The Bitcoin price is currently consolidating below the key resistance zone at $28,300. Both from a historical perspective and based on current macro events, there are good reasons to remain bullish and expect the price to continue to rise.

US Banking Crisis Will Continue To Fuel Bitcoin

The health of the US banking system remains fragile. As economic journalist Holger Zschaepitz noted today, America’s banks are short hundreds of billions of dollars. Last year, deposits at commercial banks fell by half a trillion, a decline of about 3%.

“This makes the financial system more fragile. How the Fed drained the financial system of deposits,” Zschaepitz explained. Charles Edwards, co-founder of Capriole Investments, declared that for a year, the US Federal Reserve (Fed) called inflation temporary and kept interest rates at zero while it ran rampant.

“Now, in the face of existential bank runs and the potential collapse of 100s of banks; the Fed is again blindly following their insane rate rise policy. It’s the same mistake in the opposite direction. They have no idea what they are doing,” said Edwards, who posed a rhetorical question about which bank will be next and shared a screenshot of a news story about Deutsche Bank, which has seen its credit default swap (CDS) jump 9%.

Which bank is next on the chopping block? pic.twitter.com/ge3kTexJKL

— Charles Edwards (@caprioleio) March 24, 2023

As was the case after the collapse of Silicon Valley Bank (SVB), Bitcoin could get another boost from a collapse of yet another bank – after all, this is the reason Bitcoin was invented by Satoshi Nakamoto.

Stealth QE Will Favor Risk Assets

Although there is currently no consensus on whether or not the Fed’s Bank Term Funding Program (BTFP) is Quantitative Easing (QE), the majority of experts see a turning point in the Fed’s monetary policy. Ex-Coinbase CTO Balaji S. Srinivasan writes:

The return of (stealth) QE via the BTFP and opening of daily swap lines with friendly foreign central banks clearly signals that sovereign debt will be monetized and currencies will be further debased. The endgame is now undeniable.

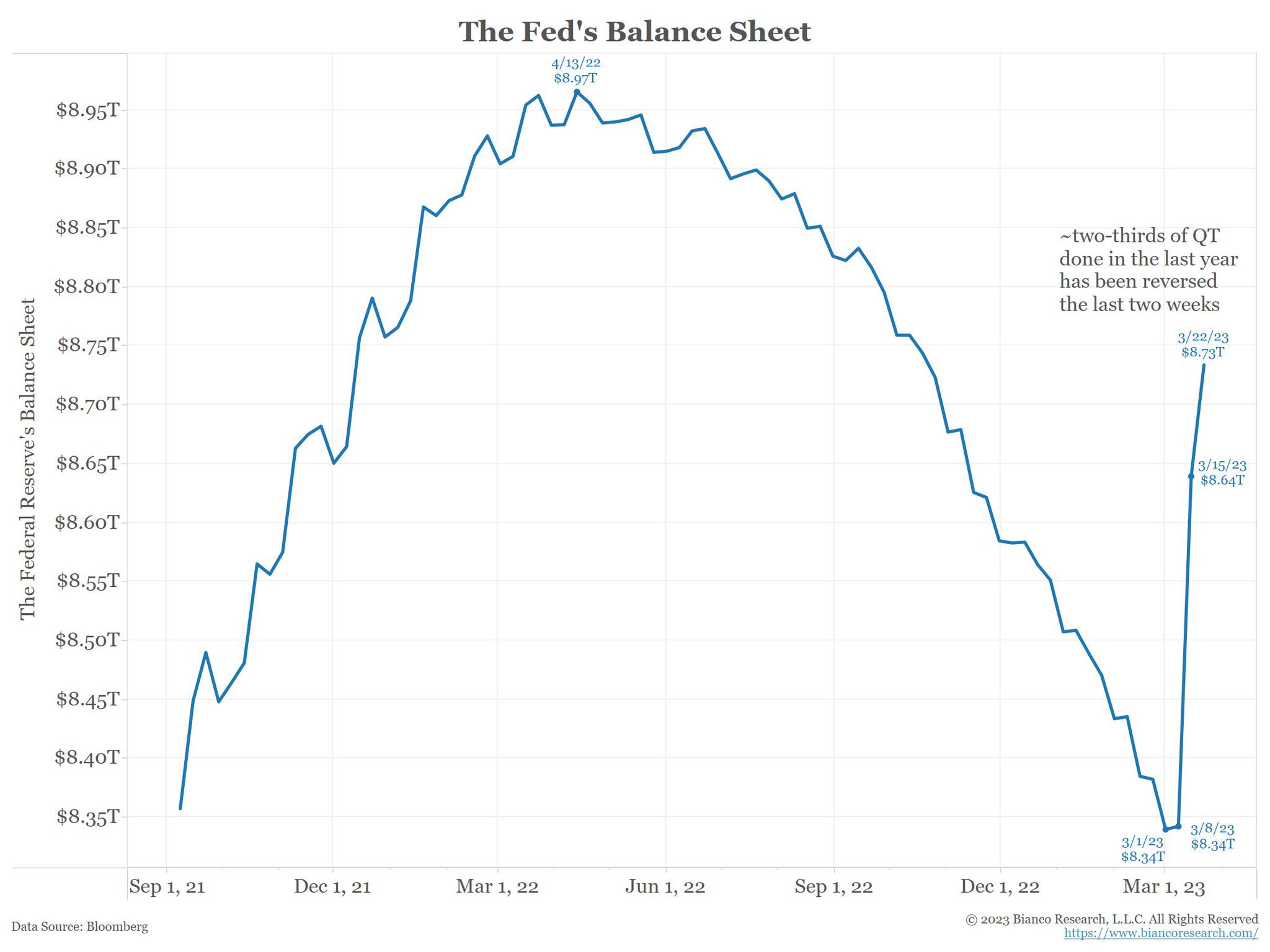

Jim Bianco of Bianco Research added that the Fed has updated its balance sheet. Now about two-thirds of the Quantitative Tightening (QT) has been reversed. Thus, in just two weeks, the Fed has pulverized 2/3 of its total monetary tightening, $100 billion last week alone.

