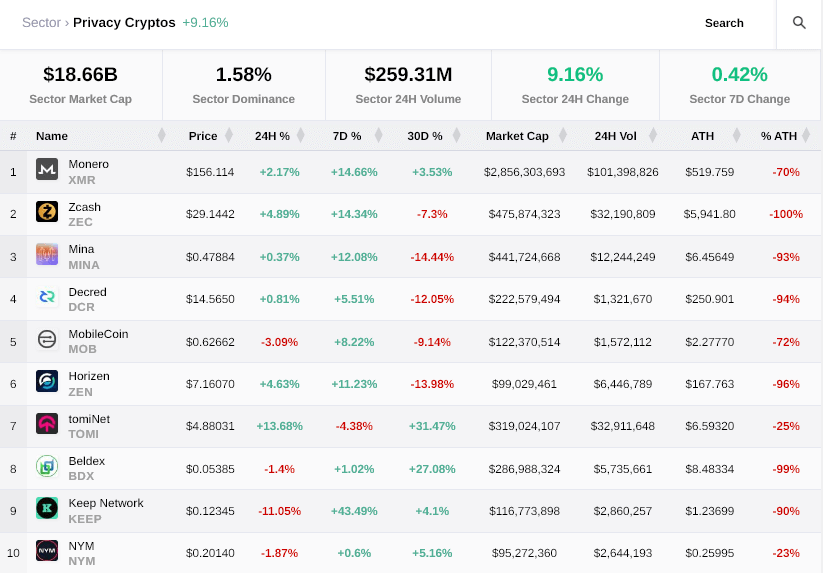

CryptoSlate data shows privacy tokens grew 9% over the last 24 hours – as the broader crypto market cooled following its recent strong run of form.

Since June 15, following BlackRock’s Bitcoin spot ETF filing, the total crypto market cap grew 18% to peak at $1.2 trillion on June 23. However, weekend price action failed to continue the uptrend, leading to minor outflows that found a local bottom at $1.17 trillion on Saturday – with the general 24-hour performance since then largely flat.

Well-known privacy tokens, such as Monero, Zcash, and Mina, posted a strong performance at +2.17%, +4.89%, and +0.37%, respectively. The best-performing token in the top 10 over the past 24 hours is tomiNet, up 13.68%. While over the past 7 days, Keep Network has led the top 10 with a gain of 43.49%.

Privacy tokens use technology, such as zero-knowledge proofs, to obscure information such as sender and recipient details, thus providing users with a degree of anonymity.

On June 23, the Federal Action Task Force, an intergovernmental body tasked with combating money laundering and terrorist financing, said many jurisdictions have yet to implement its policy standards concerning virtual assets (VAs) and virtual asset service providers (VASPs) – with more than half failing to enact the Travel Rule. It called on all countries to close the gaps.

The Travel Rule refers to policies to prevent criminal and terrorist misuse within the digital asset sector, particularly the requirement for VASPs to share information on originator and beneficiary information for crypto transactions.

The EU previously proposed a bill to ban privacy tokens, citing concerns over their use in money laundering.

On June 1, Binance announced the delisting of several privacy coins across its Spanish, French, and Polish markets, effective June 26. The affected coins are Decred, Dash, Zcash, Horizen, PIVX, Navcoin, Secret, Verge, Firo, BEAM, Monero, and MobileCoin.

The post $18.6B privacy sector up 9% leading crypto market over past 24hours appeared first on CryptoSlate.