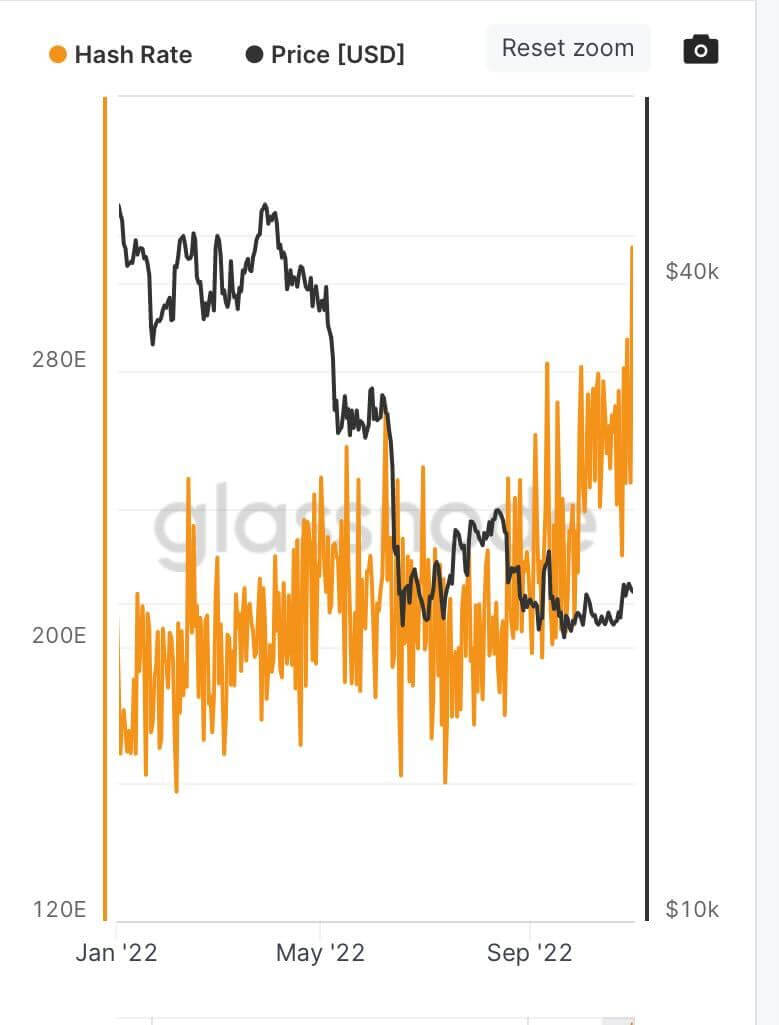

Bitcoin’s hashrate has hit a new all-time high of 331EH/s, according to data from Glassnode. Historically there has been a loose correlation between hashrate and Bitcoin’s price spurring debate as to whether hashrate follows price or vice versa.

The spike in hashrate comes at a difficult time for miners as some struggle to meet debt payments following Bitcoin’s 70% drawdown from $69k. Further, research conducted by CryptoSlate indicates that there could be further capitulation.

Should the increasing hashrate increase trend continue without a further leg up in price, a second capitulation could occur as miners sell their Bitcoin. A similar situation occurred in June when miners sold roughly 20,000 BTC.

Hashrate security

The upside to an ever-increasing hashrate is the possibility of a 51% attack on the network decreases. With a hashrate of 313EH/s, an attacker would need roughly 1.9 million Antminer KA3 (166Th) miners.

In 2018 it would have cost just $1.4 billion to conduct a 51% attack on bitcoin when the cost to mine 1BTC was just $8,000. Today the hashrate has increased by 900%, and therefore the network is that much more secure. Even in 2018, a bad actor would have needed 2.4 million top-of-the-range ASIC miners to perform the attack.

However, while the increase in hashrate has made the network more secure, it also results in higher costs for mining Bitcoin. A higher hashrate means a higher network difficulty and, thus, a reduction in the BTC generated per kW of energy.

Bitcoin Miners

When the cost of mining Bitcoin overtakes the price, miners often face liquidity issues. The issues arise from myriad factors, including margin calls, cash flow, and other general operating costs. As a result, Binance Pool launched a $500 million fund to support “distressed mining assets.”

However, investment in Bitcoin mining shows little sign of slowing down. Several mining companies, such as CleanSpark, are seeking new investors as they purchased 3,83 miners from Argo. Riot broke ground at a new 1GW mining facility, Great American Mining was acquired by Crusoe Energy, and Compass Mining signed a deal on a new 27MW mining center.

New innovation in the mining space includes Fabric Systems’ new liquid-cooled mining machines, a mining investment entity from Greyscale, and Block launching a new mining unit acquiring former Argo CTO.

While the short-term picture may be ominous for Bitcoin miners, there is little evidence of long-term bearish sentiment.

The post Bitcoin hashrate hits all-time high as Bitcoin holds above $20k appeared first on CryptoSlate.