On-chain data from Glassnode shows 96.9% of Bitcoin short-term holders are in profit following the asset’s rally above the $30,000 level.

Bitcoin Rally Has Taken A Large Number Of Short-Term Holders Into Profit

According to data from the on-chain analytics firm Glassnode, 2.6 million coins held by the short-term holders are now carrying some unrealized profit. The “short-term holders” (STHs) here refer to all those investors who have been holding onto their coins since less than 155 days ago.

Statistically, the longer an investor holds their coins, the less likely they become to sell said coins at any point. Thus, since the STHs haven’t been holding their coins since that long ago, they are the weak hands of the market who may easily sell at the sight of FUD or profit-taking opportunities.

On the other hand, the counterpart group to the STHs, the “long-term holders” (LTHs), includes the investors with a strong conviction (a fact that has also earned them the name the “diamond hands” of the market).

As the price of Bitcoin has observed a sharp rally recently, it’s not unexpected that a lot of STHs would be carrying notable profits right now. Usually, the more the investors enter into profits, the more likely they become to be swayed into realizing those gains. Thus, the risk of mass selling occurring can increase when there are a lot of holders carrying profits.

An indicator that keeps track of such profits is the “percent supply in profit,” which calculates the percentage of the total Bitcoin supply that’s currently holding an unrealized gain.

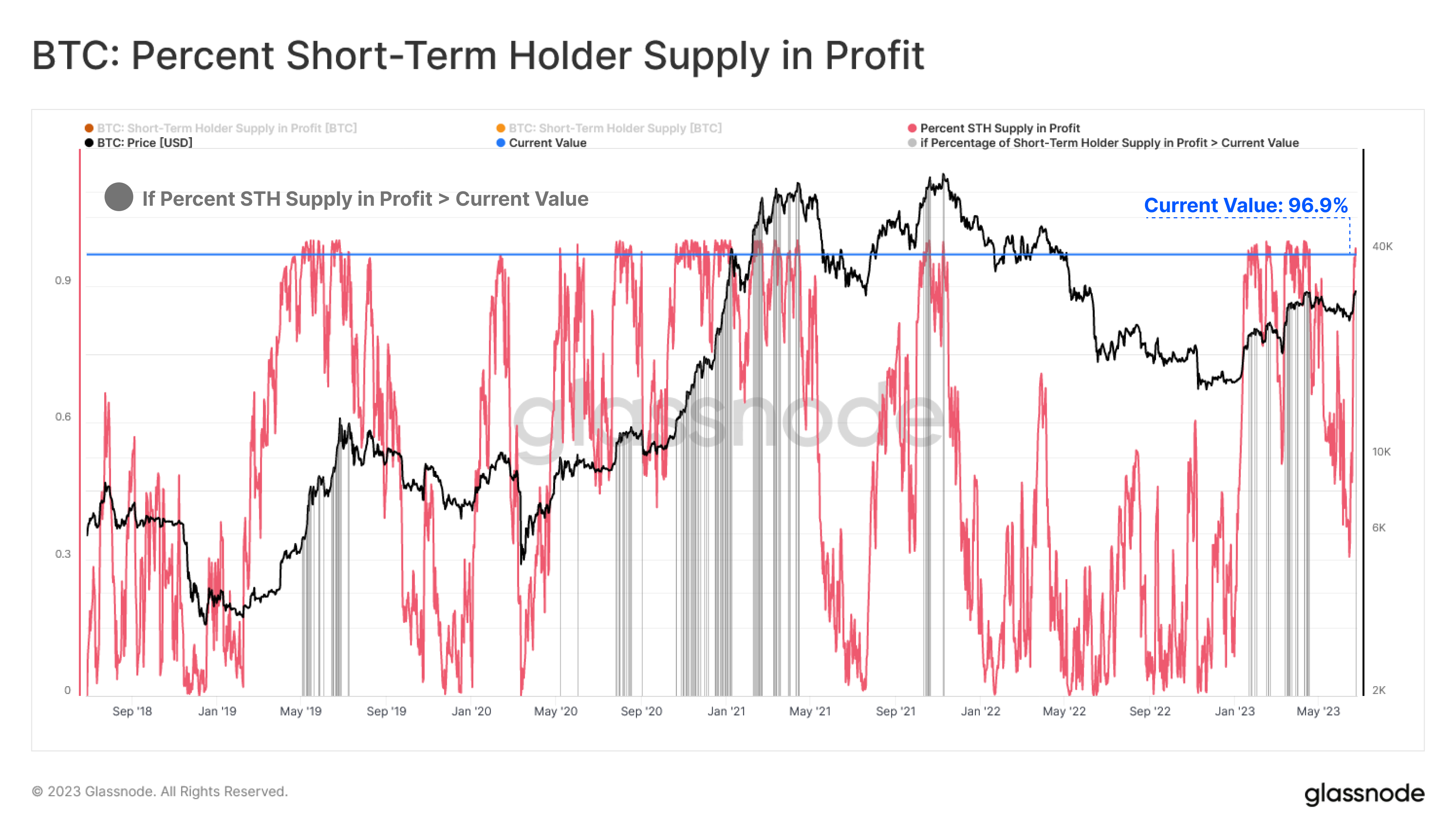

Here is a chart that shows the trend in this metric specifically for the STHs over the past few years:

As you can see in the above graph, the Bitcoin STH supply in profit had gone through a decline recently as the asset’s price had been struggling. With the latest sharp rally above the $30,000 mark, however, the indicator has seen a revival, as its value has observed rapid growth.

Following this latest spike, the metric’s value has hit 96.9%, meaning that 96.9% of the entire supply held by the STHs is now carrying some amount of unrealized profit.

In the chart, Glassnode has also marked the historical instances where a similar or larger part of the STH supply was in profit. It looks like a lot of such spikes in the past have coincided with tops for the cryptocurrency.

As explained before, this trend would make sense as at these high levels of profits, a large number of STHs may be inclined to participate in profit-taking, leading to the price registering a drawdown.

Though, the latest surge in the Bitcoin STH supply in profit doesn’t necessarily spell doom for the current rally, as often, such tops have only been local highs, and some of the occurrences of this pattern haven’t resulted in the price rise slowing down at all.

It now remains to be seen whether the market can absorb the profit-taking that would be taking place at the current price levels, or if the asset would soon observe a pullback.

BTC Price

At the time of writing, Bitcoin is trading around $30,200, up 15% in the last week.