Ethereum is now the undisputed king of chains, but its transaction congestion and high fees make it nearly impossible to use. In response, Layer 2 projects have become one of the fastest-growing areas of blockchain development. The leading solutions are:

- State Channel

- Sidechain

- Plasma

- Rollup

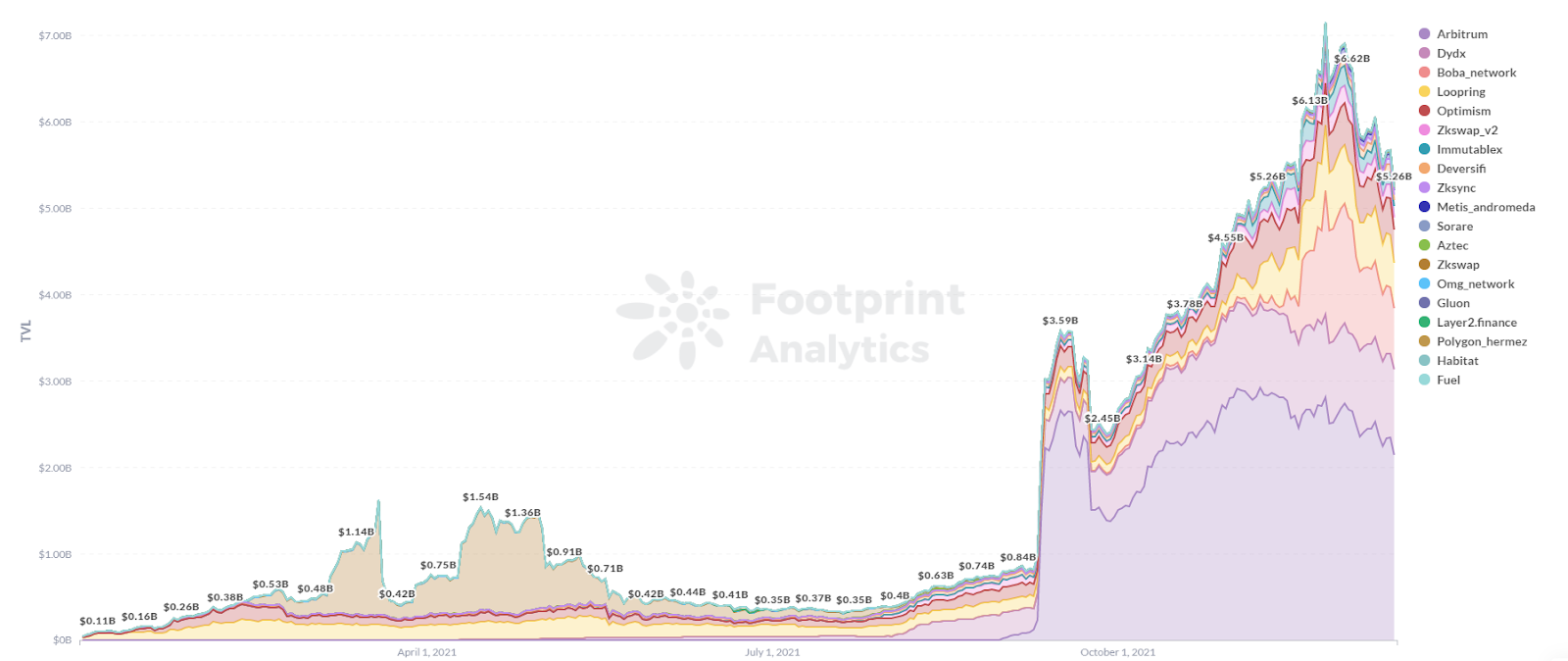

Rollup is the most popular solution and Optimism is one of its scaling projects. While it was one of the first projects to launch on Rollup, Optimism’s growth has slowed, and it now ranks 5th out of all Layer 2 networks in terms of TVL.

What’s happened to Optimism?

Optimism is a Layer 2 scaling solution based on Optimistic Rollup. The advantage of this solution is that it is easy to integrate with DApps. As a result, it received immediate support from developers upon launching.

Optimism first went live in January, 2021 with a test network based on the Ethereum mainnet. Uniswap, Compound and Synthetix have been working on Optimism to support its ecosystem. On July 14, Uniswap V3 went live on Optimism’s mainnet. Since then, Optimism has been in a state of slow development.

Optimism’s current status: Slow ecosystem growth, reliant on Synthetix

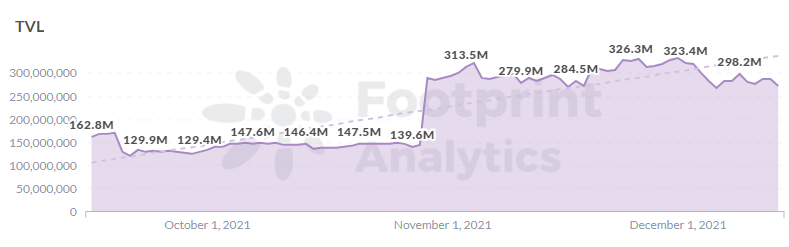

Optimism had a TVL of $272 million as of Dec. 14, just 7.35% of the total TVL of the whole Layer 2 ecosystem.

