The post 5 Things to Know as Bitcoin Crosses $67k: Is a New ATH in Reach? appeared first on Coinpedia Fintech News

With the crypto market capitalization reaching 2.25 trillion dollars, the bullish week witnessed Bitcoin surpassing the $67,000 mark. Since July 29, this is the first time the price of BTC has crossed $67,000.

As the recovery rally in BTC price gains momentum, the chances of a new all-time high are increasing in this October rally. Amid such hype and bullish sentiments, here are the five things you should know about Bitcoin as it aims for a new all-time high.

Bitcoin Price Breaks the Channel

In the daily chart, the BTC price action reveals a breakout of a high-supply resistance trend line. With the preparation of a third Bullish candle, the biggest crypto has increased by 7.03%. Meanwhile, the weekly gains for Bitcoin stand at $14.33 from the 7-day low of $58,867.

Taking a double-bottom reversal from the 200-day EMA, the recovery run in Bitcoin marks a channel breakout that formed a larger Bullish pattern. As the recovery rally heads towards the 78.60% Fibonacci level at $69,471, the Bullish momentum is on the rise.

With an uptick in the 50-day EMA and the RSI reaching the 70% overbought boundary line, the chances of an uptrend continuation are higher. However, a minor pullback to retest the broken trend line is possible.

Based on the Fibonacci level, the upside potential stands to reach the previous all-time high at $73,794. With a potential breakout, the upcoming price targets for the largest cryptocurrency stand at $79,028 and $85,832.

Bitcoin ETFs Witness $926M Net Inflow in 3 Days

As the Bullish trend in Bitcoin gains momentum, the Bitcoin ETF market in the U.S. witnesses a third consecutive day of inflows, with $253 million worth of net total inflow on Monday, followed by $555 million on Tuesday. Thus, the ETFs have accounted for a net inflow of ~$926M in three days.

On October 15, Bitcoin’s spot ETF recorded an inflow of $371 million. Currently, the U.S. spot Bitcoin ETFs hold a total net asset of $63.13 billion or 4.80% of the total Bitcoin supply. Among the top performers, BlackRock’s IBIT market witnessed an inflow of $288.84 million yesterday.

IBIT currently holds $25.06 billion worth of Bitcoin, making it the largest U.S. spot ETF for Bitcoin. This is followed by Grayscale’s $14.74 billion worth of holdings and Fidelity’s $12.31 billion holdings.

Bitcoin Whales Continue to Buy

The whales continue accumulating as the bullish sentiments around Bitcoin continue to rise. Over the last week, the institutional wallets, excluding miners and exchanges, bought over 67,000 coins in the past 30-day window, surpassing more than 3.9 billion Bitcoin.

Based on the data from CryptoQuant, as whales accumulate over Coinbase and Bitfinex, Binance and Bybit continue to be predominantly short. The disparity reflects a dynamic where large investors continue to absorb coins while retail investors are exhausted.

As the whales continue to buy back, the BTC price is expected to rise with the support of institutional players building their positions.

Bullish Speculations Rise in Derivatives Market

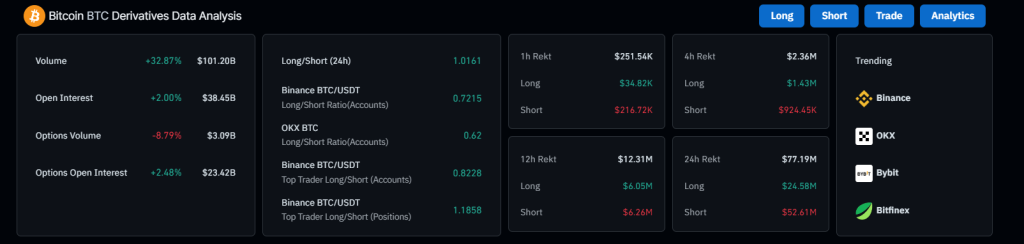

As the BTC price is coming back in the derivatives market, the Bitcoin open interest stands at $38.45 billion. With $77.19 million positions liquidated in the last 24 hours, $52.61 million were liquidated from the short side.

Hence, the selling side takes a setback with Binance. Furthermore, Binance’s top traders reflect a long-to-short ratio based on positions crossing the 1.18 mark, reflecting the top traders speculating a bullish move ahead.

Analyst Targets BTC Price To Hit $86,600

Supporting the bullish trend in Bitcoin ahead, Martinez Ali, a crypto analyst, has recently shared that the BTC price will likely create a local top of $86,600.

However, the prerequisite for this new all-time high will require Bitcoin to surpass the $67,400 mark. Currently, the Bitcoin price is trading at $67,238.

Curious to know if Bitcoin will hit $100k in 2024? Find a technically and logically driven answer in Coinpedia’s BTC price prediction for 2024 to 2030!