Crypto platform Midas Investment will shut operations because of the significant losses it incurred in 2022, according to a Dec. 27 statement.

CEO Iakov “Trevor” Levin said the Midas DeFi Portfolio lost 20% of its $250 million ($50 million) in assets under management. Trevor added that users withdrew around 60% of its AUM following the collapse of crypto firms like FTX and Celsius.

Liabilities exceed $100 million

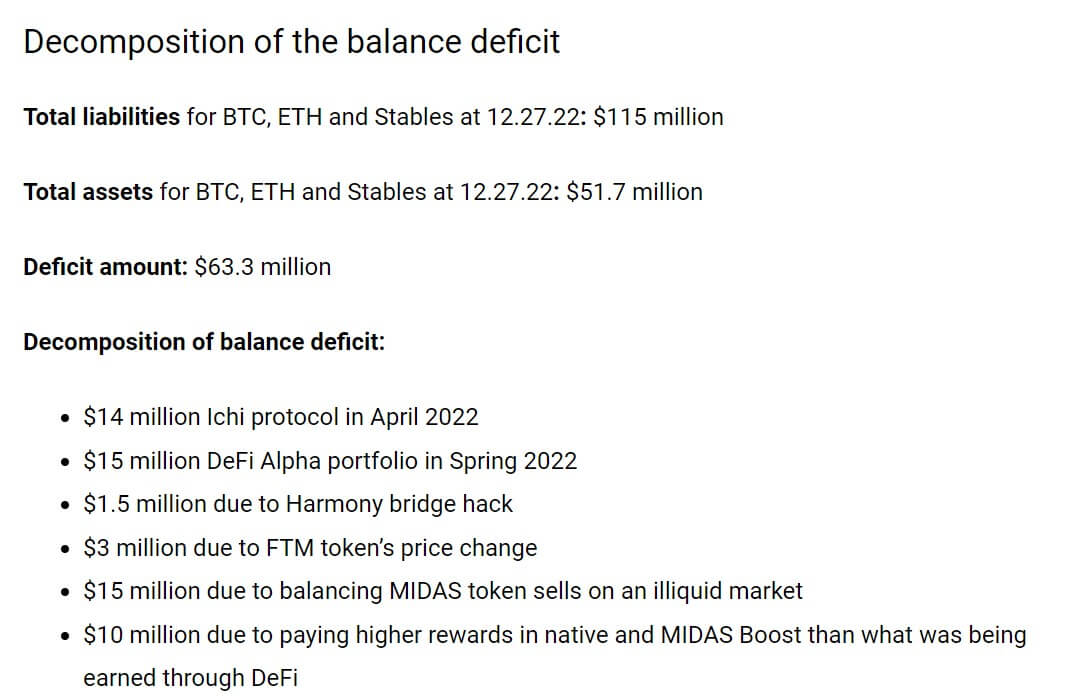

As of Dec. 27, Midas’ total liabilities were $115 million in Bitcoin (BTC), Ethereum (ETH), and stablecoin. However, the platform holds roughly $51.7 million of these assets, creating a deficit of $63.3 million. He added that only C-level executives of the firm were aware of the asset deficit.

“The asset deficit was caused by the long-term risk of DeFi investment, the instability of our business model after the loss of assets, and the illiquidity of the Midas token.”

Meanwhile, Trevor highlighted that Midas lost $58.5 million to several DeFi-related security breaches and overpaid interest in its native MIDAS token.

What next?

CEO Trevor said Midas would rebalance its users’ accounts by deducting 55% from it and their rewards earned. The move would allow users to withdraw 45% of their assets.

According to him, users whose balances are less than $5000 would have only their earnings deducted. He added that Midas would pay for the differences in its native tokens that would be exchanged for the token of its new project.

The Midas CEO wrote that the platform would look to pivot its businesses into centralized, decentralized finance (CeDeFi). He said:

“This project will be fully transparent, on-chain, and built with the goal of offering a new and improved investment experience.”

The post Midas reveals $60M deficit, announces closure of operations appeared first on CryptoSlate.