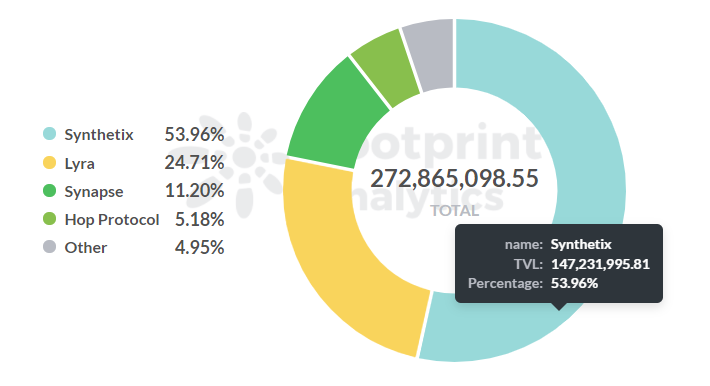

Data from Footprint Analytics shows that there are only 12 DApps on the network. Synthetix is the largest, with a TVL of $147 million, providing 53% of Optimism’s TVL. Lyra, a protocol in the Synthetix ecosystem, is second with a TVL of $67.43 million. Uniswap is in fourth place with a TVL of $28.29 million.

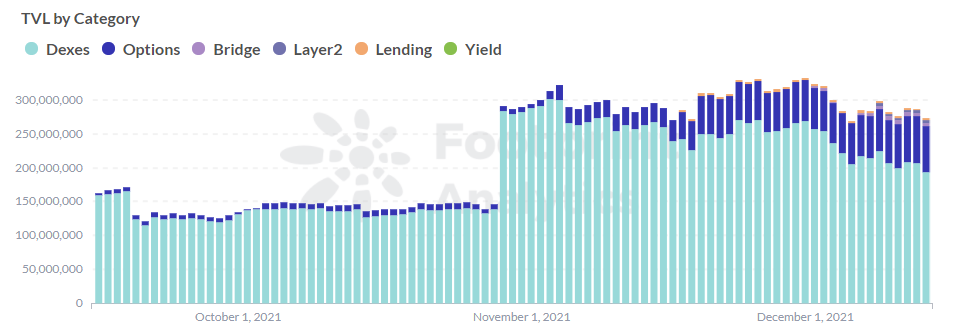

Looking at the types of DeFi projects in Optimism, there is a clear lack of variety with almost all TVL being occupied by DEX.

Reasons for Optimism’s slow development

- Reason 1: Optimism is not 100% EVM compatible

The current market method for scaling up transactions is to use Turing’s full programming for off-chain EVM-compatible instructions so that everyone can execute solidity programs directly off-chain.

Optimism, on the other hand, wants to implement an on-chain smart contract via OVM (Optimistic Virtual Machine) that can accept and execute off-chain EVM-compatible instructions, thus ensuring that the OVM bytecode can be mapped to the EVM one by one. However, this mapping may only be about 20 bytecodes, which makes Optimism not 100% EVM-compatible and slightly more costly to develop.

- Reason 2: Optimism’s whitelisted launch mechanism

Another thing holding Optimism back is the fact that only whitelisted protocols can be deployed, which makes it difficult for many new projects or for many mid-career protocols that wish to do so.

The main reason Optimism uses whitelisting is because it wants to create a new fraud prevention system, but it is not an easy task and requires a lot of time and experience.

- Reason 3: The current ‘anti-VC’ culture of the crypto community

Optimism’s growth has been backed by notable VCs, such as Paradigm and a16z. Arbitrum, which is also an Optimistic Rollup, is considered by the community to be more grassroots. The current anti-VC bent of the crypto community has dinged Optimism.

Summary

Layer 2 is now a major area for blockchain innovation with dozens of highly competitive projects all vying to scale up the Ethereum ecosystem.

While Optimism was one of the early movers in the area, its growth has since stalled. It puts up barriers to smart contract migration for leading protocols, has no ticket to entry for new protocols, and lacks a community environment. Whether it can regain its momentum largely depends on whether it can handle these issues.

Data Source: Footprint Analytics – Optimistic Dashboard

What is Footprint Analytics?

Footprint Analytics is an all-in-one analysis platform to visualize blockchain data and discover insights. It cleans and integrates on-chain data so users of any experience level can quickly start researching tokens, projects and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anyone can build their own customized charts in minutes. Uncover blockchain data and invest smarter with Footprint.

The post 3 Reasons for Optimism’s Slow Development appeared first on CryptoSlate.