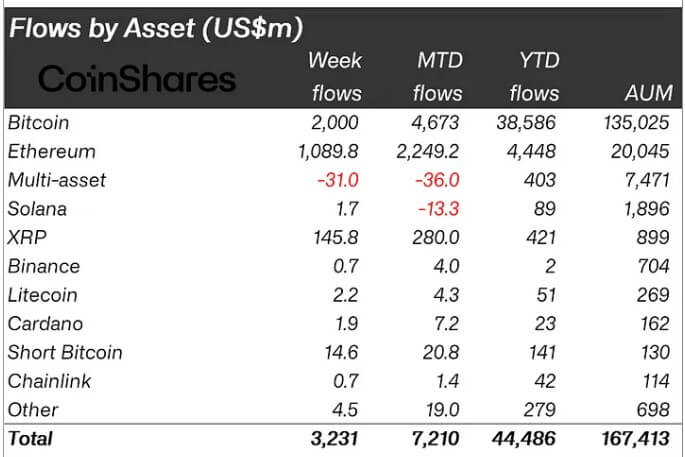

CoinShares’ latest report showed that the crypto sector experienced $3.2 billion in inflow last week, extending its streak to 10 consecutive weeks of positive flows. This marks the longest streak of inflow this year.

The inflow also brings total year-to-date flows to $44.5 billion, which is four times higher than any previous annual record.

Trump’s election victory spur $11 billion inflow

Last week, Bitcoin-related investment products saw inflows totaling $2 billion. This means the flagship digital asset has recorded over $11 billion in inflows since Donald Trump‘s election victory in November.

The strong post-election momentum in Bitcoin ETPs is primarily attributed to optimism around potential regulatory clarity and a more crypto-friendly stance from the incoming US administration. This has led the US market to dominate inflows, contributing $3.1 billion, followed by Switzerland ($36 million), Germany ($33 million), and Brazil ($25 million).

CoinShares’ Head of Research, James Butterfill, noted that trading volumes in Bitcoin ETPs averaged $21 billion weekly, accounting for 30% of Bitcoin trading activity on trusted exchanges. Bitcoin volumes on these exchanges reached $8.3 billion daily, showcasing a liquid and robust trading environment.

Meanwhile, short Bitcoin products also gained traction, with inflows of $14.6 million pushing their assets under management to $130 million. This trend highlights growing interest in hedging strategies as Bitcoin’s price climbed to an all-time high of over $106,000.

Ethereum maintained its streak of inflows, marking its seventh consecutive week with $1 billion added. Over this period, Ethereum ETPs saw total inflows reach $3.7 billion, underlining improved sentiment.

Notably, spot Ethereum ETFs reported a 15-day inflow streak, capturing over $2 billion during the reporting period.

Altcoins also experienced positive momentum. XRP drew $145 million in inflows, fueled by speculation about a potential US-listed ETF. Meanwhile, Polkadot and Litecoin recorded $3.7 million and $2.2 million in inflows as investors diversified their portfolios.

The post $3.2 billion crypto inflow marks 10-week streak as Trump election victory boosts confidence appeared first on CryptoSlate.