The post 71% of SUI Traders Go Short on Binance, Time to Sell? appeared first on Coinpedia Fintech News

SUI has gained massive attention from the crypto enthusiast following an impressive 13% of price surge over the past 24 hours. However, traders have started betting more on short positions.

Traders’ Eyes on Price Decline

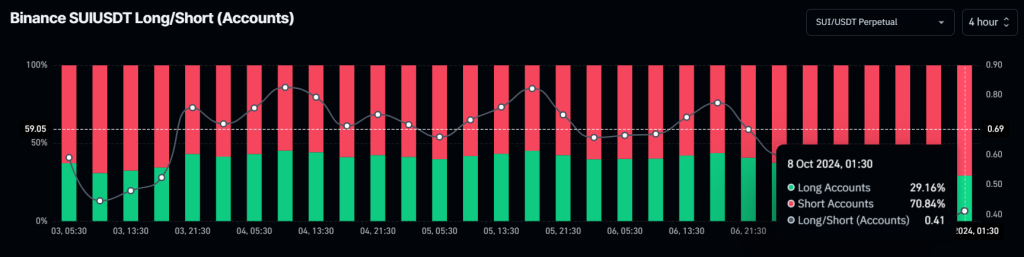

According to on-chain analytics firm Coinglass, 71% of traders on Binance are currently holding short positions as they believe that the SUI price could fall in the coming days. In Addition, currently, 29% of traders hold long positions.

This on-chain data suggests that the market sentiment of SUI is currently bearish, which may lead to selling pressure and a price decline in the coming days.

SUI Technical Analysis and Upcoming Levels

According to expert technical analysis, SUI is currently at the $2 level, where it experienced a massive price decline of over 50% the last time it reached this point. However, the active short positions on Binance suggest a similar price decline may occur this time.

Based on recent price momentum, if SUI fails to close the daily candle above $2.2, there is a strong possibility it could fall by 20% to reach the $1.62 level in the coming days. On the other hand, if it holds above the $2.2 level, there is also a possibility of reaching a new high in the near future.

Currently, SUI’s Relative Strength Index (RSI) is in an overbought zone, signaling a potential price correction or we can say a price decline in the coming days.

SUI Current Price Momentum

As of now, SUI is trading near $2.04 and has experienced a price surge of over 13% in the past 24 hours. During the same period, its trading volume jumped by 145%, indicating higher participation from traders and investors amid the ongoing price recovery.

However, the potential reason for this significant upside rally is SUI’s addition to Bybit’s Launchpool. Bybit’s Launchpool allows users to stake tokens and earn more SUI or other rewards. This is notable because Launchpool primarily features tokens from the Mantle ecosystem, but SUI’s inclusion breaks this trend.