Crypto analyst Kevin Capital has provided insights into where the Bitcoin price may be headed next. The analyst alluded to the current liquidation data, revealing that there are currently $16 billion in possible liquidations from BTC’s current price to the $107,000 price level.

Liquidation Data Indicates A Bitcoin Price Recovery Is Imminent

In an X post, Kevin Capital revealed that there is only $1.5 billion in long liquidations from the current Bitcoin price to the $77,000 price level. On the other hand, there is $16 billion in short liquidations from the current price to the $107,000 level. The analyst remarked that this is one of the biggest disparities in history.

He further noted that the market makers prefer to move prices where they can most transact. As such, this suggests that the Bitcoin price could rebound as these market makers look to grab the liquidity at the upside. Kevin Capital remarked that patience is still needed while the 3-day resolves itself. However, he added that overall, things are looking a little clearer for the bulls.

The Bitcoin price has crashed over the past two days, dropping to as low as $86,000, sparking concerns that the bull run might be over. However, Kevin Capital’s analysis provides some optimism that the bull run is far from over and that the flagship crypto could still reclaim the $100,000 price level and possibly reach new highs.

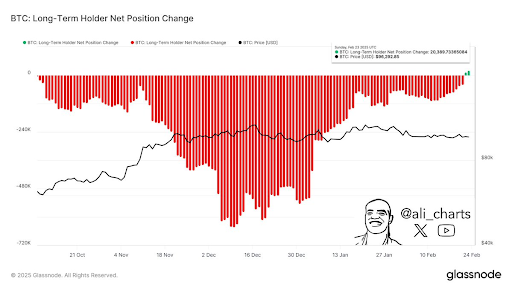

BTC’s long-term holders also seem confident that the Bitcoin price will still go higher. In an X post, crypto analyst Ali Martinez revealed that they had accumulated almost 20,400 BTC following the sharp sell-off that began two days ago.

BTC Could Still Drop To The $80K Lows

Crypto analysts Ali Martinez and Titan of Crypto have suggested that the Bitcoin price could still drop to the lower part of the $80,000 range. In an X post, Martinez stated that Bitcoin is showing similarities to the 2021 market top. He further remarked that if this pattern holds, there could be a period of consolidation at current levels before the next leg down for BTC.

His accompanying chart showed that the Bitcoin price could drop to as low as $80,850 when this next leg down occurs. Titan of Crypto also raised the possibility of BTC dropping to $81,000. He stated that BTC is breaking the trendline and dipping below the last wick low. He claimed that BTC’s weekly candle failing to reclaim the trendline could send the flagship crypto to the next support, which is Kijun at $81,000.

At the time of writing, the Bitcoin price is trading at around $88,700, down over 3% in the last 24 hours, according to data from CoinMarketCap.