Bitcoin has experienced significant volatility in recent days, navigating through bearish sentiment and market uncertainty. Despite this, BTC remains strong above the $100K mark, holding a key psychological and technical level. Investors are divided on whether Bitcoin is preparing for a surge into price discovery or a deeper correction, as speculation continues to drive market sentiment.

However, on-chain data suggests long-term confidence is growing. Crypto analyst Maartunn from IntoTheBlock shared key insights revealing that over 1,100,100 BTC has transitioned from the <1 Month to 1-12 Month age band. This means that a significant portion of recently acquired Bitcoin—bought near $100K and higher—has not been immediately sold but has instead aged into the next holding cohort. This behavior signals strong HODLing activity from newer participants, suggesting that many investors remain confident in Bitcoin’s long-term potential.

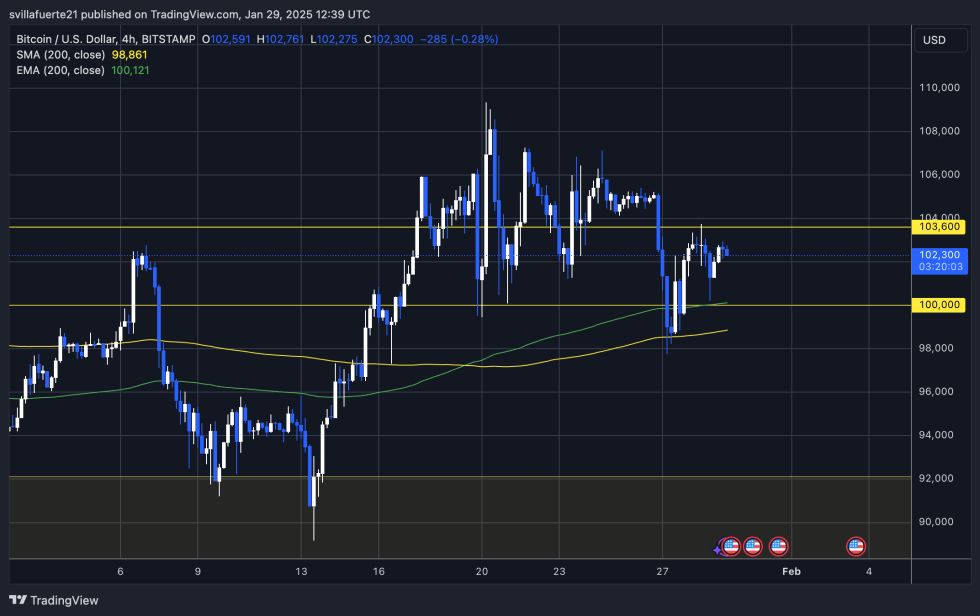

As Bitcoin consolidates near all-time highs, investors are watching key resistance and support levels closely. If BTC holds above $100K and reclaims $103,600, a push toward new all-time highs could be imminent. On the other hand, losing the $100K level could introduce further downside risks, leading to a deeper market correction.

Bitcoin Consolidates Below Key Levels

Bitcoin has faced days—if not weeks—of uncertainty, consolidating below the $110K mark, a psychological level that investors believe could trigger the next major move. While BTC has yet to test this price, market participants closely monitor key support and resistance levels to determine Bitcoin’s next direction.

Crypto analyst Maartunn shared on-chain metrics on X, revealing that over 1,100,100 BTC has transitioned from the <1 Month to 1-12 Month age band. This data suggests that a significant portion of recently acquired Bitcoin—bought near $100K and higher—has not been immediately sold but has moved into a longer-term holding category. This behavior indicates HODLing activity among newer investors, showing confidence in Bitcoin’s long-term value despite recent price fluctuations.

Right now, the $100K level remains the most critical price point in the market. Analysts suggest that holding this level is essential for BTC to continue its bullish trend. If Bitcoin fails to hold above $100K, a deeper correction could follow, leading to extended consolidation or even a short-term bearish phase. However, if BTC remains stable above this mark, it could provide the foundation for further price appreciation in the coming weeks.

Unless BTC sees further drops below $100K, this trend suggests a strong accumulation phase, which could fuel the next bullish leg toward price discovery.

BTC Faces Key Resistance

Bitcoin is currently trading at $102,300 after days of massive volatility and repeated tests of the $100K demand zone. Despite the uncertainty and bearish sentiment, BTC has managed to hold its ground, showing resilience at this crucial psychological level.

However, for bulls to maintain control, Bitcoin must reclaim the $103,600 level as soon as possible. This supply zone has been acting as a strong resistance, preventing BTC from making a decisive move higher. If BTC pushes above this level and holds it as support, a move toward all-time highs would become more likely in the short term.

On the flip side, if Bitcoin fails to reclaim $103,600, it could face renewed selling pressure, pushing it back toward lower demand levels. The market has already seen a strong defense of the $100K mark, but another test could weaken this support. If BTC drops below $100K, it will signal a deeper correction phase, potentially leading to extended consolidation before the next attempt at price discovery.

Featured image from Dall-E, chart from TradingView