The Ethereum Foundation was at the center of attention recently concerning a liquidation plan it has set in place to sell parts of its Ether balance.

According to the on-chain tracker Lookonchain, a wallet linked to the foundation moved 2,500 ETH, valued around $6 million, to the exchange Bitstamp on October 8, 2024. This is part of an increasing trend in which large holders, colloquially known as “whales,” are selling their holdings in the face of this volatile market environment.

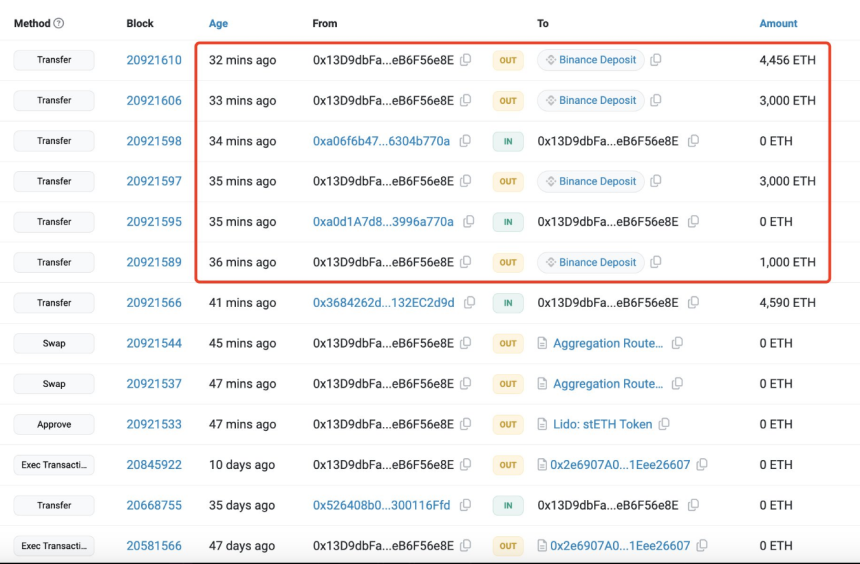

A whale deposited 11,456 $ETH($27.8M) to #Binance in the past 40 minutes!https://t.co/0L5r2u9wF9 pic.twitter.com/gNZI3pKAEx

— Lookonchain (@lookonchain) October 8, 2024

Significant Transactions Uncovered

Lookonchain claims this is not the only transaction this foundation has lately done. ETH sold overall in 2024 is as high as 3,766, which brought $10.46 million. The organization sold 950 ETH in September, equal to $2.27 million. They sell them often, roughly every 11 days. The transaction averages about 151 ETH in size. The foundation still retains a significant sum: 271,274 ETH, or about $655 million.

Market Reactions And Jitters

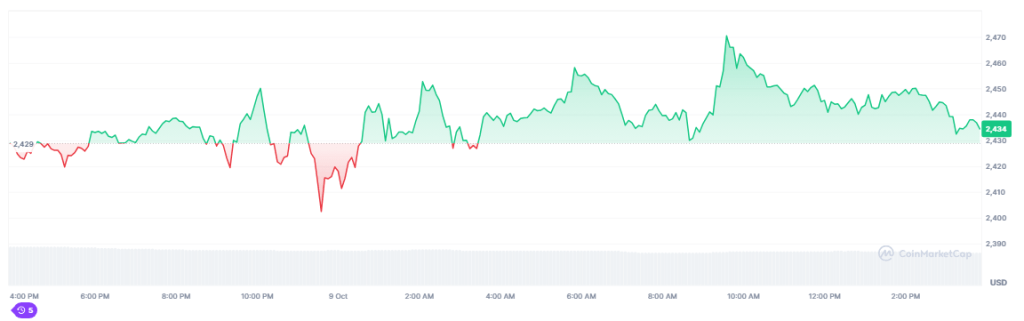

The crypto community has a reason to worry over the continuous selling of Ethereum. Much of the investors have severely feared that this huge liquidation might lead to downward pressure on ETH prices. During the last 14 days, the price of Ethereum went down by around 8%.

This has led some analysts to speculate that these selling events are contributing factors behind the bearish market of ETH. Community commentators are divided between interest and concern regarding the history of the wallet by the foundation, how it affects the market dynamics, Lookonchain has disclosed.

Future Financial Planning

Such sales, according to Aya Miyaguchi, an executive director of the Ethereum Foundation, are part of a deliberate financial strategy – working to pay for operational costs and cover the costs of ongoing projects. The entire annual budget is estimated to be around $100 million, with some of these costs – such as salaries and grants – requiring fiat currency. Thus, turning part of the ETH reserve into stablecoins like DAI has become routine.

With the Ethereum Foundation still working through its financial situation in a volatile market, only time will tell how these continued sales will affect both the price of ETH and the robustness of the Ethereum ecosystem. With quite a bit of resources still locked up by the foundation, individuals are paying close attention to look for changes or constructive/violent reactions in the market.

Featured image from ETF Stream, chart from TradingView