Data shows the Bitcoin long-term holder supply has climbed back up and set a new all-time high, suggesting that conviction may be returning in the market.

Bitcoin Long-Term Holder Supply Recovers From FTX Panic Selling

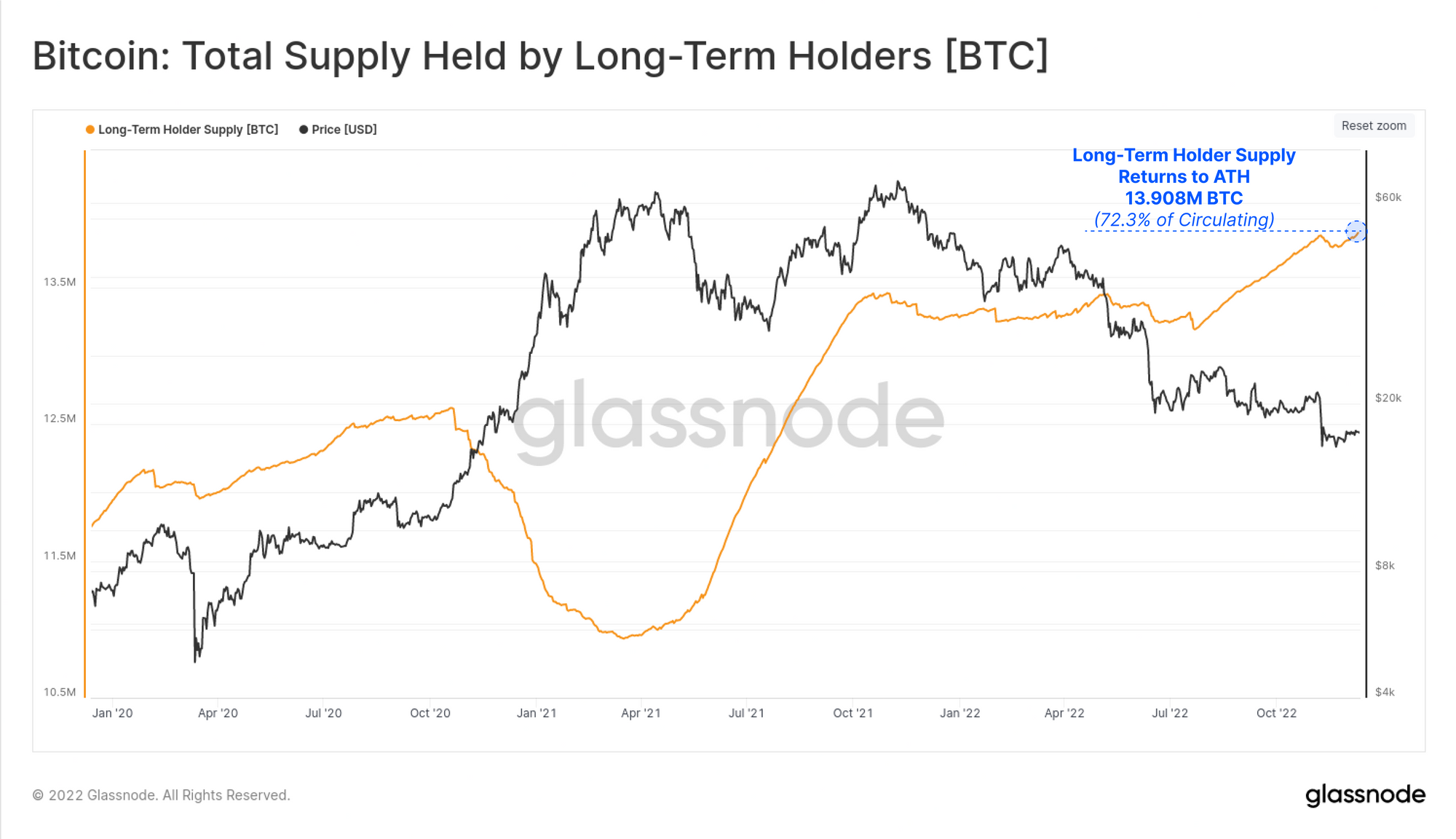

According to the latest weekly report from Glassnode, BTC long-term holders now hold around 72.3% of the total circulating supply. The “long-term holder” (LTH) group is one of the two major cohorts in the Bitcoin market and includes all investors who have been holding onto their coins for at least 155 days ago, without having moved or sold them from their wallet.

Related Reading: Bitcoin NVT Golden Cross Still In “Overbought” Region, Volatility To Follow?

“Short-term holders” (STHs) make up the other side of the market. Statistically, the longer investors hold their coins, the less probable they become to sell at any point. Therefore, LTHs are the more resolute group of the two and are sometimes dubbed the “diamond hands” of the market.

The “LTH supply” is an indicator that measures the total amount of BTC that these HODLers as a whole are currently carrying in their wallets. Here is a chart that shows the trend in this metric over the last few years:

As the above graph shows, the Bitcoin LTHs displayed a strong accumulation trend between July and early November, causing their supply to reach a new height. However, the crash due to the collapse of the crypto exchange FTX completely reversed the trend as these holders quickly started shedding off their holdings instead.

This decline in the indicator suggests that the crash made even these resolute holders panic and sell off their coins. But in the last few weeks, tides have once again seemed to have shifted. As the market has traded sideways, the LTH supply has observed a constant rise, implying that these investors are back at accumulating.

The metric has now fully retraced the drawdown due to the FTX debacle and has set a new all-time high of 13.9 million BTC, corresponding to about 72.3% of the total circulating supply.

The 155-day threshold would put the source of this new streak of accumulation back in June and July of this year, which is when the deleveraging event due to the 3AC collapse took place.

This new rise in the LTH supply means the conviction is returning among these Bitcoin HODLers, something that has historically been bullish for the price in the long term.

At the time of writing, Bitcoin’s price is trading around $17.2k, up 1% in the last week.