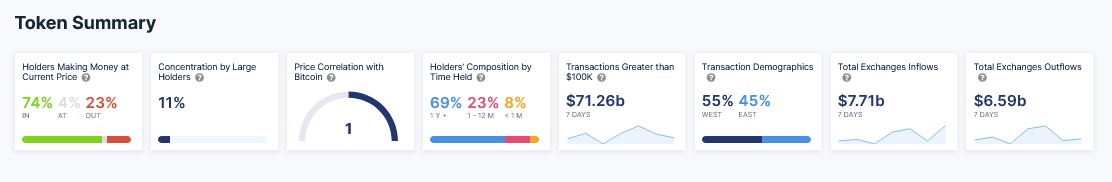

IntoTheBlock data on March 17 shows that 74% of Bitcoin holders are in the money at spot prices. 23% are out of the money, meaning they are holding to losing positions. When writing, only 4% are at break even, at parity with when they bought their bags.

74% Of Bitcoin Holders In Profits

Bitcoin is a volatile asset, and prices have been moving strongly in the last few weeks, dropping to as low as $15,300 in Q4 2022.

However, the coin has maintained a sharp uptrend in the past week, rising from last week’s depths and soaring above $26,000, printing a new Q1 2023 high.

When writing, trackers show that BTC is trading above $26,200, adding six percent in the last 24 hours and roughly 32% in the previous week. At current prices, most BTC holders are profitable.

A notable development amid this expansion is the high participation levels. The current leg up on the Bitcoin daily chart has been with rising trading volumes.

In trading and technical analysis, price expansions or contractions with a spike in trading volumes indicate participation or interest.

As BTC rallied from around $19,500 last week, there has been a notable expansion in volumes, an indicator that this rally is supported.

Banking Crisis And Binance Folding The Industry Recovery Fund

Behind the reversion to crypto assets, an asset class that Jerome Powell, the Federal Reserve chairman, said is risky, could be due to several reasons.

The placement of Silicon Valley Bank into receivership and under the custody of the FDIC triggered a bank run. This development was at the back of the collapse of Silvergate. After Silicon Valley Bank fell, Signature Bank was closed.

The United States government, through Janet Yellen and the Treasury Department, fearing contagion, said it would intervene and ensure depositors won’t be affected. The Fed also created a fund and a credit line for distressed banks.

This intervention has seen the Fed’s asset portfolio increase. It is despite a decline in the number of Treasuries and Mortgage-Backed Securities (MBS) being purchased.

QE is Back!

About $300 billion in assets added to Fed balance sheet in the last week pic.twitter.com/a46TLAkFwr

— Genevieve Roch-Decter, CFA (@GRDecter) March 16, 2023

Subsequently, analysts now say the Fed is technically back to quantitative easing. This is also increasing the odds of the central bank slashing interest rates in the next few months.

The emergence of cracks in the banking system and the announcement that Binance, one of the largest cryptocurrency exchanges, would buy several coins, including Bitcoin, from their $1 billion Industry Recovery Fund, also fanned an uptrend.

Given the changes in stable coins and banks, #Binance will convert the remaining of the $1 billion Industry Recovery Initiative funds from BUSD to native crypto, including #BTC, #BNB and ETH. Some fund movements will occur on-chain. Transparency.

— CZ

Binance (@cz_binance) March 13, 2023

Binance announced the Recovery Fund in November following the collapse of FTX. The goal was to support promising crypto projects under liquidity pressure.

Although there was news that some projects had been vetted to receive funding, Binance is now folding this initiative and diversifying into crypto assets, away from stablecoins.