Investor confidence appears to be on the rise in the crypto market lately, and Bitcoin has been a major beneficiary of this positive trend. Consequently, there has been a continuous accumulation of BTC amongst large-scale investors despite its somewhat frustrating price action.

The premier cryptocurrency’s price may have ended May beneath the psychological $70,000 mark, despite having touched the level a couple of times in the last two weeks of the month. The latest on-chain data suggests that the faith in Bitcoin has only continued to grow strong.

Is BTC Primed For A Price Rally?

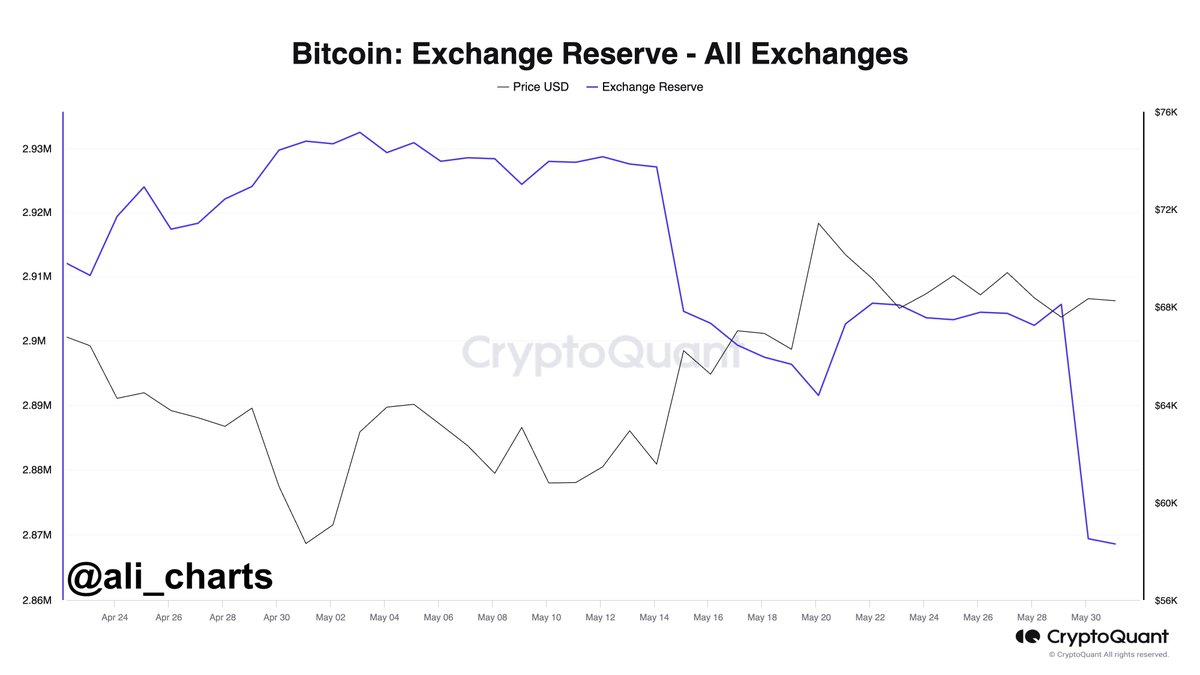

Prominent crypto analyst Ali Martinez shared via a post on the X platform that substantial amounts of Bitcoin have been making their way out of centralized exchanges. This on-chain observation is based on the CryptoQuant Exchange Reserve metric, which tracks the amount of a particular cryptocurrency in the wallets of all centralized exchanges.

An increase in the metric’s value indicates that investors are making more deposits than withdrawals of a crypto asset (Bitcoin, in this scenario) into centralized exchanges. Meanwhile, when the metric declines in value, it implies that more coins are moving out than into the trading platforms.

According to Martinez’s post, more than 37,000 BTC (worth roughly $2.53 billion) have been transferred out of crypto exchanges in the past three days. This significant exodus of funds indicates a change in sentiment and the long-term holding strategy of Bitcoin investors.

While it is difficult to tell the exact rationale behind the massive outflow from exchanges, the movement of funds from trading platforms suggests an increase in investor confidence. This indicates that many investors might be convinced by the future promise of Bitcoin, thereby opting to store their assets in self-custodial wallets in the long term.

What’s more, the downward spiral of Bitcoin’s supply on centralized exchanges could trigger a bullish rally for the premier cryptocurrency’s price. The sustained decline in BTC’s balance on exchanges could result in a supply crunch.

For context, the supply crunch refers to a scenario or period during which the supply of a particular asset is lower than the demand for it, resulting in a surge in the asset’s value.

Bitcoin Price At A Glance

As of this writing, the price of Bitcoin stands around $67,489, reflecting a 1.5% decline in the past 24 hours. This sluggish performance in the past day underscores the premier cryptocurrency’s struggles in the past week. According to CoinGecko’s data, the BTC price is down by nearly 2% in the last seven days.