Data shows some shifts have taken place in the Ethereum ecosystem this year. Here’s how the shares of some popular transaction types have changed on the network in 2022.

Both DeFi And NFTs Have Taken A Hit In Dominance On Ethereum

As per the latest weekly report from Glassnode, the DeFi and NFT sectors both have similar dominance on the Ethereum blockchain now. The “dominance” here refers to the percentage of the total Ethereum gas usage that a particular transaction type is contributing to at the moment.

The ETH network hosts a very diverse ecosystem of applications made possible thanks to the smart contracts mechanism of the blockchain. Some of the popular constructs that have found a home on the network include non-fungible tokens (NFTs), decentralized finance (DeFi) applications, and stablecoins.

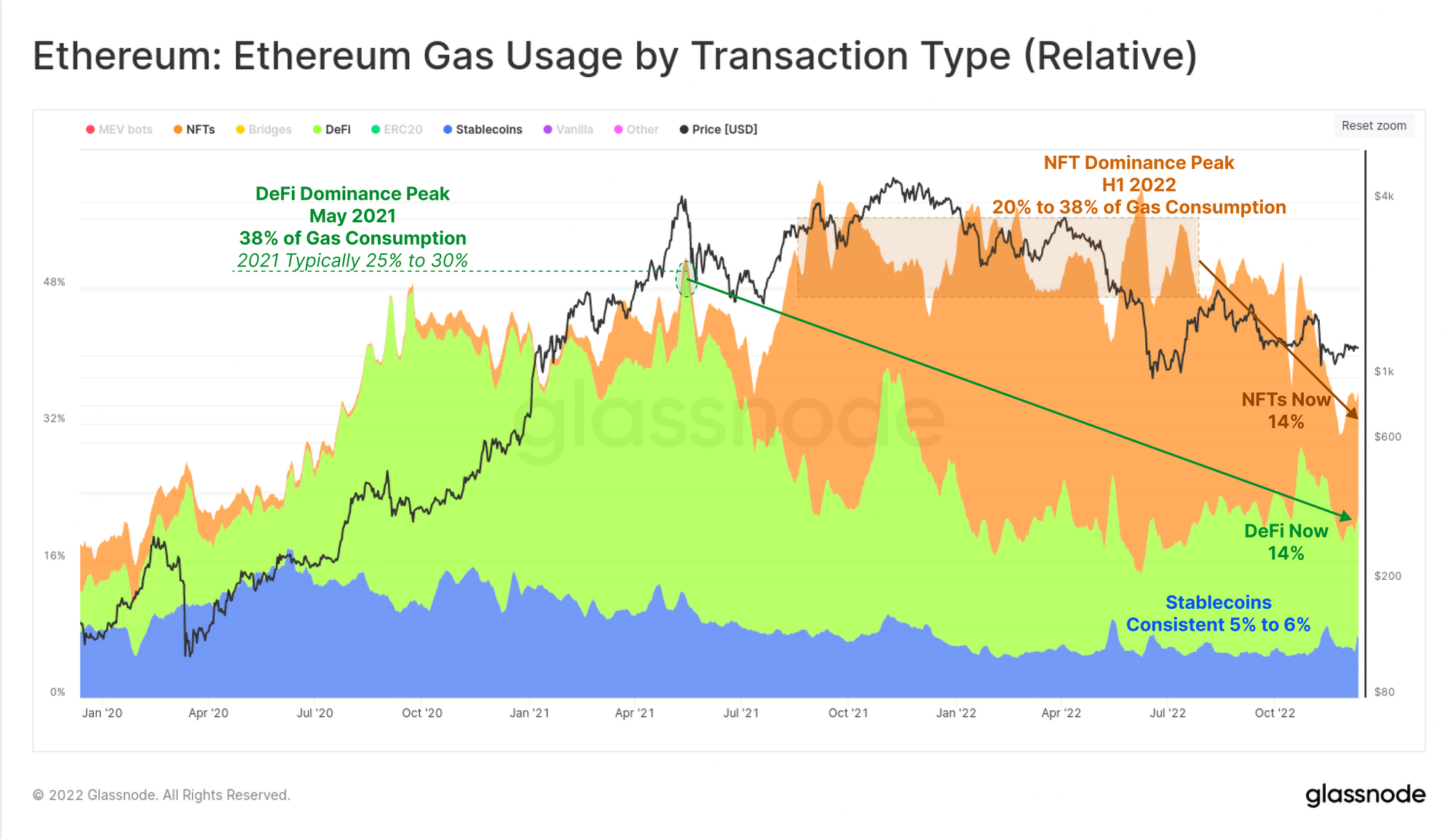

Here is a chart that shows how the individual dominances of these three transaction types have changed on the Ethereum network over the last few years:

As the above graph shows, the Ethereum gas usage due to NFT transactions fluctuated between 20% to 38% of the network’s total during the first half of this year as these tokens were trending. In this second part of 2022, however, NFT popularity has severely dropped as the bear market has become worse, leading to the gas share of these digital collectibles rapidly dropping off to around 14%.

