On-chain data shows around 91% of all Bitcoin holders have entered into the green following the latest rally towards the $66,000 level.

Bitcoin Has Enjoyed Sharp Bullish Momentum Recently

Bitcoin has kicked off the new week on a positive note as its price has surged around 4% to return to the same highs as back at the end of last month. The below chart shows how the cryptocurrency’s recent trajectory has looked.

At the peak of this latest rally, Bitcoin had briefly touched the $66,500 mark, but since then, the coin has suffered a pullback, although the degree of it isn’t too significant as the price is still trading around $65,500.

The recent surge of the asset would naturally have had an effect on the profitability of the investors, which on-chain data has confirmed.

An Overwhelming Majority Of BTC Investors Are Now Above Water

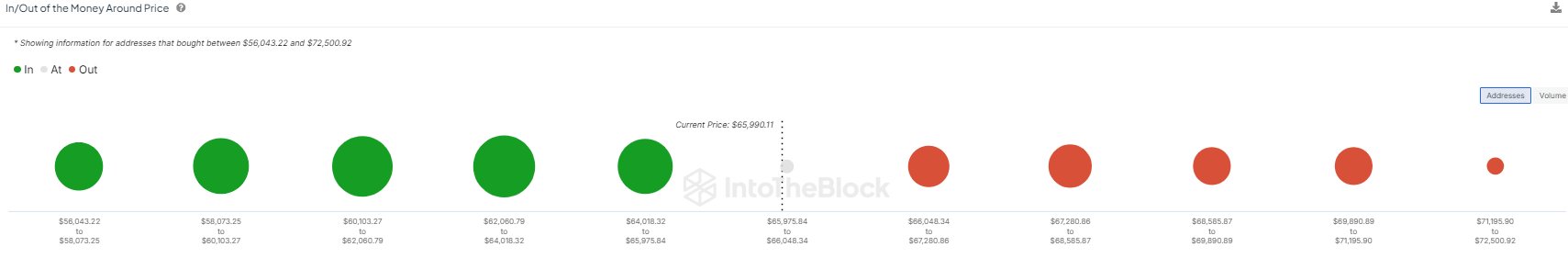

According to data from the market intelligence platform IntoTheBlock, 91% of the Bitcoin userbase is now carrying some unrealized profit. The analytics firm has shared how the various BTC price ranges are currently like in terms of the amount of investors who purchased their coins at them.

In the chart, the size of the dot corresponds to the amount of BTC that has its cost basis in the corresponding price range. It would appear that some large dots have turned green after the asset’s recent recovery, implying a large number of addresses have gone back into a net profit.

It’s also visible that the dots ahead aren’t too big, which makes sense given the fact that only 9% of the investors are still underwater. Such holders in loss can react to a retest of their cost basis by panic selling, so large demand zones above the asset’s price can be potential sources of resistance.

As the price ranges ahead don’t carry the cost basis of too many investors, though, any resistance that emerges may not be too notable. That said, this doesn’t mean BTC would have an easy time mowing through these last few levels on the way to the all-time high.

When a high amount of investors get into profits, the risk of a mass selloff taking place with the motive of profit-taking can become significant. As such, even though resistance ahead appears to be weak, Bitcoin could still have trouble reaching a new high given that 91% of the investors are sitting on gains.

In some other news, the Bitcoin whales have been showing a long-term trend of accumulation this year, as an analyst has pointed out in a CryptoQuant Quicktake post.

The whales refer to the Bitcoin entities who hold between 1,000 and 10,000 BTC in their wallets. From the graph, it’s visible that the 30-day change in their holdings has almost entirely been positive this year so far, suggesting relentless buying.