The cryptocurrency community has taken notice of Ripple Labs as a result of a recent transfer of 300 million XRP, which is estimated to be worth more than $680 million. Because of the magnitude of the acquisition, there have been a lot of questions and speculations floating around about what the company’s next moves are in the coming weeks or months.

A lot of people are curious about whether or not this move indicates a new strategy or a change in the way that Ripple intends to approach the market. This large-scale transfer has certainly piqued the interest of investors and experts alike, and as a result, Ripple’s subsequent actions are something that should be actively monitored.

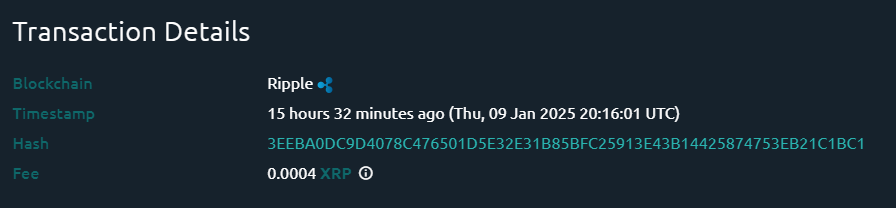

300,000,000 #XRP (682,584,540 USD) transferred from #Ripple to unknown wallethttps://t.co/d5Vu4aasU6

— Whale Alert (@whale_alert) January 9, 2025

Significant XRP Transaction

The transfer occurred on January 9, 2025, and was tracked by Whale Alert. The average exchange price for each XRP was approximately $2.275.

Notably, this is not the first instance of Ripple transferring such a substantial sum; merely days prior, a same volume of XRP was dispatched to a Ripple address on New Year’s Day. These movements indicate that Ripple may be up for something big.

Market Responses And Speculations

Historically, large Ripple transactions have greatly changed market mood. An escrow fund moved earlier this month produced a notable 15% price rise in XRP.

The current activity is not an exception; traders and investors are closely monitoring how it impacts market dynamics. Although the actual objective of this latest action is unknown, observers speculate that it could be tied to Ripple’s ongoing efforts to enhance the value of XRP.

Potential Changes In Regulations

While Ripple negotiates these obstacles, there is also hope for potential legislative improvements under the incoming administration of President-elect Donald Trump.

The crypto community believes that this adjustment will help new crypto ventures and exchange-traded funds (ETFs) be introduced more easily. Such changes could significantly increase institutional interest and trade volume for XRP, hence changing its long-term course.

Ripple Labs is still working on a number of projects to grow its community and make it easier to use XRP. Among these are the creation of the XRP Ledger (XRPL) and the release of the RLUSD stablecoin. People who have a stake in these efforts are eager to see how these developments will fit into their overall plan as they move forward.

Ripple Labs’ recent transfer of 300 million XRP has grabbed attention and sparked questions about its impact on the market and regulations. Investors and analysts are keeping a close eye on Ripple’s actions and what they could mean for XRP and the broader crypto community.

Featured image from Getty Images, chart from TradingView