The fallout from FTX’s insolvency has already shaken the crypto industry to its core. After several days of speculation about the state of FTX’s balance sheet, the exchange yielded and admitted defeat, announcing that it was in process of being acquired by Binance.

The tension that arose from speculation strained the market, which took a devastating hit once the news was out. With almost every token deep in the red, many began comparing the crash to the fallout we’ve seen in June after the Luna crash.

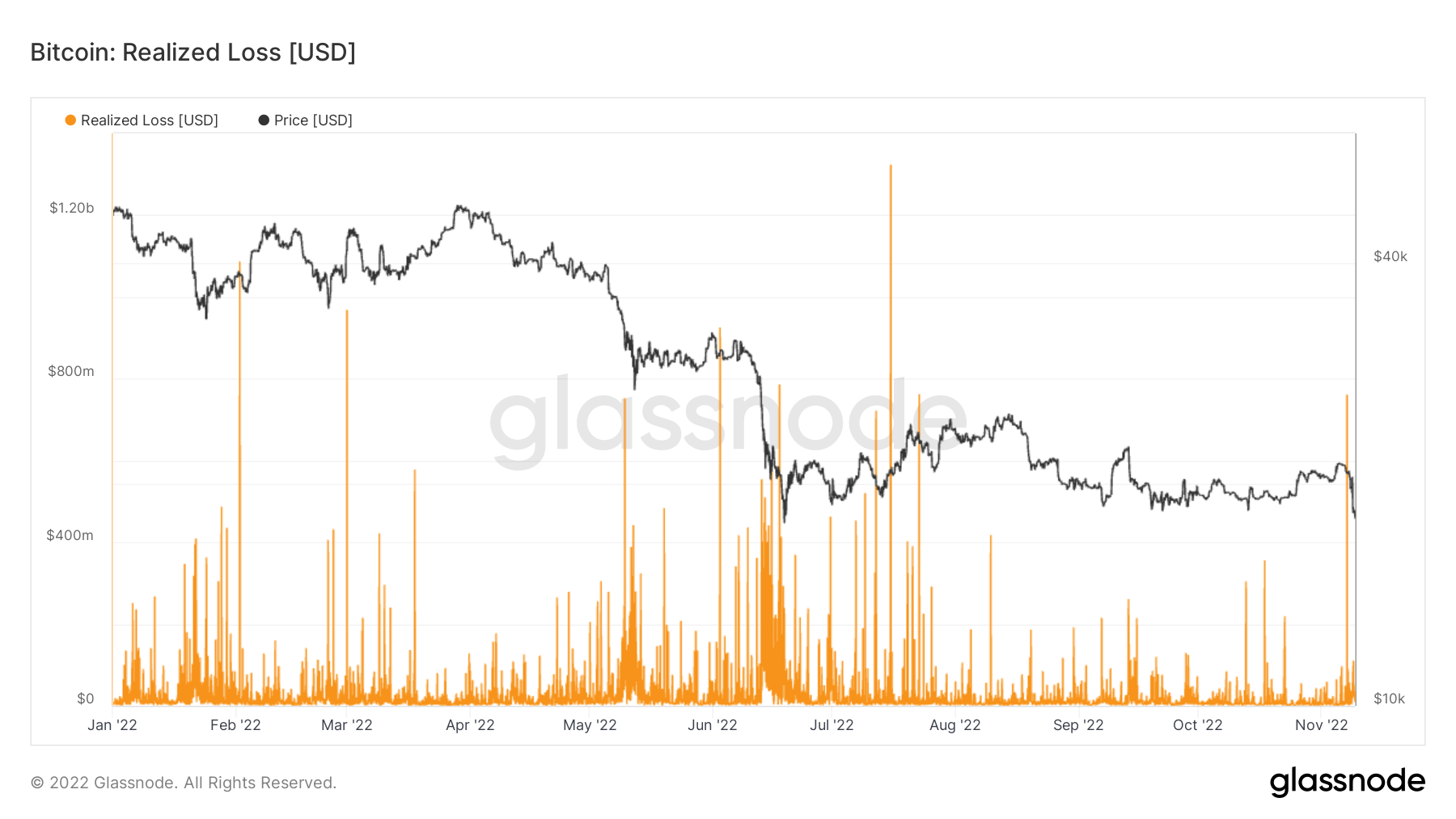

However, the comparison tends to be rather subjective. Data analyzed by CryptoSlate showed that the losses from the Luna fallout dwarf the current market downturn caused by FTX.

That isn’t to say that losses aren’t beginning to mount up.