DeFi observed its zone of peak activity back in May 2021 when the bull run of the period saw its high. Since then, the sector has seen lesser and lesser usage, with its dominance declining to 14%, a low value when compared to the 25% to 30% average seen throughout 2021.

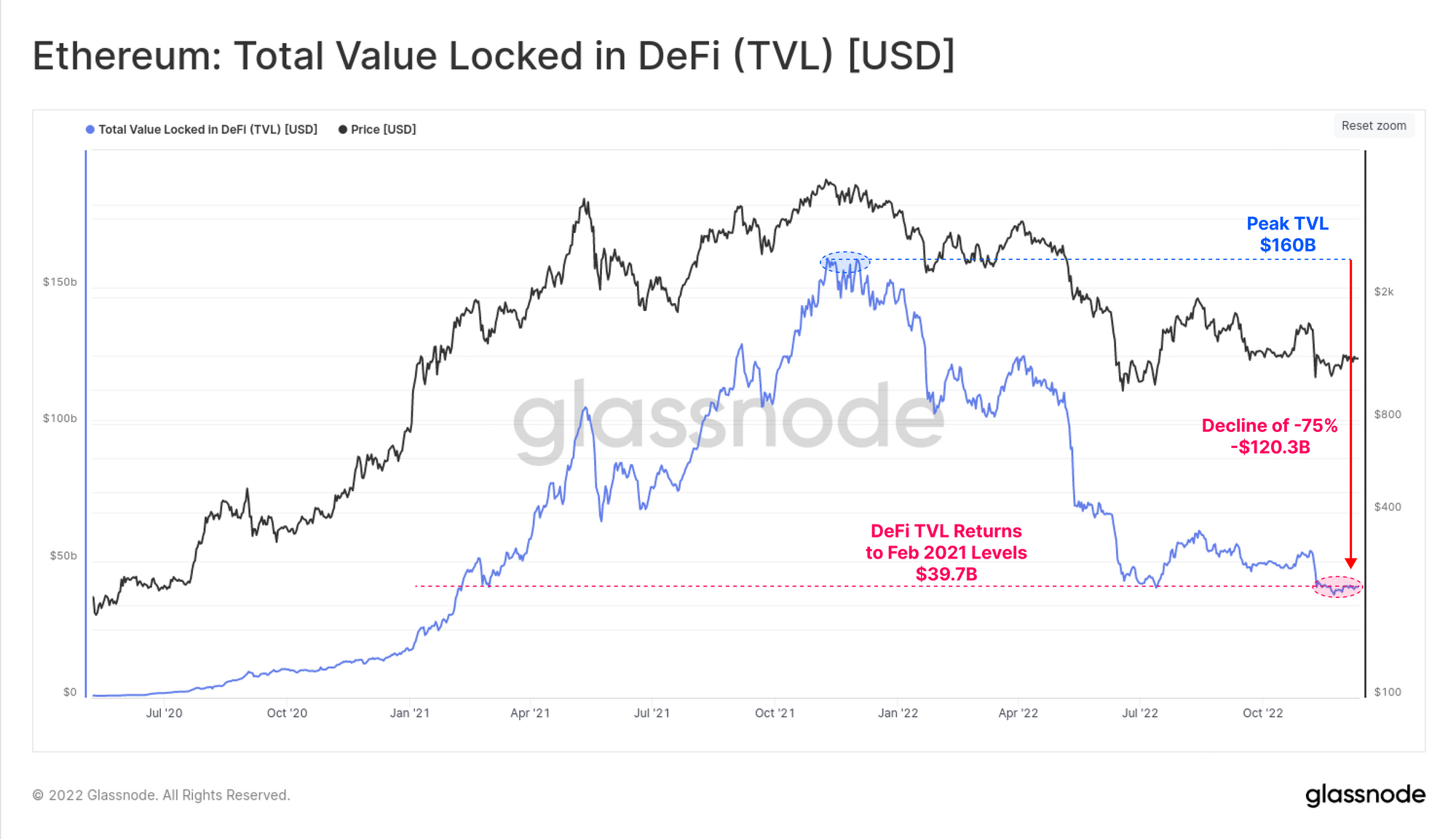

The bust of the DeFi boom is also visible from the total value locked (TVL) in these protocols, as the below chart displays.

The Ethereum DeFi TVL measured around $160 billion during the November 2021 peak, but has since declined to just $39.7 billion over the year 2022. This corresponds to a decline of 75% from the all-time high, and represents a reset in the metric’s value to February 2021 levels, a time when the bull run had just started.

While both NFTs and DeFi have waned in popularity recently, the stablecoins have continued to see about the same usage as they have consistently consumed around 4% to 5% of the total gas usage on Ethereum.

At the time of writing, ETH’s price floats around $1,300, up 8% in the last week.