As more and more investors choose to keep their Ethereum assets frozen rather than actively selling them, the Ethereum ecosystem suddenly finds itself severely short of supplies. The second-largest cryptocurrency in the world could face serious challenges going forward depending on the planned behavior of market players.

Ethereum Supply Tightens Up

The first sign of this supply gap came earlier this month when an unknown market player moved a staggering 6,400 Ethereum to the Beacon Chain depositor wallet. The Beacon Chain, which checks recently added blocks to the network, is the basis of Ethereum 2.0 This big action suggests that investors might be inclined to lock down their ETH holdings instead of aggressive trading.

6,400 #ETH (20,015,930 USD) transferred from unknown wallet to Beacon Depositorhttps://t.co/wrOSlw2LaR

— Whale Alert (@whale_alert) July 11, 2024

According to cryptocurrency analysts, this is a blatant sign that a lot of Ethereum users are optimistic about the network’s long-term prospects. They are effectively removing a sizeable chunk of the ETH supply from the market by locking up their coins on the Beacon Chain, which might have a big impact on the asset’s price dynamics.

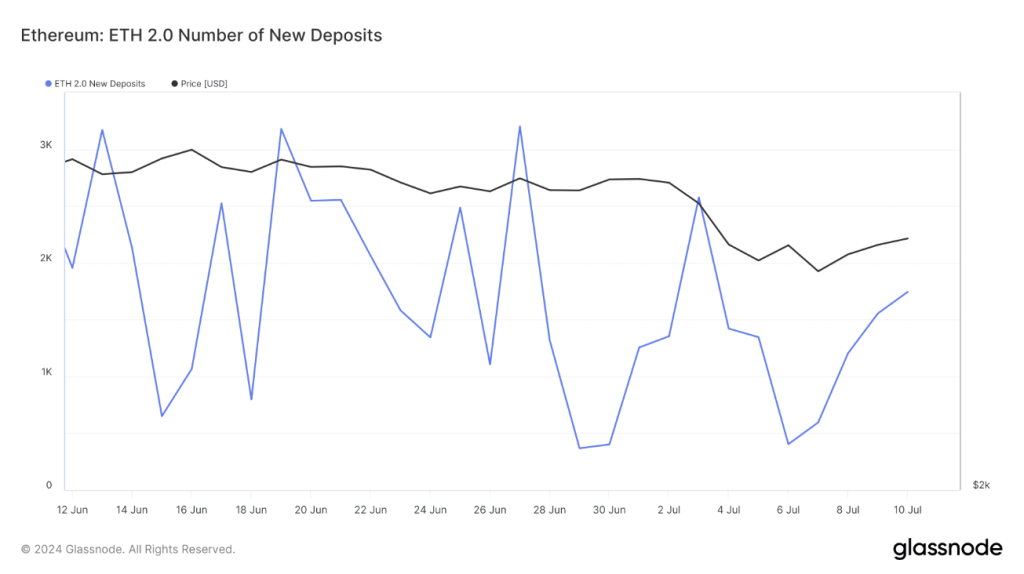

Following this trend, Glassnode data shows that Ethereum 2.0 fresh deposits have recently grown. Key to the next Ethereum 2.0 update, this measure monitors the number of users staking at least 32 ETH to participate in the rewards system on the network.

The rising staking activity suggests that the community is rather optimistic about the future of the Ethereum ETF, which is fast approaching.

Bullish Momentum Surge Ahead

An examination of Ethereum’s exchange inflow and outflow data provides even more evidence in favor of the bullish story. Santiment claims that the network’s exchange outflow has been greater than its influx, which suggests a lessening of sell-side pressure.

When ETH is being taken from exchanges more than being deposited, buyers are certainly in power. Together with the rising amount of locked-up coins, this dynamic could provide the perfect environment for an ETH price surge .

The report also predicts that Ethereum would be set to surpass Bitcoin in the fourth quarter of 2024, per normal altcoin market cycle pattern. This prediction acquires further weight from the Bulls and Bears indicator from IntoTheBlock, which now shows bullish against bearish dominance for Ether.

Market expert Benjamin Cowen believes Ethereum could reach $3,300 in the next weeks or months and might possibly hit $3,500 should buying demand overcome selling pressure.

Featured image from Pexels, chart from TradingView