Recent events have seen the Bitcoin market show fresh vitality; the price of the coin exceeds $63,000. This spike coincides with a slew of noteworthy occurrences that both experts and investors have noticed.

Dormant Wallet Turns Into Action

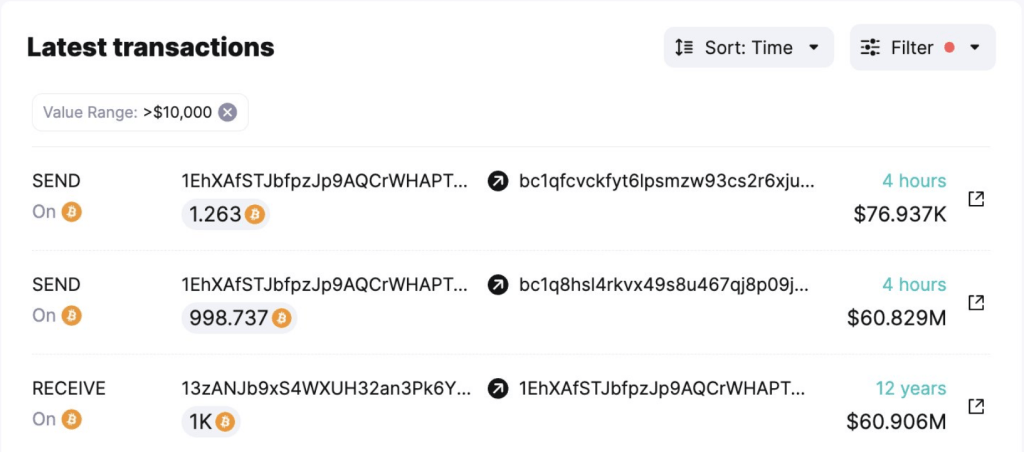

The turning on of a long-dormant Bitcoin wallet is among the most interesting events. Known as “1 EhXAfST,” the wallet had been dormant for almost 12 years until abruptly sending 1,000 BTC—worth about $60 million—to two new wallets.

Given the wallet’s background, this shift is very important; each BTC was only worth $12.06, hence the initial investment was $12,060. With a current worth of $60 million, Bitcoin’s price rise over the previous ten years is clearly shown as amazing.

4 hours ago, the dormant wallet “1EhXAfST” woke up after 11.8 years and moved 1,000 $BTC (~$60M) to 2 new wallets!

The wallet received those $BTC on Sep 25, 2012, when the price was only $12.06 ($12.06K).

Watch out for more #Bitcoin updates by following @spotonchain and setting… pic.twitter.com/0YUVUWFKdJ

— Spot On Chain (@spotonchain) July 15, 2024

Although the causes of this movement are yet unknown, it has spurred debates about possible profit-taking or strategic repositioning by long-term owners. Nonetheless, experts believe that this one transaction is not expected to have a major influence on the general price of Bitcoin on the market.

Raised Whale Activity And Accumulation

Along with the dormant wallet’s ressurection, Bitcoin whale activity has clearly increased. As Bitcoin’s price dropped to about $53,500 during the previous week, big investors bought over 71,000 BTC, or almost $4.3 billion overall.

Reported to be the quickest since April 2023, this accumulation pace points to a high positive attitude among the main market participants.

The increase in whale activity corresponds with a period of price volatility, indicating that these big players might be seeing recent price declines as purchase prospects. This behaviour usually conveys assurance about the long-term future of the item.

ETFs Boost Market Momentum

The function of spot Bitcoin ETFs is another major determinant of the dynamics of the present market. With just the previous week acquiring $1.1 billion worth of Bitcoin, these quite young investment vehicles have showed strong success. The whole Bitcoin holdings of US ETFs have been driven to fresh all-time highs by this flood of institutional interest.

The great success of Bitcoin ETFs is interpreted as a good indication of the general acceptance of the bitcoin. It offers conventional investors a controlled way to get exposure to Bitcoin without really owning the asset, hence perhaps widening the investor base and raising general market liquidity.

Overview Of Bitcoin Prices

With Bitcoin trading at $63,165 as per the most recent statistics, it is over a significant trend line. Market players are attentively observing this present price point as it can suggest the direction of further price fluctuations.

Technical experts propose that there is possibility for a further 8% price gain should Bitcoin keep its position above the $59,500 support level. The current patterns in accumulation and growing institutional interest support this perspective.

Still, the market is vulnerable to change. A dip below $56,405 might indicate a turn towards negative attitude, maybe resulting in a 7.5% price decline. This emphasises how crucial the present support levels are for deciding temporary price swings.

The Road Ahead

Meanwhile, rising ETF participation, awoken dormant wallets, and more whale activity all point to a market in change. Although these advancements are usually seen as encouraging signs, the bitcoin market is notoriously erratic.

In the next weeks, experts and investors will be attentively observing several aspects. They will be looking for more moves from once inactive wallets to gain understanding of long-term holder mood.

Featured image from CNBC, chart from TradingView