiment among traders remains mixed. While there is evident optimism driving the market, reflected in the increase in open interest, the Long/Short Ratio paints a nuanced picture.

Currently standing at 0.94, the Long/Short Ratio indicates that more traders are betting on a potential price drop for Shiba Inu. This divergence in sentiment adds a layer of complexity to the market dynamics surrounding Shiba Inu.

Leveraged Trading Statistics And On-Chain Indicators

Examining the market, statistics on leveraged trading offer additional insights into the current state of SHIB. Across exchanges like Bitget, CoinEx, BingX, Huobi, OKX, Kraken, and BitMex, open interest for Shiba Inu futures contracts stands at a staggering 2.40 trillion SHIB tokens. While exchanges like Bitget lead the pack with significant gains in open interest, others like BingX and CoinEx also show notable increases.

Furthermore, on-chain indicators present a bullish outlook for Shiba Inu, despite the fluctuations in price and market sentiment. A consistent decline in SHIB tokens held on exchanges since the onset of the bull market in October 2023 suggests that long-term investors maintain confidence in Shiba Inu’s potential. This trend persists even amidst recent market dips in March and April, highlighting the resilience of Shiba Inu’s investor base.

Navigating Shiba Inu’s Market Dynamics

While the recent surge in price and open interest signals renewed interest and activity, the divergence in trader sentiment underscores the inherent uncertainty of the market. Nevertheless, with on-chain indicators pointing towards long-term confidence, Shiba Inu remains a cryptocurrency to watch closely in the days to come.

Featured image from Pexels, chart from TradingView