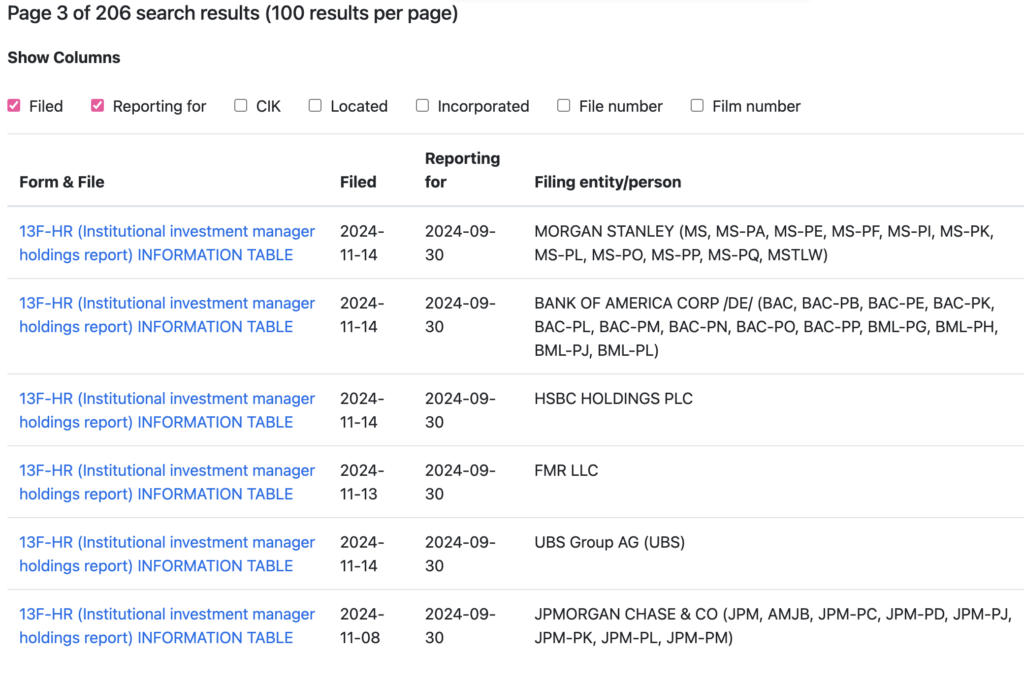

According to 13F filings released so far for the past quarter, 206 companies listed in the US with over $100 million in assets invested have confirmed to the SEC ownership of spot Bitcoin ETF shares.

Notable inclusions in the most recent wave of 13F filings include JP Morgan Chase, Goldman Sachs, Bank of Canada, HSBC, Morgan Stanley, Bank of America, UBS Group, and the State of Michigan Retirement Fund.

Goldman Sachs holds over $700 million in spot Bitcoin ETF shares across five funds, with BlackRock’s ETF the largest holding at $461 million. Among the banks, HSBC holds over $3.8 million in ARK Bitcoin ETF shares, while Bank of America holds over $7 million across multiple ETFs.

Institutional interest is in Bitcoin clearly increasing amid the potential lessening of crypto regulation throughout the United States.

The post 206 SEC registered funds hold Bitcoin ETFs including Canadian banks and Goldmach Sachs appeared first on CryptoSlate.