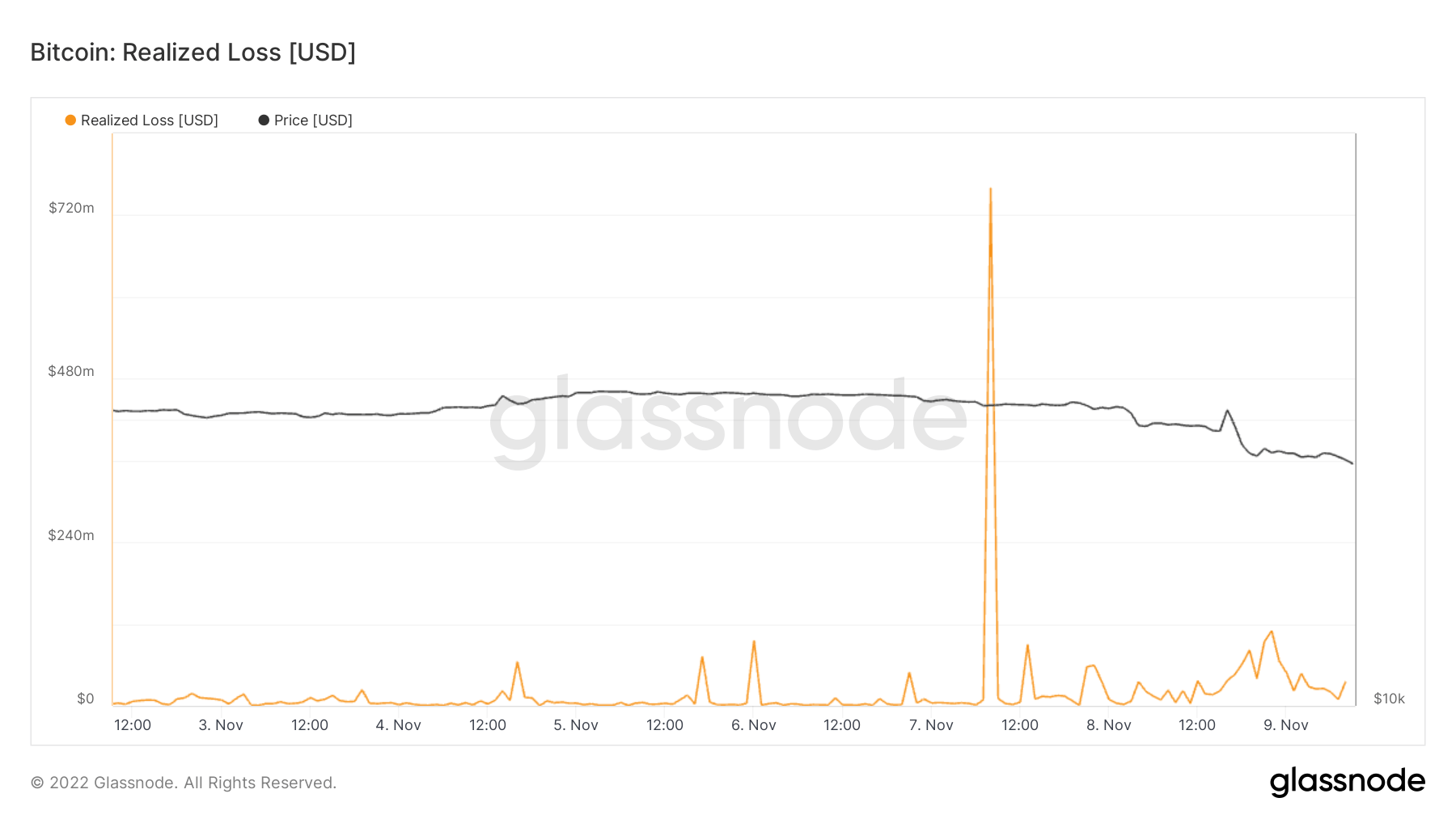

Realized loss is a metric used to denote the total loss of all moved coins. The metric shows the coins whose price at their last movement was higher than the price at their current movement. From Nov. 4 to Nov. 7, there have been several spikes of realized loss ranging from $50 million to $100 million.

The spikes correlate to the increasing tension in the market. As speculation surrounding FTX and Alameda’s liquidity began to rise, the market started gearing up for liquidations.

The three days of sporadic liquidations culminated on Nov. 7 when the market finally capitulated. On Nov. 7 the market recorded $760 million in realized losses and saw continuous spikes of around $50 million until Nov. 9. As of Nov. 9, the total realized loss caused by the FTX fallout stands at around $1.5 billion.

