The cryptocurrency market is down again after a couple of days of promise. At $1.99 trillion, its total cap has fallen by 1.7% in the past 24 hours. That said, it has risen by about 3.5% since April 12, indicating medium-term momentum. This may hopefully continue into next week, so here’s our selection of 5 cryptocurrency to buy for price boom this weekend.

5 Cryptocurrency to Buy for Price Boom This Weekend

1. Lucky Block (LBLOCK)

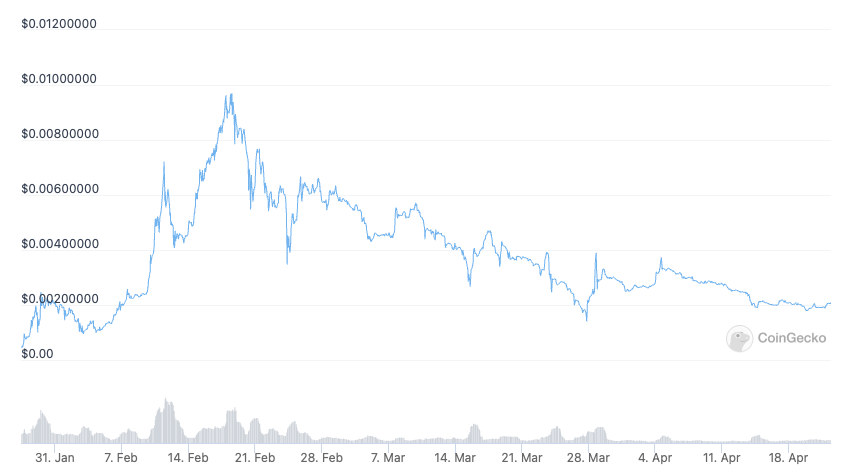

LBLOCK is up to day, having risen by 8% in the past 24 hours, to $0.00207936. This represents a 2.5% fall in the past week and a 36% drop in the last 30 days. However, LBLOCK is more than 350% up since becoming tradable in late January.

LBLOCK is rising at the moment thanks to a little promotional boost: it has announced boxer Dillian Whyte as its newest brand ambassador.

Great news for the #LuckyBlockArmy🤞🔥 https://t.co/uPr7rujKqB

— Lucky Block 🤞 (@luckyblockcoin) April 20, 2022

The British boxer, who will be competing against WBC World Heavyweight Champion Tyson Fury on Saturday, has been wearing Lucky Block merchandise at press conferences and other bout-related events. This has served to raise the lottery platform’s profile considerably, largely explaining its rally in the past day or so.

More generally, LBLOCK continues to show good potential for a surge in the near future. Lucky Block is due to hold its first draw at the end of the month, something which will boost it significantly. From this point on, draws will be held regularly, with LBLOCK holders able to spend the altcoin in order to buy tickets. Holding a ticket grants users the chance to win 70% of each draw’s prize fund. However, all holders of LBLOCK will take an equal share of 10% of each fund, regardless of entry.

It’s this structure that promises to make LBLOCK one to watch for the future. And with Lucky Block making good progress with the rollout of its app, it’s only a matter of time before it rises strongly again. This is why we’ve included it in our list of 5 cryptocurrency to buy for price boom this weekend.

🚀 We are pleased to announce that the web app beta version is available for testing by the communityhttps://t.co/qy13vdUXME

To fully explore the web app, please get testnet LBLOCK here https://t.co/mAfjkm4fnv

Use ‘save to home screen’ function for the optimal experience

— Lucky Block 🤞 (@luckyblockcoin) April 20, 2022

2. Bitcoin (BTC)

BTC is down by 3% in the past 24 hours, dropping to $40,430. This means it has risen by a modest 1.2% in the past week, but fallen by 4.5% in the last 30 days.

BTC’s indicators show that it’s on the kind of downswing that may turn into an upswing. Its relative strength index (in purple) has dropped down to 40, indicating that traders are overselling it. Likewise, its 30-day moving average (in red) has just dropped below its 200-day average (in blue), suggesting that it may rise up again in the next few days.

In general, BTC always remains a safer bet for traders, if only because it continues to lead market-wide movements. More fundamentally, whales and other larger investors have continued to accumulate BTC during the current period, with the amount of bitcoin that hasn’t moved for at least 12 months now passing its all-time high of 64%.

