Quick Take

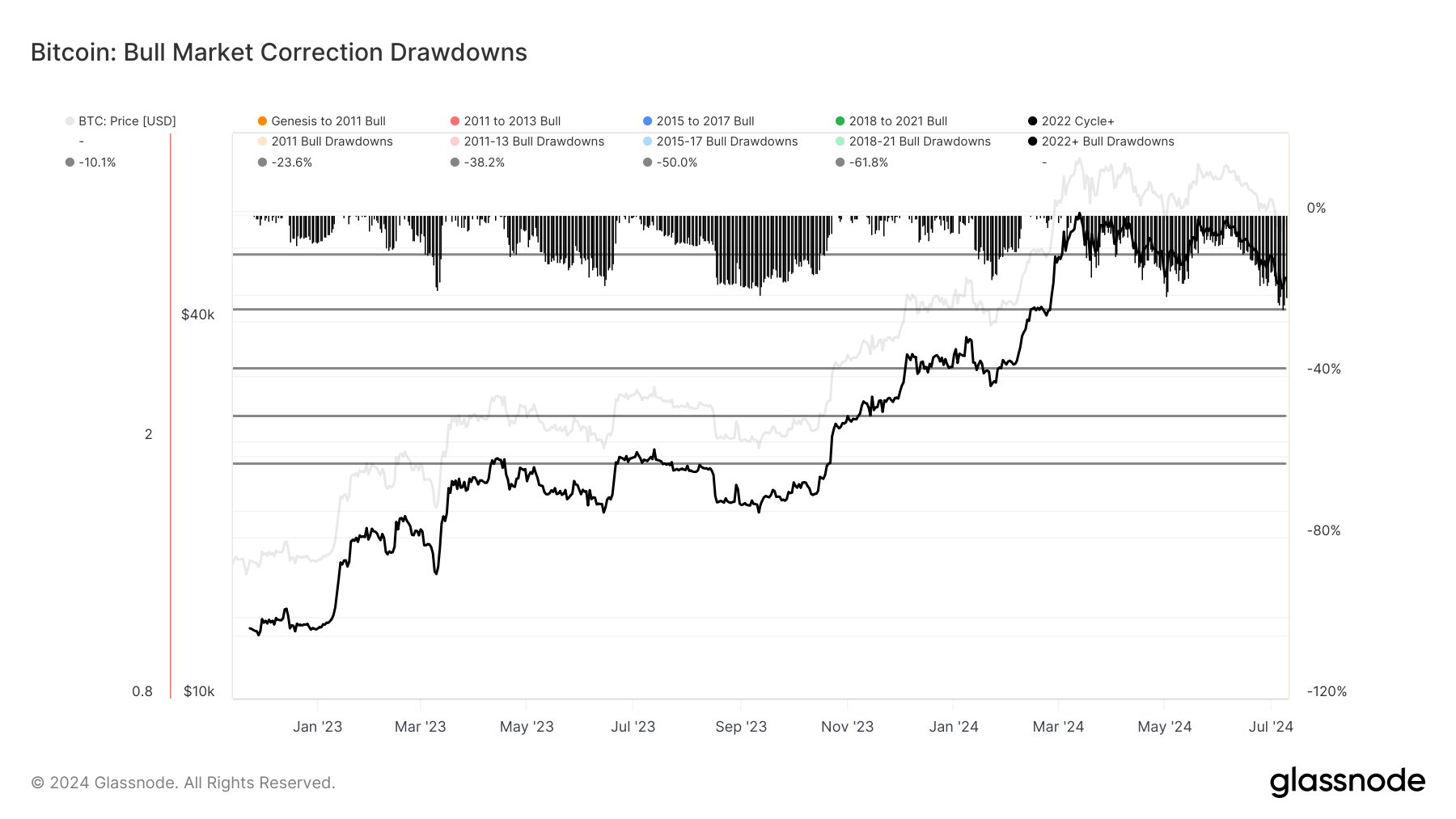

Bitcoin, currently trading 20% below its all-time high, is experiencing a period of consolidation in the high $50,000s. The market has just seen its largest correction of this cycle, dipping by 28% to just below $54,000.

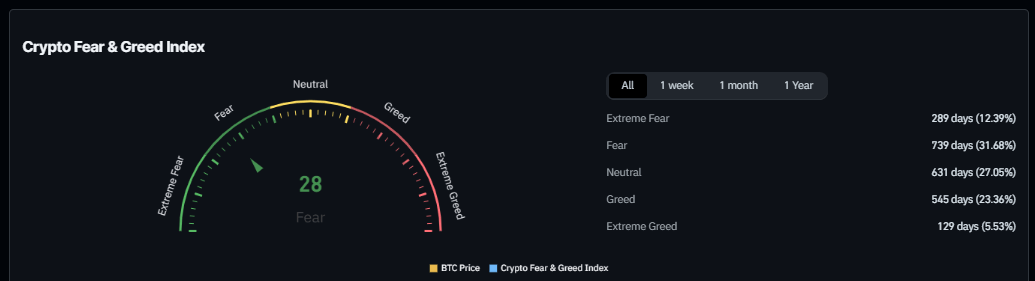

Coinglass data shows that Bitcoin remains in a state of fear according to the Fear and Greed Index, which is currently at 28. This presents an opportunity for investors to purchase Bitcoin at a discount.

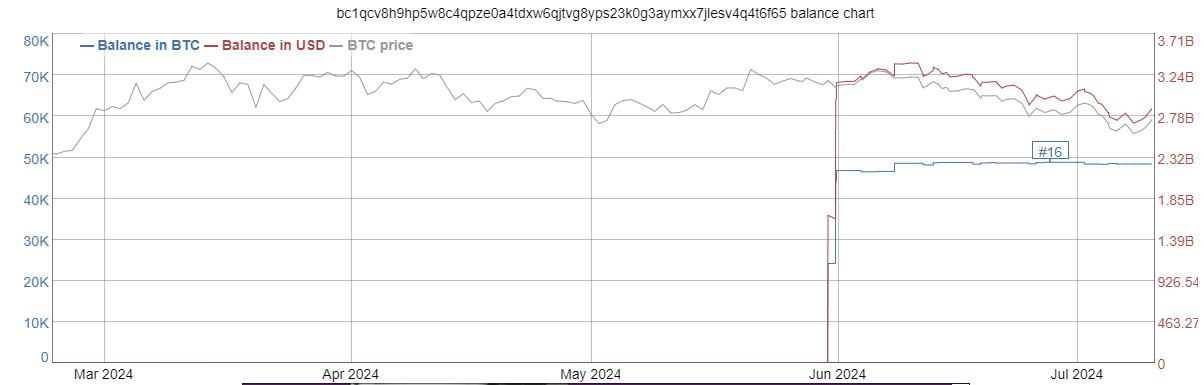

Data from BitinfoCharts, which tracks the top 100 rich Bitcoin addresses, reveals that a whale now holds 48,429 BTC, making it the 16th largest holder. This investor, who first bought in on May 30, a week before the correction started on June 7, accumulated roughly 48,500 BTC by June 8. Despite the subsequent market downturn, the whale has maintained their position, now facing over $518 million in unrealized losses. This address accounts for 0.25% of the circulating Bitcoin supply.

As new investors accumulate Bitcoin during correction cycles, holding an unrealized loss becomes as significant as buying the dips. This also demonstrates that whales are no more adept than retail investors.

The post 16th largest Bitcoin whale buys 48k BTC before correction with $500M in unrealized losses appeared first on CryptoSlate.