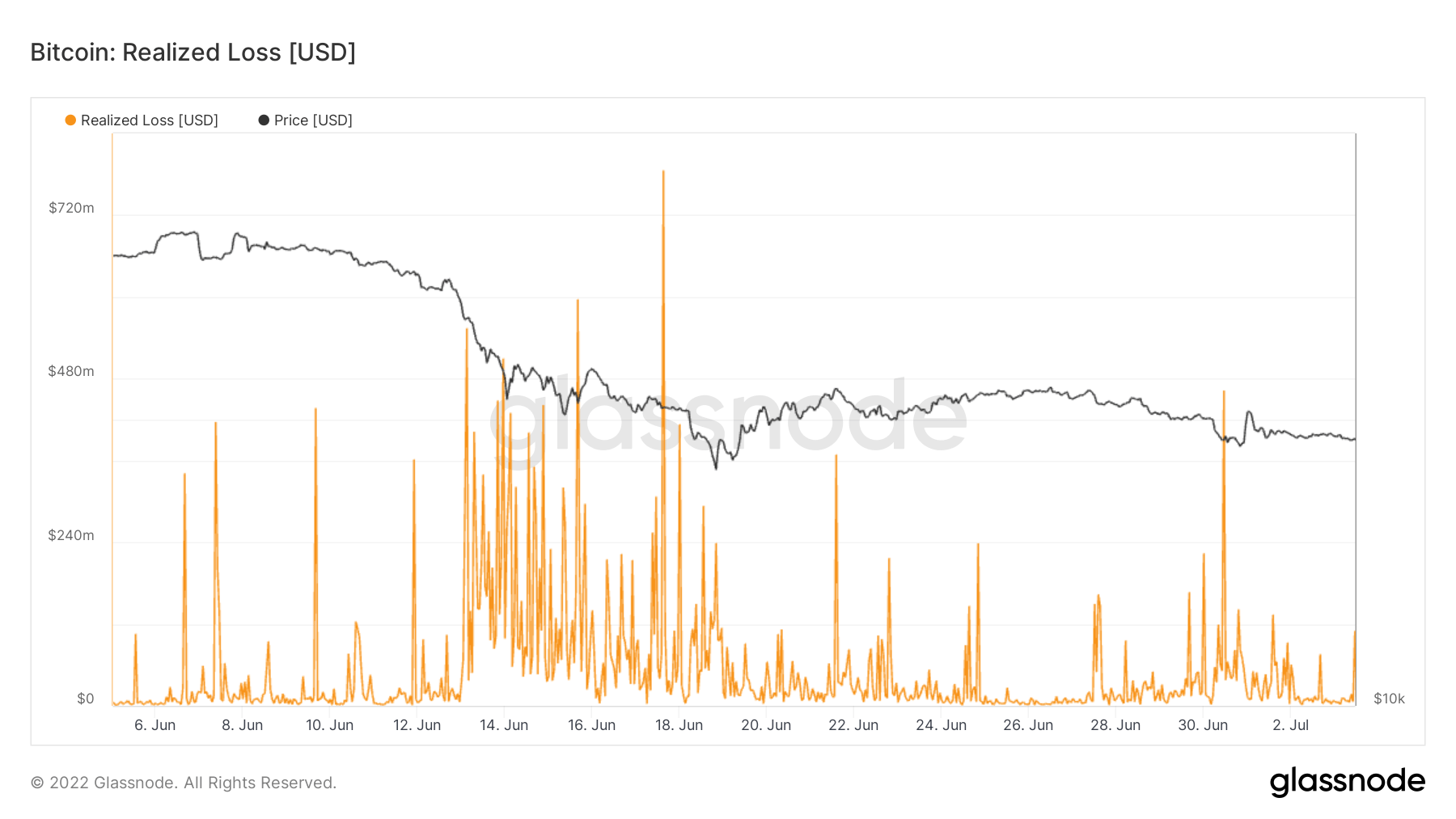

Looking at the realized loss following the Luna collapse in June shows a much more volatile market. At the time, Bitcoin dropped to its two-year low of $17,600 and triggered several billion worth of realized losses. These realized losses then caused a ripple effect that led to the insolvencies of some of the industry’s biggest players, including Celsius, BlockFi, Voyager, and Three Arrows Capital.

In June, the market saw over a billion liquidations per day. Since Nov. 4, there has been a total of 500 million liquidations caused by FTX’s collapse. Looking at the year-to-date chart for realized losses puts the FTX fallout into perspective and highlights the severity of Luna’s collapse.

And while Luna’s collapse was both unprecedented and unique, the market is still in the early days of the FTX fallout. It might take weeks before the true scope of the crisis is felt.

The post Crash of the Titans: LUNA dwarves FTX in terms of losses but the worst is yet to come appeared first on CryptoSlate.