If there’s one thrilling narrative to study and revisit in 2024, it’s Ripple’s XRP. For those in the know, this crypto had a rough few years due to its ongoing cases and investigations launched by the US Securities and Exchange Commission.

For three years, XRP’s price stayed sideways due to pressure from the SEC. But the story of XRP altered drastically in 2024. Days after the US elections, it began a parabolic price climb, breaking the $2 level on December 2nd and the $3 level on January 16th. XRP is making waves three weeks into 2025.

Last January 19th, on-chain data suggests that 30 million XRPs worth roughly $95.5 million were transferred from Upbit to an unknown crypto wallet. Also, Twitter/X is abuzz with price projections, with many anticipating that XRP will break $4 soon and others going bolder with a price projection of $24.

So, what’s up with XRP– and are these predictions made on solid ground?

Whale Reportedly Transferred 30 Million XRPs

Three weeks into the new year, on-chain data revealed an interesting activity for XRP. Multiple reports say that an XRP whale approved the transfer of 30 million tokens from South Korea’s Upbit to an undisclosed crypto wallet. The huge asset transfer raises questions and speculations on XRP’s short-term direction.

30,000,000 #XRP (95,519,899 USD) transferred from #Upbit to unknown wallethttps://t.co/FwwJoMhxET

— Whale Alert (@whale_alert) January 19, 2025

Whale Alert’s Twitter/X page shared little information except for the timestamp, on January 19th (05:09:42 UTC), that it was subject to a fee of 0.01 XRP.

While whale transactions reflect optimism in the market, some analysts advise caution. Market traders and holders are advised to proceed cautiously, considering current regulations and the inherent volatility of these tokens.

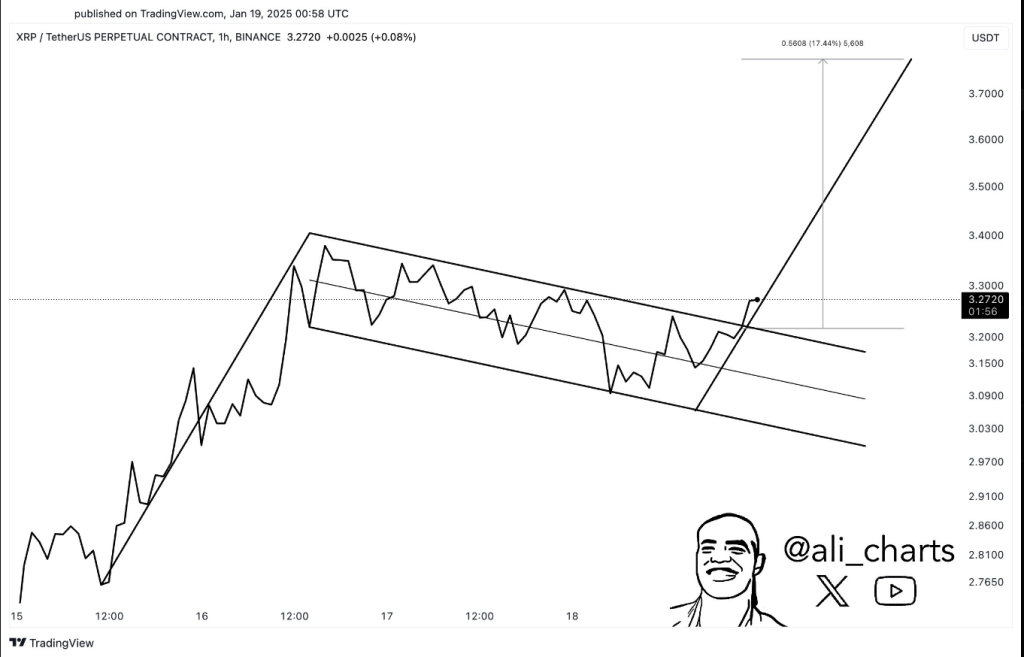

XRP On A Bullish Pattern

Based on its charts, some experts think that XRP’s price movement is going up. Experts say the price of the asset is moving out of a symmetrical triangle it has been in for years. The asset’s current pattern began after it hit an all-time high of $3.80 last December 2017.

According to Ali Martinez, XRP has broken out from this pattern starting November 2024, days after the US elections. Martinez offers $15 as the long-term target for XRP, which is 5x its current price.

XRP’s Price Can Peak In The $20s

Forget about the target price of $4 that some observers float. If one Bitcoin supporter is to be believed, the altcoin’s bullish run can send it to the $20 to $24 price range. In a social media post, Davinci Jeremie (@Davincij15) predicts that XRP may hit $24.

XRP may hit $24!!

Well well well…

XRP may hit $20 – $24, but it’s not a safe long term investment for everyone. Trade, but don’t HOLD Blindly. pic.twitter.com/JOpUiSGkpm

— Davinci Jeremie (@Davincij15) January 17, 2025

Jeremie’s optimism comes as XRP rides an impressive price run that started late last year. Currently, Ripple’s token is trading at its seven-year high, beating the performance of other digital assets.

However, Jeremie tempered his projections, saying that Ripple’s XRP may not be a “safe long-term investment for everyone. In short, Jeremie is offering a “Buy” signal for XRP, but one should know when to exit the position.

Featured image from Pexels, chart from TradingView