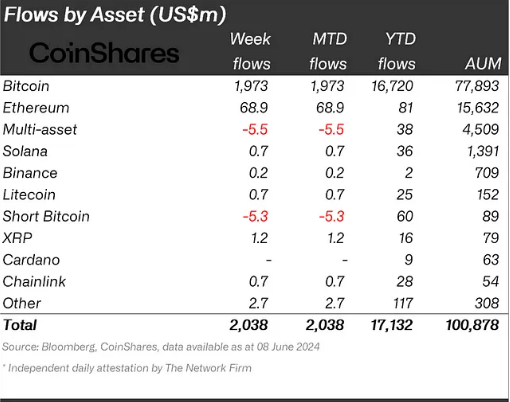

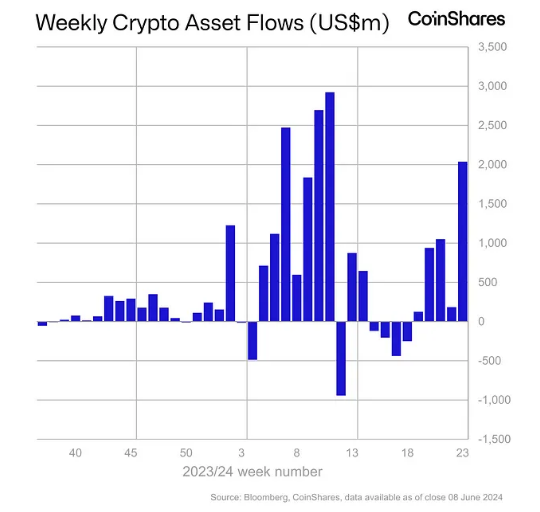

The cryptocurrency market is buzzing with renewed optimism as investment funds witness a historic inflow surge. CoinShares, a leading digital asset manager, reported a record-breaking $2 billion influx into crypto funds in just one week, surpassing the entire month of May’s net inflows.

This positive trend, now spanning five consecutive weeks, has propelled total assets under management (AUM) in crypto funds back above the coveted $100 billion mark, a level last seen in March 2024.

Bitcoin ETFs Fueling The Fire

Bitcoin, the undisputed king of cryptocurrencies, remains the primary focus of investor interest. The recent launch and sustained inflows into US-approved spot Bitcoin ETFs are a major driver of the current market sentiment.

These exchange-traded funds, which allow investors to hold Bitcoin without directly owning the digital asset, saw $890 million pour in on June 4th alone, marking their third-largest inflow day ever.

This enthusiasm for Bitcoin ETFs suggests a growing appetite for regulated and accessible ways to participate in the crypto market, potentially attracting a broader range of investors.

Ethereum Shines Bright, Altcoins Show Promise

While Bitcoin takes center stage, Ethereum, the second-largest cryptocurrency, is also enjoying a strong run. Ethereum funds raked in nearly $70 million last week, marking their best week since March 2024.

CoinShares attributes this positive inflow to investor anticipation surrounding the upcoming launch of spot Ethereum ETFs in the US. The approval of these ETFs could further legitimize the Ethereum ecosystem and unlock significant investment potential.

Beyond the top two coins, altcoins like Fantom and XRP are also experiencing a resurgence in investor interest, with inflows of $1.4 million and $1.2 million, respectively. This broader market participation suggests a potential return of investor confidence across the crypto landscape.

CoinShares said it observed that inflows were unusually widespread across nearly all providers, coupled with a continued reduction in outflows from incumbents.

They attribute this shift in sentiment to weaker-than-expected macroeconomic data in the US, which has heightened expectations for an imminent monetary policy rate cut.

Total crypto market cap at $2.4 trillion on the daily chart: TradingView.com

Crypto Price Stagnation, Economic Uncertainty

Despite the surge in fund inflows, cryptocurrency prices haven’t exhibited a corresponding significant upward movement. This disconnect could be attributed to several factors, including lingering investor uncertainty surrounding the future of US economic policy.

The current trend of record inflows into crypto funds paints a positive picture for the future of the market. The increasing popularity of regulated investment vehicles like spot Bitcoin ETFs signifies growing institutional acceptance and potentially wider investor adoption.

Featured image from Vecteezy, chart from TradingView