According to blockchain security company Certik, the number of cryptocurrency incidents involving exit scams, hacks, and code exploits in Dec. 2022 was the lowest monthly figure of the year. Certik noted that the combined incidents amounted to $62.2 million “lost to exploits, hacks, and scams.”

Record Low Cyber Attacks in December 2022 Result in $62.2 Million in Losses

On Dec. 31, 2022, Certik tweeted that the last month of the year saw the least amount of exploits, hacks, and scams. All the incidents combined added up to roughly $62.2 million, and Certik noted it was the “lowest monthly figure” of the year.

Certik detailed that exit scams accounted for $15.5 million, and flashloan attacks represented $7.6 million. The largest flashloan attack came from the Lodestar exploit, and the largest exit scam was Defrost Finance.

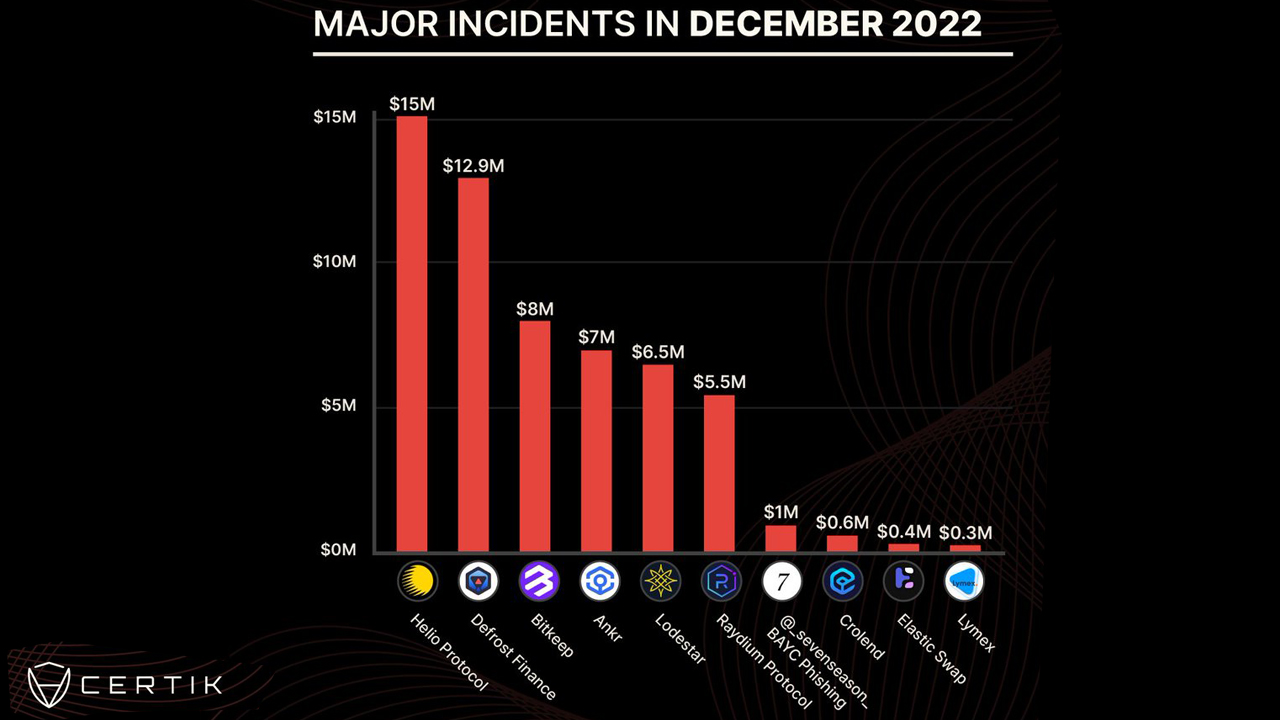

The following day, on Jan. 1, 2023, Certik said that the exploits, hacks, and scams from the previous month stemmed from “23 major attacks.” The largest incident that occurred was the Helio Protocol and stablecoin attack.

Despite the 23 occurrences that saw $62.2 million lost, the month prior, in Nov. 2022, Certik explained that there were “36 major attacks” that amounted to $595 million lost. The largest incident in Nov. 2022 was the FTX hack, which took place the same day the company filed for Chapter 11 bankruptcy protection.

$477 million was stolen during the FTX hack, and the second-largest incident in Nov. 2022 was Deribit’s loss of $28 million. 2022 saw a record number of hacks, and the slowdown in Dec. 2022 was a welcome relief for many.

According to statistics, besides the FTX hack in Nov. 2022, the largest hacks included Binance Smart Chain’s token hub exploit, which saw the loss of $569 million, the Ronin bridge breach, which saw $540 million drained, and the Wormhole exploit, which saw $326 million stolen.

On Dec. 15, 2022, Elliptic noted that roughly $2.7 billion was siphoned from decentralized finance (DeFi) protocols. Blockchain security firm Peckshield estimated that there was $1.55 billion taken from defi protocols in 2021.

Do you have an opinion on the relatively low number of exploits, hacks, and scams that occurred in Dec. 2022? Please share your thoughts on this topic in the comments section below.