The amount of #Bitcoin that has not moved for 12months or more has now equalled its all-time high of 64%

Last time this happened price was $10-11k before a huge rally pic.twitter.com/GX9LfNVlRl

— Alistair Milne (@alistairmilne) April 5, 2022

This accumulation makes it likelier that BTC will rally big sooner or later. For instance, Nexco co-founder Antoni Trenchev recently predicted a price target of $100,000 by the end of 2020. This is a level predicted by numerous other analysts and observers.

Do you think #Bitcoin will hit $100k this year? $NEXO Co-Founder and Managing Partner @AntoniNexo believes it’s possible. Check out his remarks to @CNBC https://t.co/Ng3BMHOKiu

— Nexo (@Nexo) April 14, 2022

Given institutional interest in BTC, and the fact that US banks continue to work on rolling out bitcoin services, it has a better chance than most cryptocurrencies of rallying big in the near future.

3. Polygon (MATIC)

At $1.47, MATIC is up by 2.5% in the past 24 hours. It’s also up by 6.6% in the past week, but down by 2.5% in the last 30 days.

MATIC’s RSI and 30-day average have both climbed upwards in the past couple of days, despite undergoing a slight dip in the past few hours. This momentum could continue over the weekend, although given the precarious state of the global economy, nothing can be taken for granted.

MATIC has been doing well ever since it made the pledge a week ago to become completely carbon neutral in 2022. This effort will be helped in part by its pledge of $20 million in funding for development for carbon neutral technologies.

#Polygon pledges up to $20M to take immediate steps to offset the ecosystem’s environmental footprint entirely.

Read more 👇 [2/2]https://t.co/2l2HXU2Abo

— Polygon 💚 (@0xPolygon) April 12, 2022

If successful, this would make Polygon the first blockchain platform to become “carbon POSITIVE,” according to Polygon Studios CEO Ryan Watt. But even without this initiative, Polygon has benefitted from other good news recently, including Robinhood’s listing of MATIC. It also has a big announcement scheduled for later today, something which may boost its price further.

22.4.22#wagmi💜 pic.twitter.com/u8WgeSpvBZ

— Polygon 💚 (@0xPolygon) April 18, 2022

If this weren’t enough, Polygon continues to account for $4.15 billion in total value locked in, more than any other layer-two platform. Given its growth, it’s not surprising we’ve included it in our list of 5 cryptocurrency to buy for price boom this weekend.

4. Theta Network (THETA)

THETA is up by 4.7% in the past 24 hours, rising to $3.48. This is a 14% rise in the past week and a 13% increase in the last 30 days.

THETA is currently enjoying an upswing in momentum that could last for several days yet. This has arisen from an announcement the Theta Network made on April 9 concerning the 4th version of its mainnet. This will be dubbed the Theta Metachain, and will find the video delivery network becoming more adapted to Web3 and metaverse-related use cases.

Introducing the next evolution of Theta blockchain – Theta Metachain goes live in Q4 2022. Learn how Theta Metachain is designed to scale to the needs of Web3 businesses in the new whitepaper: https://t.co/5FnRkKgvIp pic.twitter.com/k8L8vpheXX

— Theta Network (@Theta_Network) April 8, 2022

Theta Network’s total value locked in has now risen to just over $300 million, up from just over $200 million in February. This is good progress for a video delivery platform, and signals good things to come for THETA.

5. Terra (LUNA)

LUNA is $93.76 today, a 1% fall in the past 24 hours. However, it’s up by 11% in the past week, and more or less flat (up by 0.8%) in the past month.

LUNA has been surging ever since late February, when Terraform Labs raised $1 billion in a private token sale. It continued rising upwards from March, when Terra began buying up millions of dollars in BTC, in order to support the price of the UST stable coin.

Since then, Terra has been gradually growing its bitcoin reserves, increasing confidence in UST — and by extension — LUNA. And because LUNA is burned when issuing new UST, the growth of UST has served to ramp up the price of LUNA.

The supply of UST has risen by over $2 billion in a month. Such growth is likely to continue, with LUNA rising in parallel. This is why we’ve added it to our list of 5 cryptocurrency to buy for price boom this weekend.

Capital at risk

Read more: