On-chain data shows the Bitcoin miner selling power is at its lowest for the year, something that could be favorable for the price of the crypto.

Bitcoin Miner Selling Power Has Been Going Down In Recent Weeks

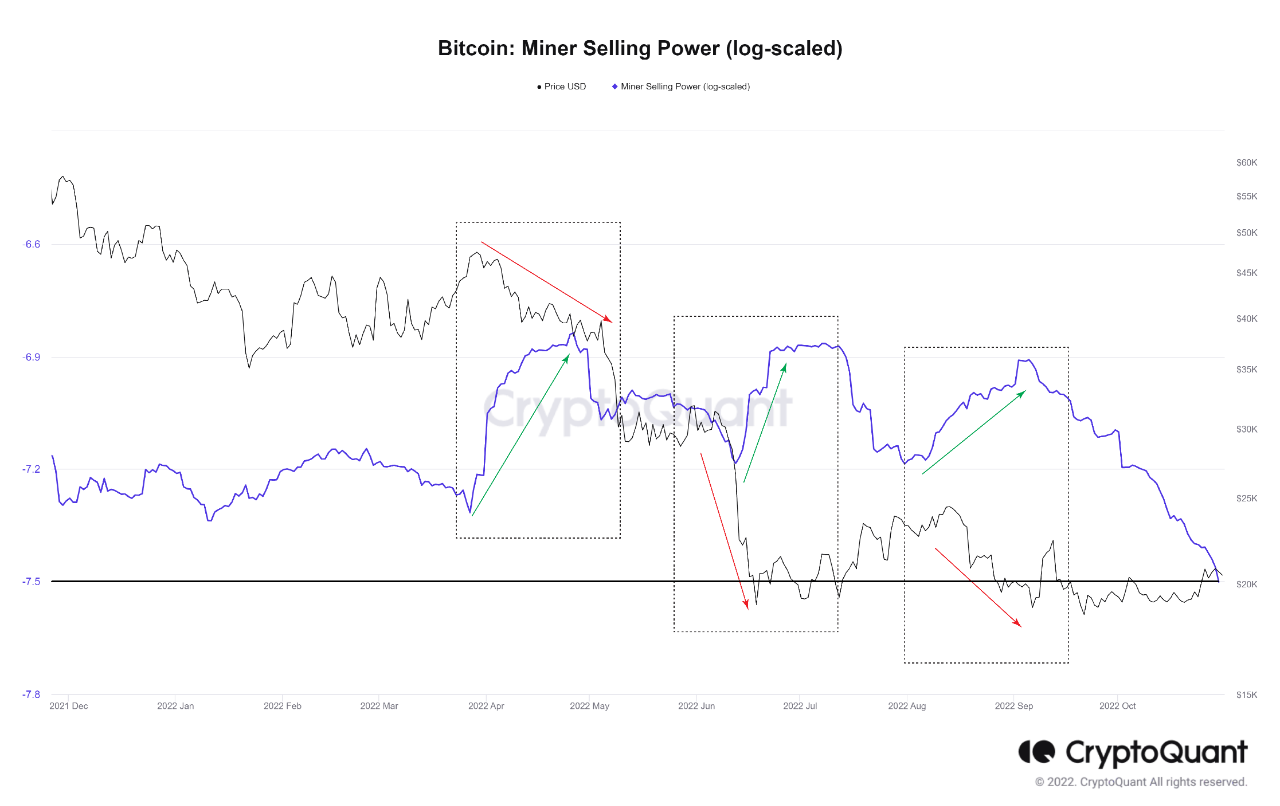

As pointed out by an analyst in a CryptoQuant post, the metric has observed surges in its value a few times this year, and each time the BTC price has gone down.

The “miner selling power” is an indicator that’s defined as the ratio between the Bitcoin miner outflows and the total number of coins held by this cohort (30-day moving average, log-scaled)

Here, the “miner outflows” is a measure of the total amount of BTC that miners are transferring out of their personal wallets.

When the value of the miner selling power rises, it means the ability of miners to dump their coins is going up right now as they are withdrawing more of them from their reserve. Naturally, such a trend can be bearish for the value of the crypto.

On the other hand, low values of the indicator suggest miners aren’t putting much selling pressure on the market at the moment, and hence might prove to be bullish for the BTC price.

Now, here is a chart that shows the trend in the Bitcoin miner selling power (log-scaled) over the year 2022 so far:

Looks like the log-scaled value of the metric has been on the way down recently | Source: CryptoQuant

As you can see in the above graph, the quant has marked the relevant points of trend for the Bitcoin miner selling power.

It seems like during the past year, the indicator has observed three instances of sharp growth, and around the time of each of these surges, the price of the crypto has taken a beating.

In the last few weeks, the metric has been on a constant decline, suggesting that miners haven’t been selling much during the period.

As a result of this downtrend, the Bitcoin miner selling power has now reached its lowest value for the last year. Going by the previous trend, this could be a positive sign for the current rally in the crypto.

BTC Price

At the time of writing, Bitcoin’s price floats around $20.5k, up 6% in the last week. Over the past month, the crypto has gained 5% in value.

The below chart shows the trend in the price of the coin over the last five days.

The value of the crypto seems to have been moving sideways between $20k and $21k | Source: BTCUSD on TradingView

Featured image from Brian Wangenheim on Unsplash.com, charts from TradingView.com, CryptoQuant.com