The ENS token (Ethereum Name Service) has recently taken center stage in the crypto community, sustaining a 36% rise in in the last week. This steady surge has sparked widespread interest, with some analysts predicting a prolonged bullish trend, while others advise caution.

ENS: Price Explosion & Renewed Investor Interest

ENS, the native token of the Ethereum Name Service, which translates human-readable domain names into machine-readable wallet addresses, surged by over 2% in the past day. This propelled the token as one of the highest gainers today. ENS briefly surpassed the $33 mark. It is currently trading at $31.89, data from Coingecko shows.

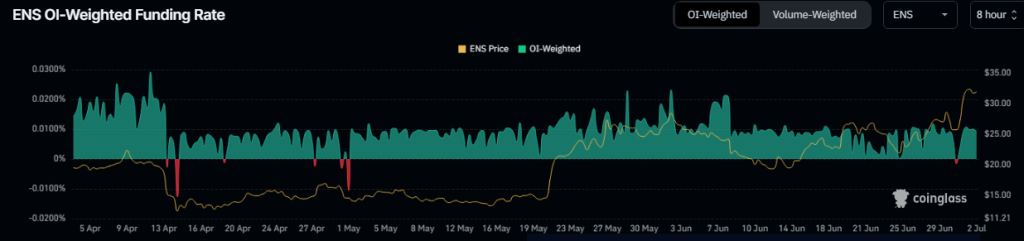

This excitement wasn’t limited to spot markets; the derivatives sector also saw a ripple effect. Open interest, which reflects the total value of outstanding futures contracts, reached record highs exceeding $160 million, suggesting a dramatic increase in investor participation and speculation around ENS.

Furthermore, the funding rate, which indicates the cost of holding futures contracts, shifted from negative to positive territory. This transition points to rising demand for long positions, where investors bet on the price increasing. A positive funding rate indicates a growing pool of optimistic traders expecting further price hikes for ENS.

Technical Analysis: Bullish Signals

Daily technical analysis of ENS reveals a recent price rally following a period of mixed trends. The most significant development occurred on June 30th, with a substantial price jump pushing the token to $33.21.

This bullish momentum has continued, with the RSI (Relative Strength Index) hovering near 70, indicating a strong uptrend. While a high RSI can suggest potential overbought conditions, it also reflects significant buying pressure.

However, some analysts caution against interpreting this short-term rally as a guaranteed path to sustained growth. The cryptocurrency market is notoriously volatile, and historical price movements don’t necessarily predict future performance.

Long-Term Prospects & Potential Risks

Several factors could be contributing to the recent surge in price and activity. The upcoming ENSv2 upgrade, which aims to improve efficiency and scalability, might be fueling investor excitement. Additionally, the growing adoption of decentralized applications (dApps) within the Ethereum ecosystem could be driving demand for user-friendly domain names facilitated by ENS.

Despite the current optimism, potential risks remain. The overall health of the cryptocurrency market can significantly impact individual tokens like ENS. A broader market correction could lead to a pullback in ENS price. Additionally, the success of ENS depends on the continued adoption and growth of the Ethereum network and the dApps built upon it.

Featured image from SpaceRef, chart from TradingView