Bianco therefore expects Wednesday’s rate hike to be the last in this cycle. “For the first time this hiking cycle, the actual funds rate and the expected terminal rate have converged. So, by this metric, this could be the end of the rate hiking cycle,” Bianco said, referring to the chart below.

Gold bug Peter Schiff is also on the side arguing that QE has kicked in:

Powell claims the Fed isn’t doing QE because it’s not printing money and buying bonds specifically to lower long-term interest rates. Therefore, its asset purchases don’t qualify as QE. When the Fed does QE when it wants to do its QE, but when it does it because it has to do it’s not.

BTC Looks Bullish

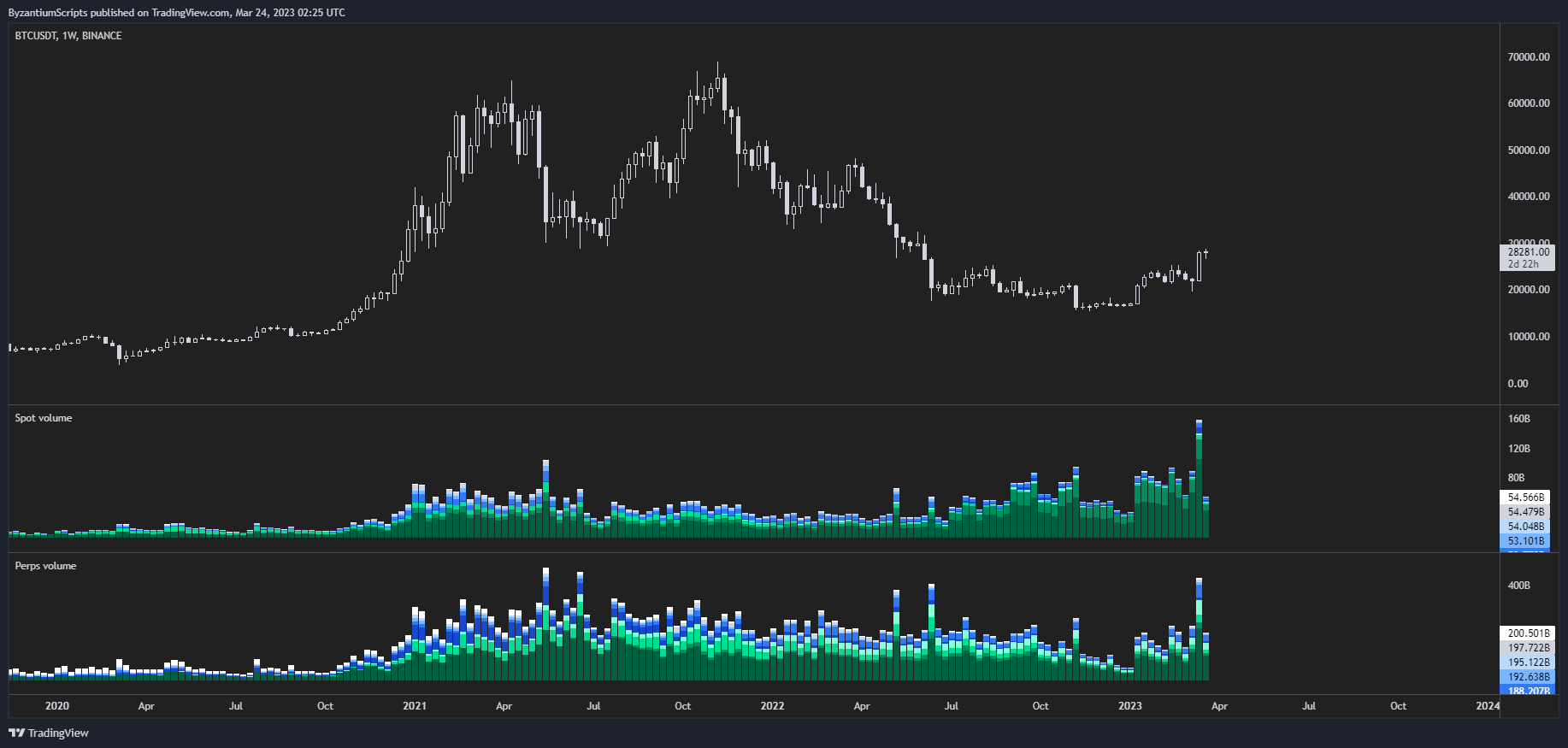

Last but not least, numerous Bitcoin-centric metrics are also looking bullish. As analyst “Byzantine General” stated via Twitter, last week was a new volume record for Bitcoin. Historically, a breakout with a lot of volume is sustainable.

Analyst Ali Martinez, meanwhile, stated that the bullish megaphone pattern remains valid and could signal a rise in the bitcoin price to $34,000.

At press time, the BTC price stood at $27,995, consolidation just below the key resistance zone.