The post $100M in Shorts Suggest Solana (SOL) May Not Cross $235: Report appeared first on Coinpedia Fintech News

Amid the ongoing market decline, Solana (SOL) is gaining attention from crypto enthusiasts due to its current price action on the daily time frame. On January 29, 2024, the blockchain-based transaction tracker Whale Alert posted on X (formerly Twitter) that a crypto whale had moved a significant 220,308 SOL worth $52 million.

Crypto Whale Moves $52 Million of SOL

This substantial amount of SOL was transferred from the cryptocurrency exchange Bitfinex following the opening bell of the United States market. However, analysts and experts view this transaction as an accumulation by the whale as the asset experiences a significant price decline.

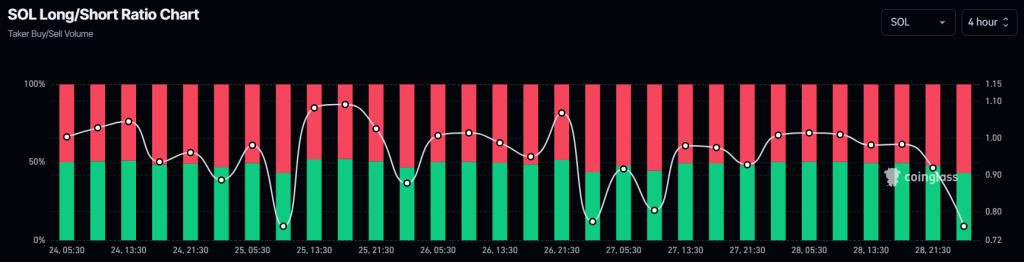

Despite the whale’s potential accumulation, SOL’s price has continued its downward trajectory, struggling near $227 with a 2.56% decline in the last 24 hours. According to on-chain data from Coinglass, the sentiment among traders remains strongly bearish, with a Long/Short ratio of 0.77. This indicates that 57% of top traders are holding short positions, compared to 43% with long positions.

Traders’ Strong Bearish Sentiment

However, not just participation has declined but intraday traders also seem to be betting on the short side, as revealed by the on-chain analytics firm Coinglass.

At press time, SOL’s Long/Short ratio stands at 0.77, indicating strong bearish sentiment among traders. Further data reveals that 57% of top Solana traders hold short positions, while 43% hold long positions.

When combining these on-chain metrics, it appears that potential long-term holders are accumulating, taking advantage of the current price decline. Meanwhile, intraday traders seem to be capitalizing on the prevailing market sentiment, leading to notable bets on short positions.

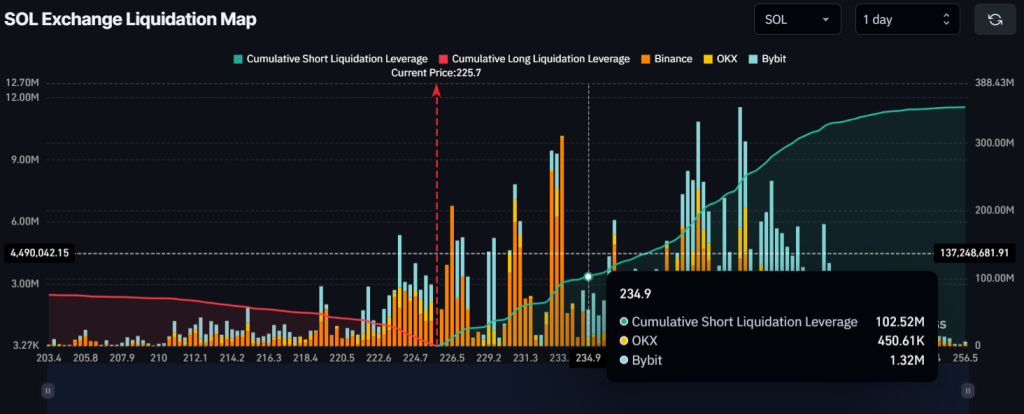

$100 Million Worth of SOL’s Short Positions

The current market sentiment appears to be bearish, with short-sellers holding over $100 million worth of bets on short positions at $235.

Meanwhile, bulls seem exhausted, holding only $40 million in long positions at the $215 level, which could be easily liquidated if the sentiment remains unchanged and prices continue to decline.