The post 62% of Traders Go Long on SUI, Buy Signal? appeared first on Coinpedia Fintech News

The overall cryptocurrency market recovering impressively. Amid this, the SUI layer-1 blockchain is poised for a significant rally as its on-chain metrics flash a potential buy signal. SUI has shown impressive growth of 175% since the beginning of September 2024, and now investors and traders are making big bets on this layer-1 token.

SUI Technical Analysis and Upcoming Level

According to CoinPedia’s technical analysis, SUI appears bullish as it has recently breached a strong resistance level of $2.01 and is now heading toward an all-time high. The recent breakout, along with the daily candle closing above the resistance level has cleared the path for an upside rally.

Based on the historical price momentum, there is a strong possibility that SUI could soar significantly and reach a new high in the coming days. Despite the many ups and downs in the recent market, SUI remains in an uptrend as it is trading above the 200 Exponential Moving Average (EMA) on a daily time frame.

Bullish On-Chain Metrics

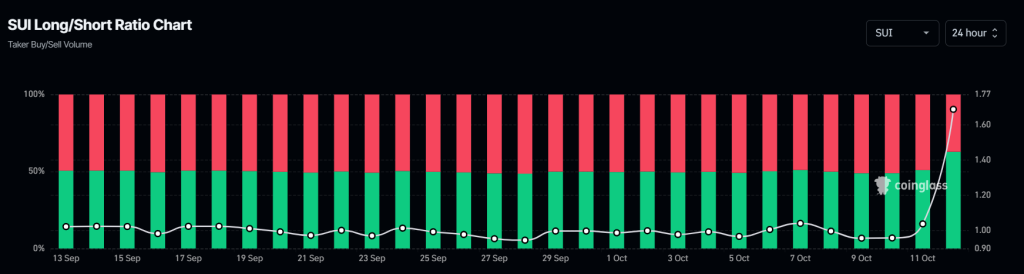

SUI’s positive outlook is further supported by on-chain metrics. According to the on-chain analytics firm Coinglass, SUI’s Long/Short ratio currently stands at 1.688, the highest since September 2024. This record ratio suggests a strong bullish market sentiment among traders.

Additionally, its future open interest has increased by 21% over the past 24 hours and by 4.2% over the past four hours. This growing open interest indicates that traders are potentially betting more on long positions compared to short positions. Currently, 62.8% of top traders hold long positions, while 37.2% hold short positions. This shows traders believe that SUI could soar significantly in the coming days.

Combining these on-chain metrics with technical analysis, it appears that bulls are currently dominating the asset and have the potential to support SUI in its forthcoming upside rally.

SUI’s Current Price Momentum

At press time SUI is trading near $2.05 and has experienced a price surge of over 13.1% in the past 24 hours. During the same period, its trading volume soared by 26%, indicating increased participation from traders and investors amid ongoing market recovery.