The entry of DeepSeek into the market has caused a seismic shift in the cryptocurrency landscape, causing wide-scale volatility and significant capital outflows. Ripple effects were felt across multiple sectors, with crypto mining stocks bearing the brunt of the impact. Investors scrambled to reassess their positions. Market sentiment turned bearish within hours.

Tech Giants Show Resilience Amid DeepSeek Scare

Major US technology stocks remained surprisingly resilient during the uncertainty within the cryptocurrency space. Companies such as Nvidia, Apple, and Amazon were able to bounce back strongly. Their recovery was a stark contrast to the crypto market’s struggles. The divergence between traditional tech and digital assets was apparent throughout the trading session.

Bitcoin And Ethereum ETFs Face Massive Withdrawals

The turbulence was particularly challenging for cryptocurrency investment products. Spot Bitcoin ETFs, which had thrived with inflows amounting to nearly $2 billion in the week following Donald Trump’s second term launch, sharply reversed. Farside Investors reported that this saw the product see outflows of $457.6 million. Still, this was not better for Ethereum ETFs, which lost $136.2 million.

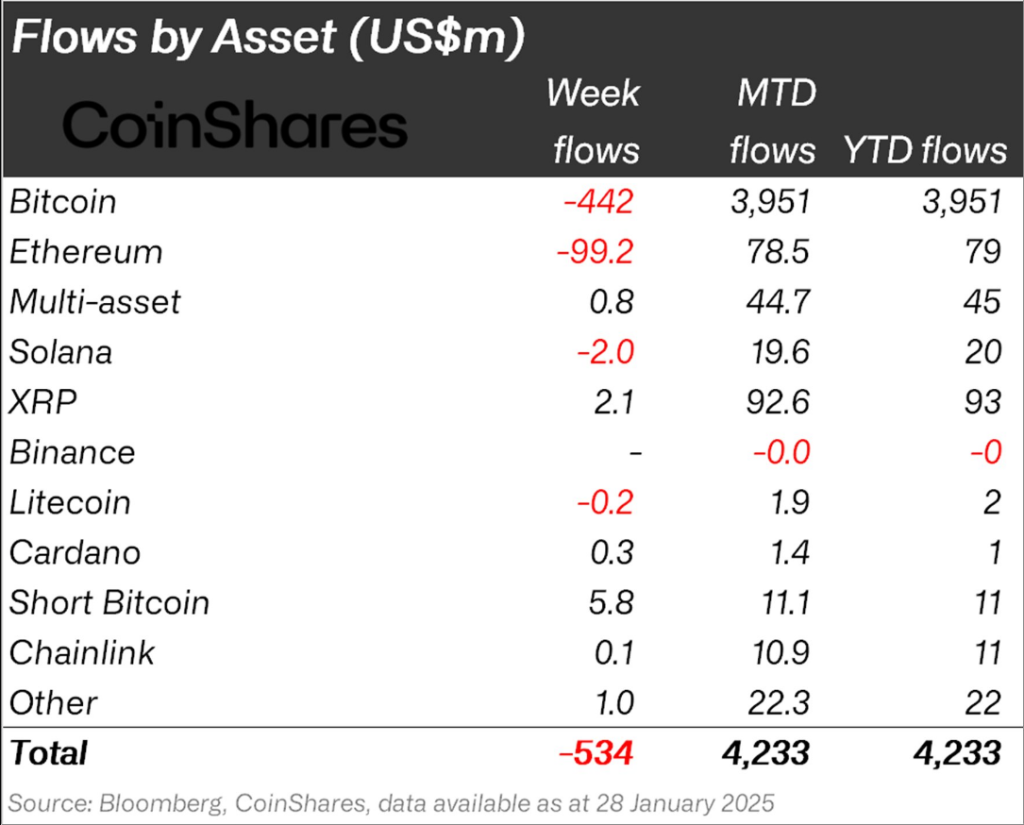

Yesterday’s rout in the markets caused by the DeepSeek news caused investors to panic, prompting outflows from Bitcoin and Ethereum totalling US$442m and US$99m respectively. pic.twitter.com/7a01ZwUTu1

— James Butterfill (@jbutterfill) January 28, 2025

Head of research at CoinSharesCo James Butterfill broke this story open to reveal insight:

“Yesterday’s rout in the markets caused by the DeepSeek news caused investors to panic, prompting outflows from Bitcoin and Ethereum totalling US$442m and US$99m respectively.”

The cryptocurrency mining business was not immune to the market downturn. Large companies like Riot Platforms, Cleanspark, and MARA Holdings all recorded losses for the second day running. Their troubles reflected the greater instability in the market. According to CoinMarketCap, the global cryptocurrency market lost nearly a percent in value in the last 24 hours.

Total ETP outflows exceeded $534 million during the crypto market’s stunning one-day sell-off, which rattled investor confidence.

XRP, Surprise Performer

Despite the general chaos, XRP was a surprise performer. Even with some drops, the digital product quickly bounced back. XRP ETPs even registered a new purchase of $2.1 million in the face of the market turmoil.

On-chain data supported this contrarian movement when high-net-worth wallets accumulate around 120 million XRP during the downtrend. These strategic investors apparently viewed the market dip as a buying opportunity rather than a reason to exit.

The DeepSeek incident has highlighted the cryptocurrency market’s continued susceptibility to sudden shocks. Different assets and areas showed different levels of strength.

XRP’s growth was very noticeable compared to the overall weakness in the market. Now that things have calmed down, investors and experts are watching to see if these trends are just a short-term issue or signal a more significant shift in market dynamics.

Featured image from Gemini Imagen 3, chart from TradingView