The Bitcoin price has somewhat slowed down since reaching the unprecedented high of $73,000, moving mostly sideways since mid-March. However, with the halving event less than a fortnight away, all eyes will be on the premier cryptocurrency and all that pertains to it over the next couple of weeks.

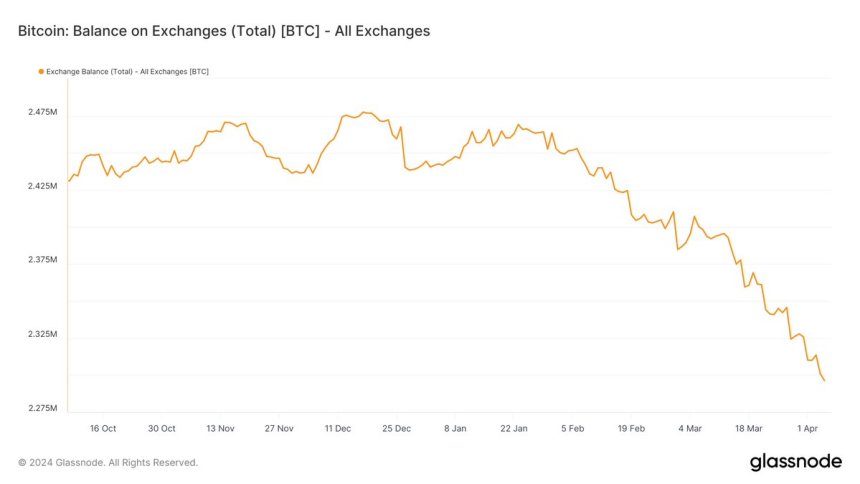

According to a recent on-chain observation, the BTC supply on exchanges has been on a steady decline over the past few months. This trend has sparked discussions on what this could mean for the Bitcoin price, both in the short and long term.

$7.55 Billion Transferred Out Of Exchange Wallets In The Past Month

Prominent crypto pundit Ali Martinez took to the X platform to share that a significant amount of Bitcoin has been moved out of crypto exchanges over the past month. The relevant metric here is Glassnode’s Balance on Exchanges, which tracks the total amount of a cryptocurrency (Bitcoin, in this case) held across all exchange addresses.

A decrease in the value of this indicator implies that investors are making more withdrawals than deposits of Bitcoin into centralized exchanges. The metric’s increase, on the other hand, indicates that more BTC is flowing into these exchanges than leaving.

According to Martinez, about 111,000 BTC (worth approximately $7.55 billion) have been transferred out of known crypto exchange wallets in the past month. Typically, an exodus of funds (of this magnitude) suggests a significant shift in the sentiment of Bitcoin investors.

While the exact rationale behind such a massive movement of Bitcoin remains unclear, the flow of funds from trading platforms suggests a growth in investor confidence. This implies that BTC owners are more interested in holding their assets in the long term rather than selling for short-term gains.

Furthermore, this continuous downward trend in BTC’s balance on exchanges could set the stage for a bullish rally for the Bitcoin price. A sustained drop in the BTC’s supply on centralized exchanges could result in a supply crunch – a scenario where the supply of a particular asset is lower than its demand, leading to a surge in its value.

Another potential bullish catalyst for the Bitcoin price is the upcoming halving event, which is expected to occur on April 18, 2024. With the miners’ rewards slashed in half and the production of Bitcoin slowed, this event is expected to impact the value of BTC positively.

Bitcoin Price At A Glance

As of this writing, the Bitcoin price stands at around $69,537, reflecting a 2.7% increase in the last 24 hours.