The post 350 Million DOGE Exit from Exchanges, Bullish Sign for Dogecoin? appeared first on Coinpedia Fintech News

Dogecoin (DOGE), the leading meme coin has been making waves in the cryptocurrency realm with its impressive performance. Currently, it appears that whales and investors are significantly accumulating tokens, even as its price continues to rally.

$100 Million Worth of DOGE Exit from Exchanges

On November 11, 2024, the whale transaction tracker Whale Alert made a post on X (Previously Twitter) that whales and investors had moved a significant 350 million DOGE tokens worth $98.15 million from exchanges including Coinbase, Binance, and Robinhood.

These notable token transfers from exchanges to wallets suggest potential buying amid bullish market sentiment. However, these notable transactions occurred within the past 24 hours, indicating strong bullish market sentiment.

Dogecoin (DOGE) Current Price Momentum

It appears that these significant transactions are fueling DOGE’s recent rally. At press time, the meme coin is trading near $0.321 and has gained 30% in the past 24 hours. During the same period, its trading volume has surged by 150%, indicating heightened participation from traders and investors amid bullish market sentiment.

DOGE Technical Analysis and Upcoming Levels

Despite DOGE’s notable rally, expert technical analysis suggests that the meme coin still has the potential to soar another 10% to reach the resistance level of $0.35 in the coming days. Based on the recent price action, there is a strong possibility that DOGE could face some sort of price correction upon reaching this resistance level.

Currently, DOGE’s Relative Strength Index (RSI) is in the overbought zone, suggesting a potential price correction or decline in the coming days.

Traders’ Rising Interest in Dogecoin

In addition to the recent transactions by whales and investors, traders have also been highly active over the past 24 hours.

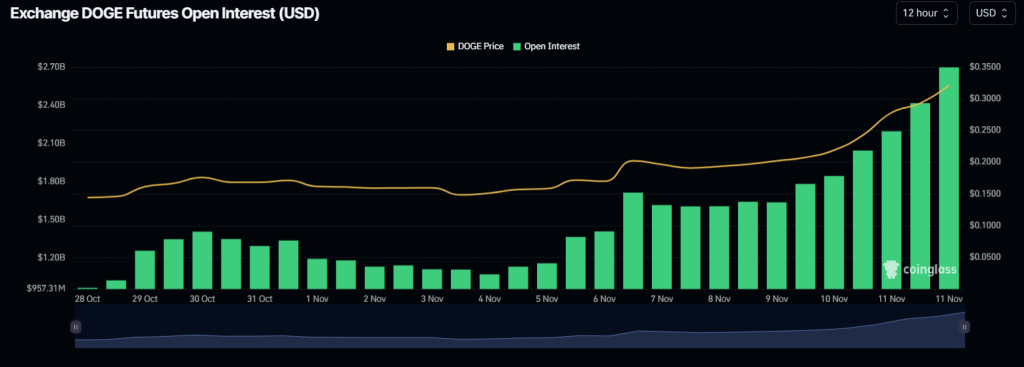

According to the on-chain analytics firm Coinglass, DOGE’s open interest has surged by 32% in the past 24 hours and 15.95% in the past four hours, indicating significant open positions by traders amid the ongoing DOGE rally.